data(LC19_S1, package = "hecedsm")

modmat <- model.matrix( # extract model matrix

~ familiarity + consistency,

data = LC19_S1)

tail(modmat, n = 5L) # print first five lines

#> (Intercept) familiarity consistencyinconsistent

#> 92 1 6 1

#> 93 1 4 1

#> 94 1 7 1

#> 95 1 7 1

#> 96 1 7 1

dim(modmat) # dimension of the model matrix

#> [1] 96 34 Linear regression models

4.1 Introduction

The linear regression model, or linear model, is one of the most versatile workhorse for statistical inference. Linear regression is used primarily to evaluate the effects of explanatory variables (oftentimes treatment in an experimental setting) on the mean response of a continuous response, or for prediction. The linear regression specifies the mean of a response variable \(Y\) of a random sample of size \(n\) as a linear function of observed explanatories (also called predictors or covariates) \(X_1, \ldots, X_p\), \[\begin{align} \underset{\text{conditional mean}}{\mathsf{E}(Y_i \mid \boldsymbol{X}_i=\boldsymbol{x}_i)}=\mu_i=\underset{\text{linear combination of explanatories}}{\beta_0 + \beta_1x_{i1} + \cdots + \beta_p x_{ip}}\equiv \mathbf{x}_i\boldsymbol{\beta}. \end{align}\] where \(\mathbf{x}_i = (1, x_{i1}, \ldots, x_{ip})\) is a \((p+1)\) row vector containing a constant and the explanatories of observation \(i\), and \(\boldsymbol{\beta} = (\beta_0, \ldots, \beta_p)^\top\) is a \(p+1\) column vector of coefficients for the mean. The model formulation is conditional on the values of the observed explanatories; this amounts to treating the \(p\) explanatory variables \(X_1, \ldots, X_p\) as non-random quantities, or known in advance. The regression coefficients \(\boldsymbol{\beta}\) is the same for all observations, but the vector of explanatories \(\mathbf{x}_i\) may change from one observation to the next.

Remark 4.1 (Linearity). The model is linear in the coefficients \(\beta_0, \ldots, \beta_p\). The quadratic curve \(\beta_0 + \beta_1x + \beta_2 x^2\) is a linear model because it is a sum of coefficients times functions of explanatories. By contrast, the model \(\beta_0 + \beta_1x^{\beta_2}\) is nonlinear in \(\boldsymbol{\beta}\).

To simplify the notation, we aggregate observations into an \(n\)-vector \(\boldsymbol{Y}\) and the explanatories into an \(n \times (p+1)\) matrix \(\mathbf{X}\) by concatenating a column of ones and the \(p\) column vectors \(\boldsymbol{X}_1, \ldots, \boldsymbol{X}_p\), each containing the \(n\) observations of the respective explanatories. The matrix \(\mathbf{X}\) is termed model matrix (or sometimes design matrix in experimental settings), and it’s \(i\)th row is \(\mathbf{x}_i\).

Assuming that the distribution of the response is drawn from a location family, we may rewrite the linear model in terms of the mean plus an error term, \[\begin{align*} \underset{\text{observation}\vphantom{\mu_i}}{Y_i} = \underset{\text{mean } \mu_i}{\vphantom{Y_i}\mathbf{x}_i\boldsymbol{\beta}} + \underset{\text{error term}\vphantom{\mu_i}}{\vphantom{Y_i}\varepsilon_i}. \end{align*}\] where \(\varepsilon_i\) is the error term specific to observation \(i\), and we assume that the errors \(\varepsilon_1, \ldots, \varepsilon_n\) are independent and identically distributed. We fix the expectation or theoretical mean of \(\varepsilon_i\) to zero to encode the fact we do not believe the model is systematically off, so \(\mathsf{E}(\varepsilon_i \mid \boldsymbol{X}_i=\boldsymbol{x}_i)=0\) \((i=1, \ldots, n)\). The variance term \(\sigma^2\) is included to take into account the fact that no exact linear relationship links \(\boldsymbol{X}_i\) and \(Y_i\), or that measurements of \(Y_i\) are subject to error.

The normal or Gaussian linear model specifies that responses follow a normal distribution, with \(Y_i \mid \boldsymbol{X}_i=\boldsymbol{x}_i \sim \mathsf{normal}(\mathbf{x}_i\boldsymbol{\beta}, \sigma^2)\). The normal distribution is a location-scale family, so \(Y \sim \mathsf{normal}(\mu, \sigma^2)\) is equal in distribution with \(\mu + \varepsilon\) for \(\varepsilon \sim \mathsf{normal}(0, \sigma^2)\).

4.1.1 Motivating examples

We present some motivating examples that are discussed in the sequel.

Example 4.1 (Consistency of product description) Study 1 of Lee and Choi (2019) considered descriptors and the impact on the perception of a product on the discrepancy between the text description and the image. In their first experience, a set of six toothbrushes is sold, but the image shows either a pack of six, or a single one). The authors also measured the prior familiarity with the brand of the item. Participants were recruited using an online panel, and the data in LC19_S1 includes the results of the \(n=96\) participants who passed the attention check (one additional participant response was outlying and removed). We could fit a linear model for the average product evaluation score, prodeval, as a function of the familiarity of the brand familiarity, an integer ranging from 1 to 7, and a dummy variable for the experimental factor consistency, coded 0 for consistent image/text descriptions and 1 if inconsistent. The resulting model matrix is then \(96 \times 3\). The prodeval response is heavily discretized.

Example 4.2 (Teaching to read and pre-post experiments) The BSJ92 data in package hecedsm contains the results of an experimental study by Baumann, Seifert-Kessell, and Jones (1992) on the effectiveness of different reading strategies on understanding of children. These are described in the abstract

Sixty-six fourth-grade students were randomly assigned to one of three experimental groups: (a) a Think-Aloud (TA) group, in which students were taught various comprehension monitoring strategies for reading stories (e.g., self-questioning, prediction, retelling, rereading) through the medium of thinking aloud; (b) a Directed Reading-Thinking Activity (DRTA) group, in which students were taught a predict-verify strategy for reading and responding to stories; or (c) a Directed Reading Activity (DRA) group, an instructed control, in which students engaged in a noninteractive, guided reading of stories.

The data are balanced, as there are 22 observations in each of the three subgroups, of which DR is the control. The researchers applied a series of three tests (an error detection task for test 1, a comprehension monitoring questionnaire for test 2, and the Degrees of Reading Power cloze test labelled test 3). Tests 1 and 2 were administered both before and after the intervention: this gives us a change to establish the average improvement in student by adding pretest1 as covariate for a regression of posttest, for example. The tests 1 were out of 16, but the one administered after the experiment was made more difficult to avoid cases of students getting near full scores. The correlation between pre-test and post-test 1 is \((\widehat{\rho}_1=0.57)\), much stronger than that for the second test \((\widehat{\rho}_2=0.21)\).

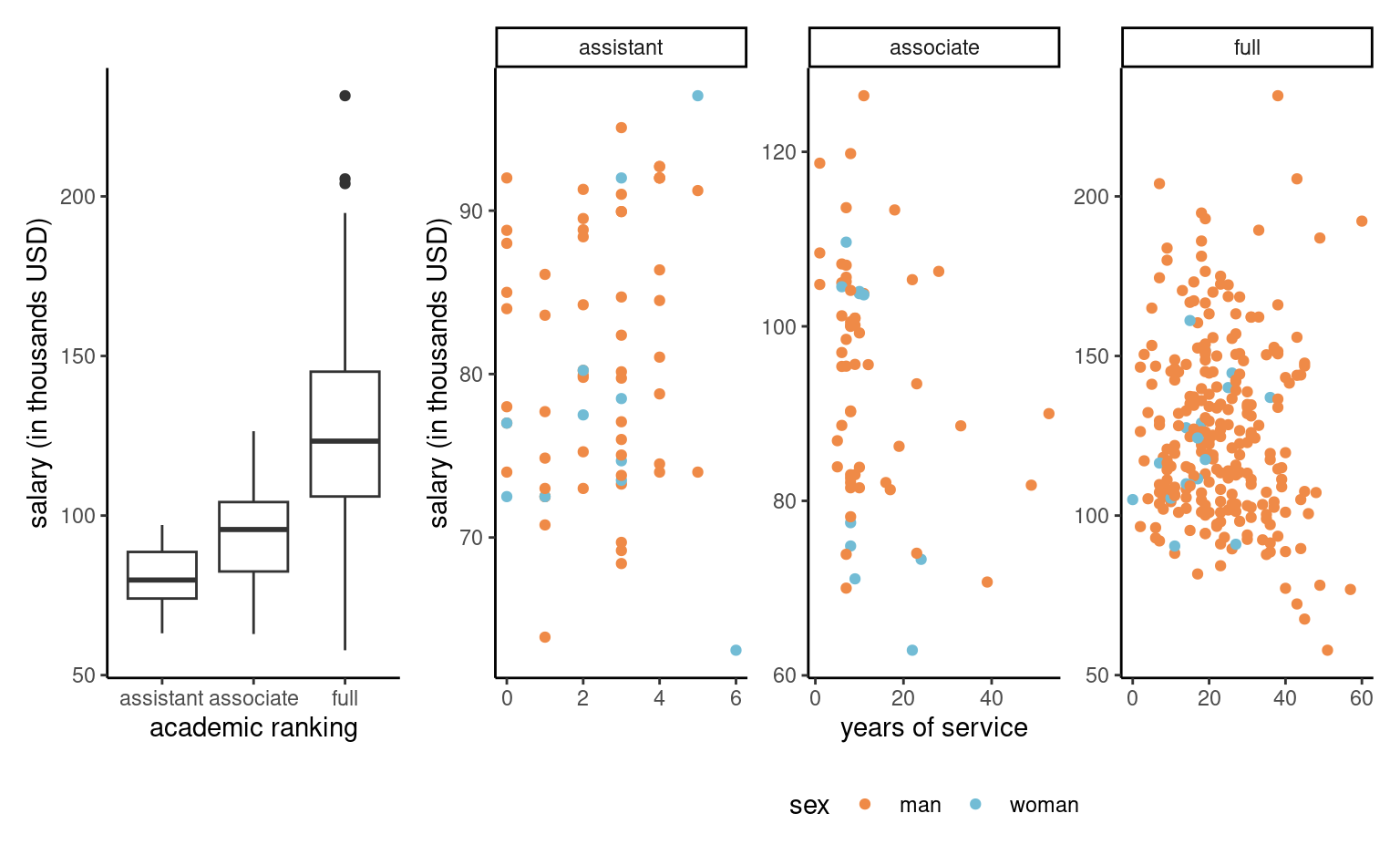

Example 4.3 (Gender discrimination in a US college) The college database consists of observational data collected in a college in the United States. The goal of the administration was to investigate potential gender inequality in the salary of faculty members. The data contains the following variables:

salary: nine-month salary of professors during the 2008–2009 academic year (in thousands USD).rank: academic rank of the professor (assistant,associateorfull).field: categorical variable for the field of expertise of the professor, one ofappliedortheoretical.sex: binary indicator for sex, eithermanorwoman.service: number of years of service in the college.years: number of years since PhD.

Example 4.4 (Suggestions increase donations to charities) Study 1 of Moon and VanEpps (2023) considers proportion of donators to a charity. Participants in the online panel were provided with an opportunity to win 25$ and donate part of this amount to a charity of their choosing. The data provided include only people who did not exceed this amount and indicated donating a non-zero amount.

Example 4.5 (Is additional paper wrapping viewed as more eco-friendly?) Sokolova, Krishna, and Döring (2023) consider consumer bias when assessing how eco-friendly packages are. Items such as cereal are packaged in plastic bags, which themselves are covered in a box. They conjecture (and find) that, paradoxically, consumers tend to view the packaging as being more eco-friendly when the amount of cardboard or paper surrounding the box is larger, relative to the sole plastic package. We consider in the sequel the data from Study 2A, which measures the perceived environmental friendliness (PEF, variable pef) as a function of the proportion of paper wrapping (either none, half of the area of the plastic, equal or twice).

4.1.2 Exploratory data analysis

Exploratory data analysis (EDA) is an iterative procedure by which we query the data, using auxiliary information, summary statistics and data visualizations, to better inform our modelling.

It is useful to get a better understanding of the features of the data (sampling frame, missing values, outliers), the nature of the observations, whether responses or explanatories and the relationship between them.

See Chapter 11 of Alexander (2023) for examples. In particular, it is useful to check that

- categorical variables are properly code as factors.

- missing values are properly declared as such using

NA(strings,999, etc.) - there is no missingness patterns (

NAfor some logical values) - there are enough modalities of each level of categorical variables

- there is no explanatory variable derived from the response variable.

- the subset of observations used for statistical analysis is adequate.

- there are no anomalies or outliers that would distort the results.

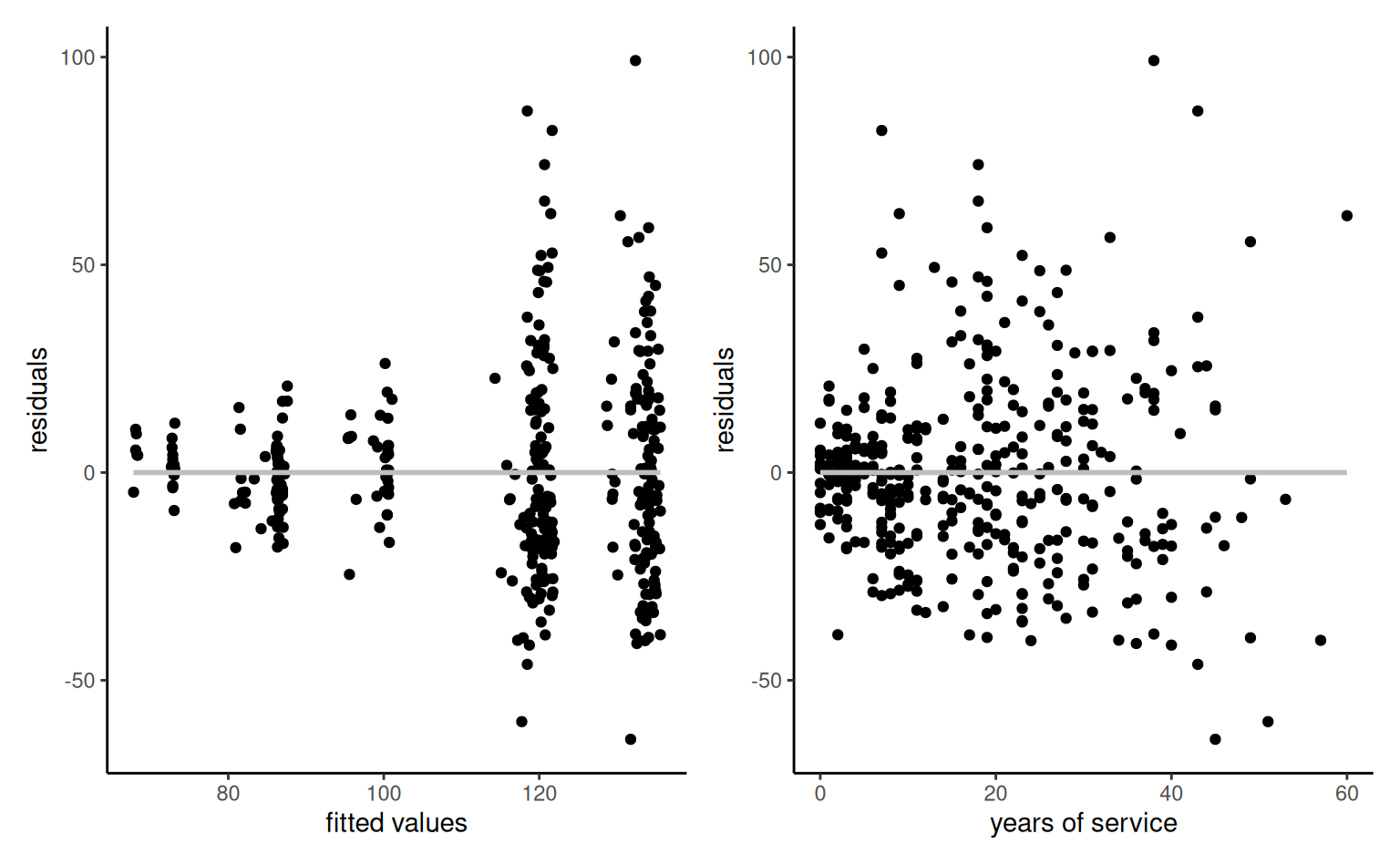

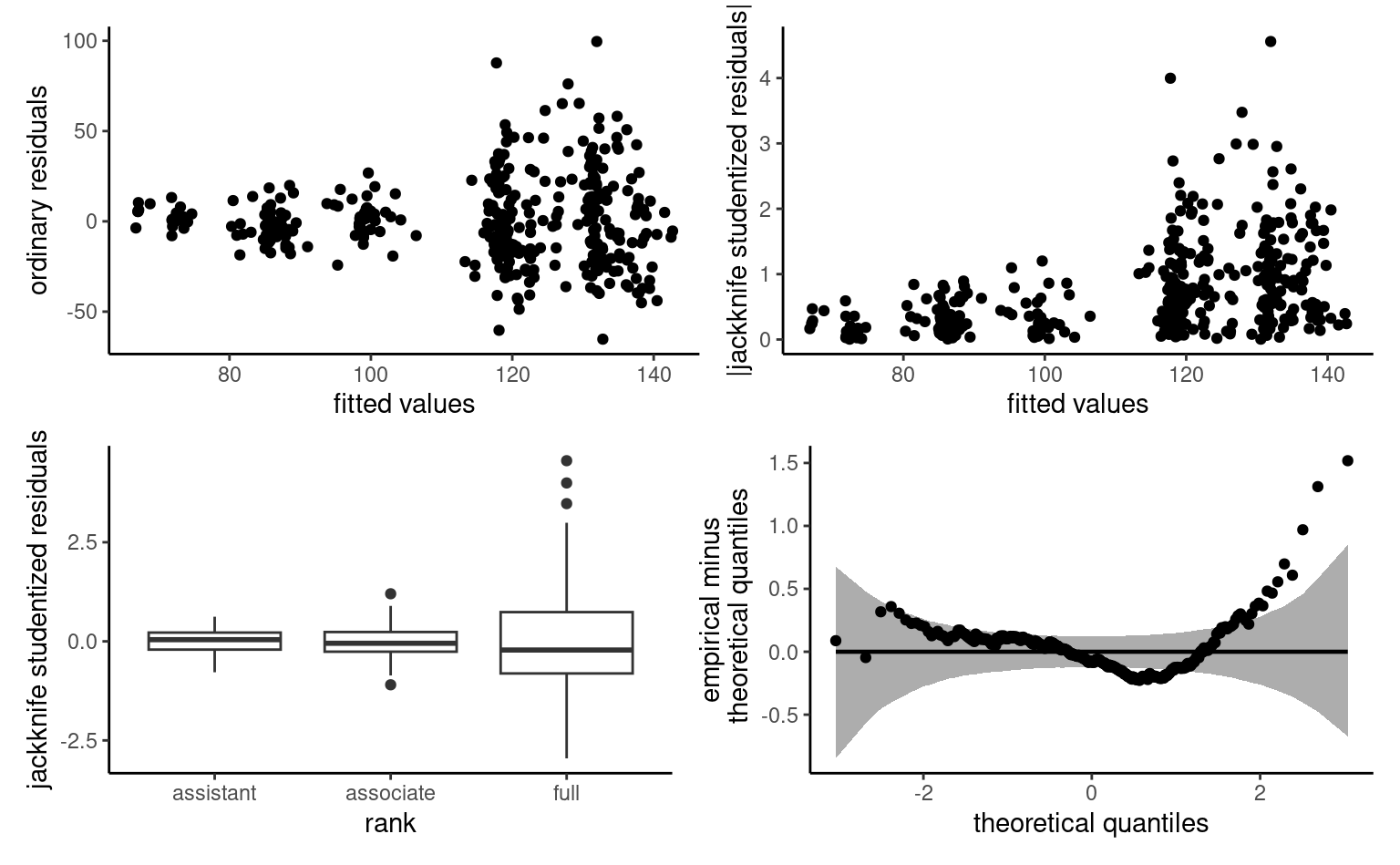

Example 4.6 (Exploratory data analysis of the college data) Before drafting a model, it is useful to perform an exploratory data analysis. If salary increases with year, there is more heterogeneity in the salary of higher ranked professors: logically, assistant professors are either promoted or kicked out after at most 6 years according to the data. The limited number of years prevents large variability for their salaries.

college data: salaries of professors as a function of the number of years of service and the academic ranking

Salary increases over years of service, but its variability also increases with rank. Note the much smaller number of women in the sample: this will impact our power to detect differences between sex. A contingency table of sex and academic rank can be useful to see if the proportion of women is the same in each rank: women represent 16% of assistant professors and 16% of associate profs, but only 7% of full professors and these are better paid on average.

| assistant | associate | full | |

|---|---|---|---|

| man | 56 | 54 | 248 |

| woman | 11 | 10 | 18 |

Some of the potential explanatory variables of the college data are categorical (rank, sex, field), the latter two being binary. The other two continuous variables, years and service, are strongly correlated with a correlation of 0.91.

Example 4.7 (Handling of missing values) The data for Moon and VanEpps (2023) should be checked to ensure that the description of the data collection matches the structure of the database. Since people who didn’t donate didn’t fill in the amount field, the latter indicates a missing value. All donation amounts are between $0.25 and $25.

data(MV23_S1, package = "hecedsm")

str(MV23_S1)

#> tibble [869 × 4] (S3: tbl_df/tbl/data.frame)

#> $ before : int [1:869] 0 1 0 1 1 1 1 0 1 0 ...

#> $ donate : int [1:869] 0 0 0 1 1 0 1 0 0 1 ...

#> $ condition: Factor w/ 2 levels "open-ended","quantity": 1 1 1 1 2 2 2 1 1 1 ...

#> $ amount : num [1:869] NA NA NA 10 5 NA 20 NA NA 25 ...

summary(MV23_S1)

#> before donate condition amount

#> Min. :0.000 Min. :0.00 open-ended:407 Min. : 0.2

#> 1st Qu.:0.000 1st Qu.:0.00 quantity :462 1st Qu.: 5.0

#> Median :1.000 Median :1.00 Median :10.0

#> Mean :0.596 Mean :0.73 Mean :10.7

#> 3rd Qu.:1.000 3rd Qu.:1.00 3rd Qu.:15.0

#> Max. :1.000 Max. :1.00 Max. :25.0

#> NA's :1 NA's :235If we include amount as response variable, the 235 missing observations will be removed by default by procedures. This is okay if we want to compare the average amount of people who donated, but we need to transform NAs to zeros otherwise. The donate binary variable should not be included as an explanatory variable in a regression model, since it is a perfect predictor of zero amounts.

4.1.3 Mean model specification

The first step of an analysis is deciding which explanatory variables should be added to the mean model specification, and under what form. Models are but approximations of reality; Section 2.1 of Venables (2000) argues that, if we believe the true mean function linking explanatories \(\boldsymbol{X}\) and the response \(Y\) is of the form \(\mathsf{E}(Y \mid \boldsymbol{X}) = f(\boldsymbol{X})\) for \(f\) sufficiently smooth, then the linear model is a first-order approximation. For interpretation purposes, it makes sense to mean-center any continuous explanatory, as this facilitates interpretation.

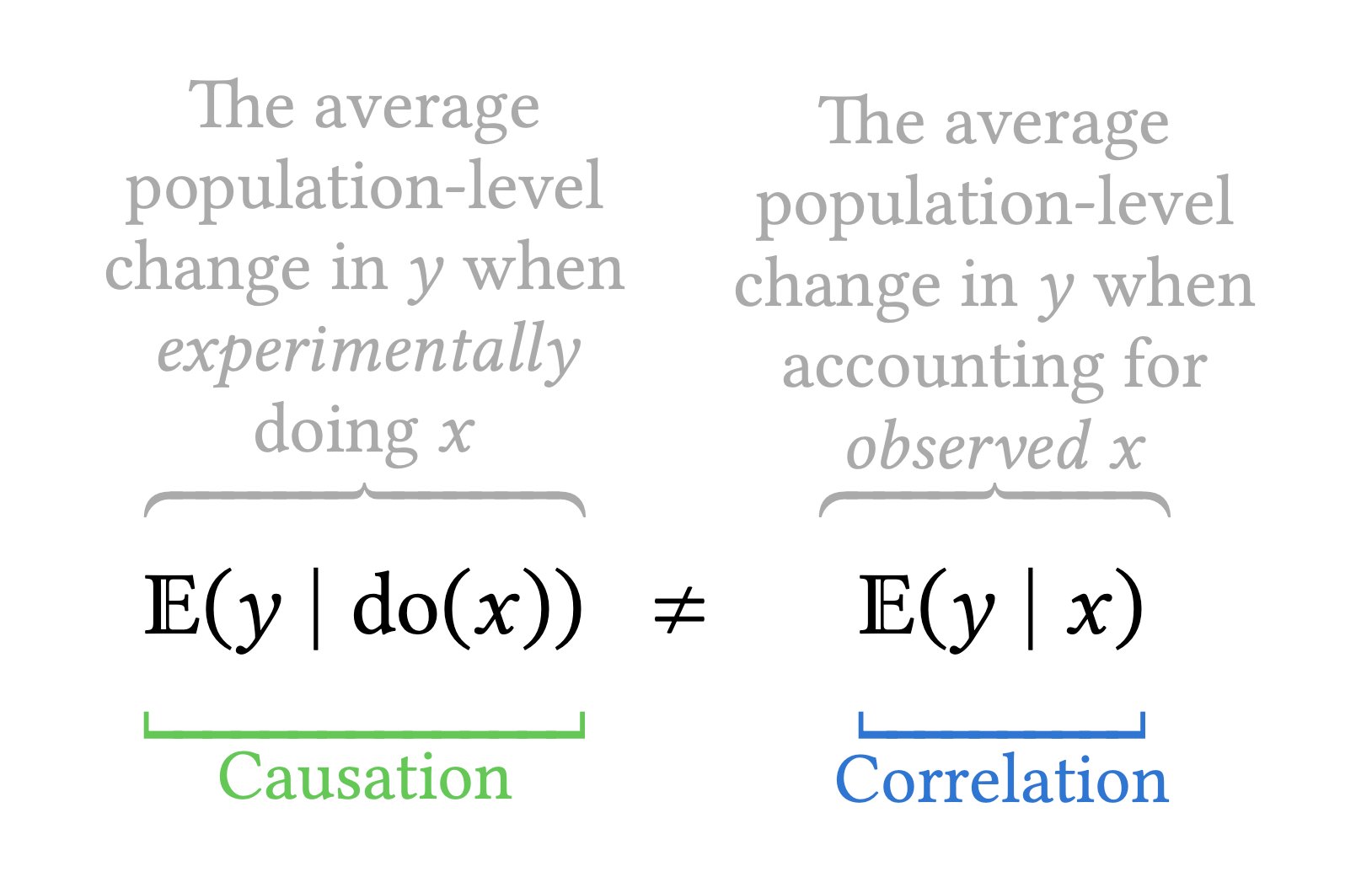

In an experimental setting, where the experimental group or condition is randomly allocated, we can directly compare the different treatments and draw causal conclusions (since all other things are constant, any detectable difference is due on average to our manipulation). Although we usually refrain from including any other explanatory to keep the design simple, it may be nevertheless helpful to consider some concomitant variables that explain part of the variability to filter background noise and increase power. For example, for the Baumann, Seifert-Kessell, and Jones (1992) data, our interest is in comparing the average scores as a function of the teaching method, we would include group. In this example, it would also make sense to include the pretest1 result as an explanatory. This way, we will model the average difference in improvement from pre-test to post-test rather than the average score.

In an observational setting, people self-select in different groups, so we need to account for differences. Linear models in economics and finance often add control variables to the model to account for potential differences due to socio-demographic variables (age, revenue, etc.) that would be correlated to the group. Any test for coefficients would capture only correlation between the outcome \(Y\) and the postulated explanatory factor of interest.

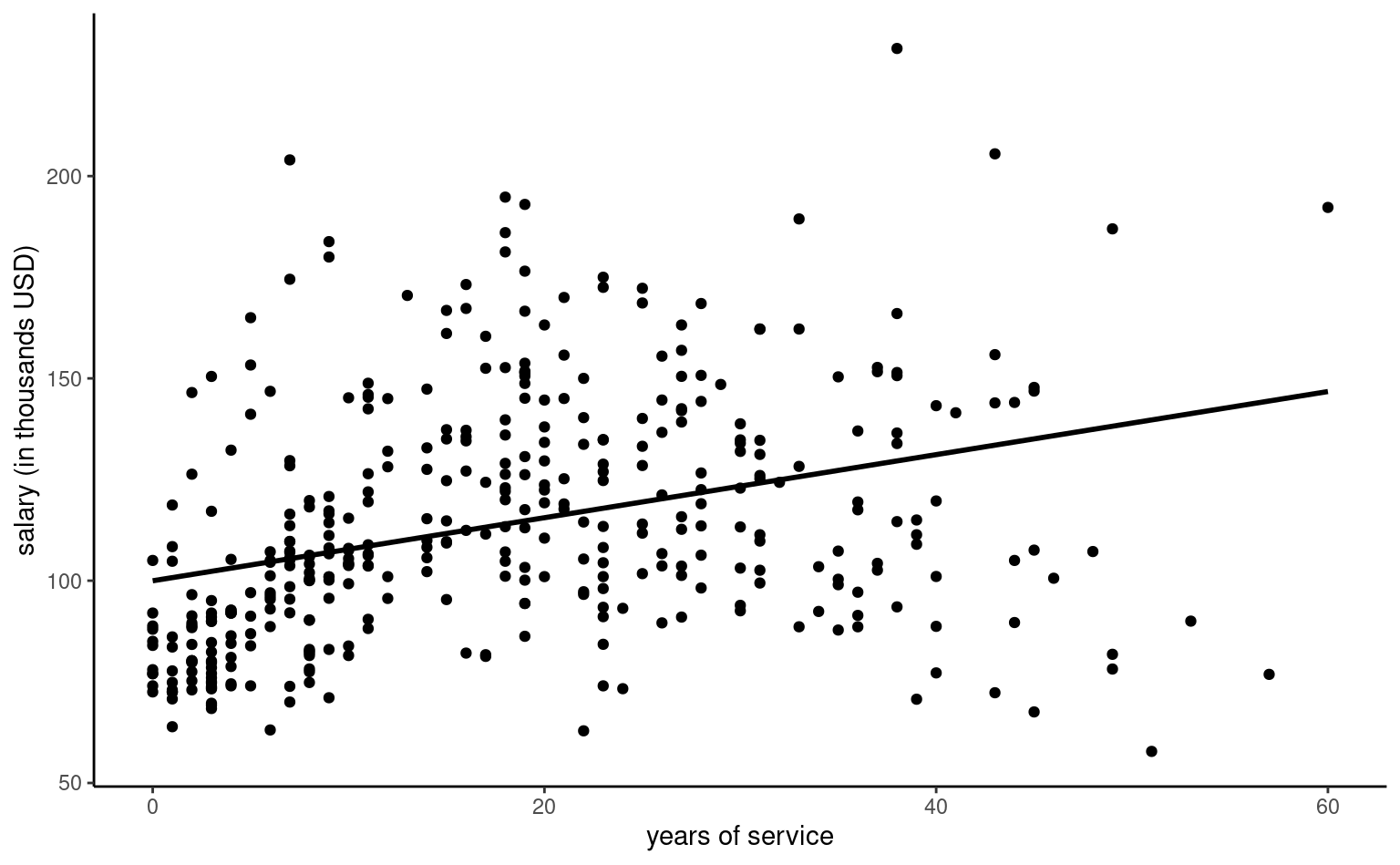

4.1.4 Continuous explanatories

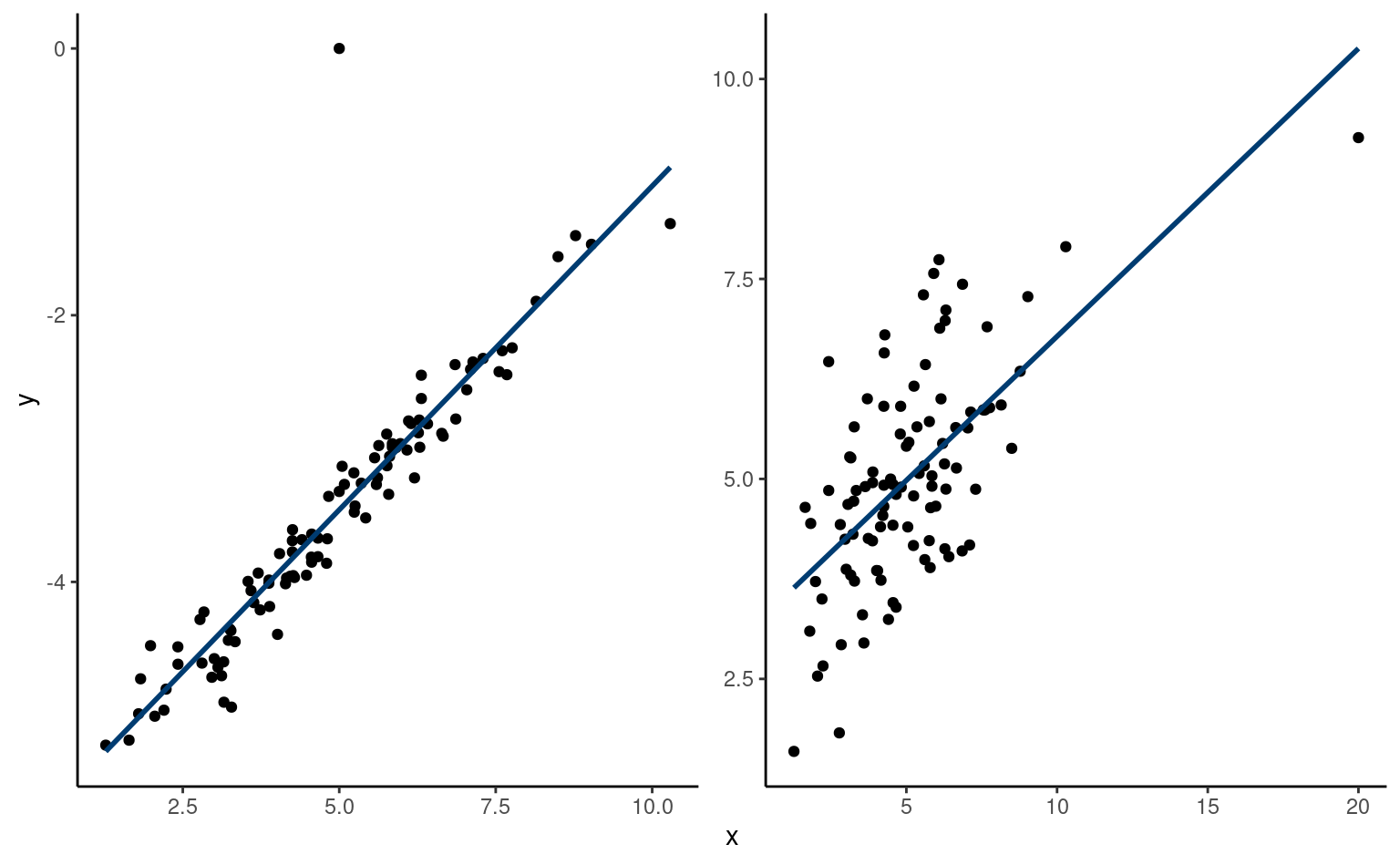

Continuous explanatories are typically specified by including a single linear term, leading to the simple linear regression of the form \(Y \mid X=x \sim \mathsf{normal}(\beta_0 + \beta x, \sigma^2)\). In this situation \(\beta_0\) is the intercept (the mean value of \(Y\) when \(x=0\)) and \(\beta_1\) is the slope, i.e., the average increase of \(Y\) when \(x\) increases by one unit. Figure 4.2 shows such an example of a model with a single explanatory. As revealed by the exploratory data analysis of Example 4.3, this model is simplistic and clearly insufficient to explain differences in salary.

The intercept \(\beta_0\) is the value when all of \(x_1, \ldots, x_p\) are zero. The interpretation of the other mean parameters in the model depends crucially on the parametrization and on potential interactions or higher order terms.

Generally, we can increase \(X_j\) by one unit and compare the increase in the mean, here for \(X_j\) \[\begin{align*} \mathsf{E}(Y \mid X_j=x_j+1, \boldsymbol{X}_{-j} = \boldsymbol{x}_{-j}) - \mathsf{E}(Y \mid X_j=x_j, \boldsymbol{X}_{-j} = \boldsymbol{x}_{-j}) = \beta_j. \end{align*}\]

Another common perspective is to consider the effect of a change in the value of an explanatory variable by looking at the slope. If \(\mu=\mathbf{x}\boldsymbol{\beta}\), then the marginal effect of the \(j\) explanatory \(X_j=x_j\) \((j=1, \ldots, p)\) is the partial derivative of the mean with respect to this value, namely \(\partial \mu/\partial x_j\).

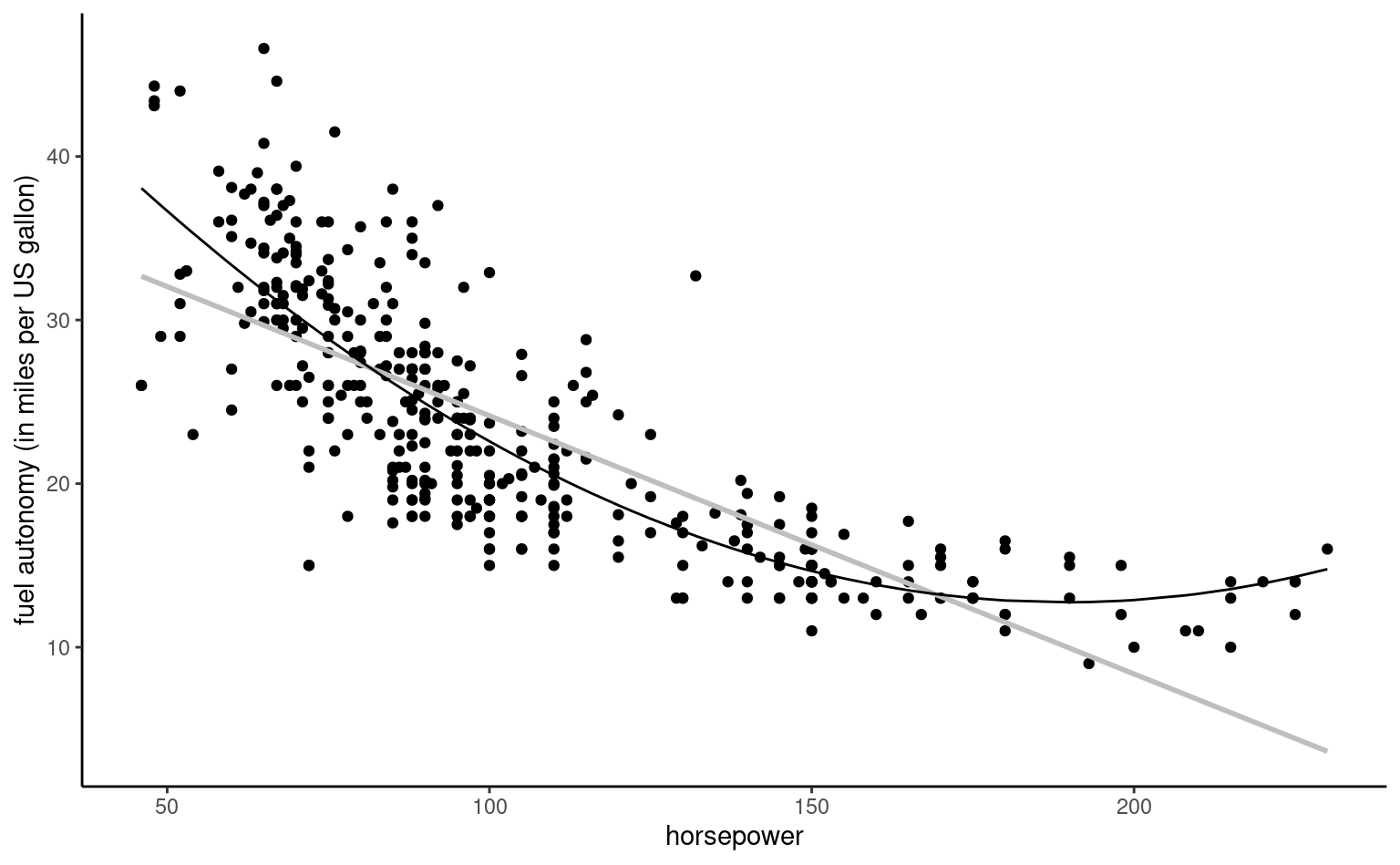

If the relationship between explanatory \(X\) and response \(Y\), as assessed from a scatterplot, is not linear, we may consider more complicated function of the explanatories, as Example 4.8 shows.

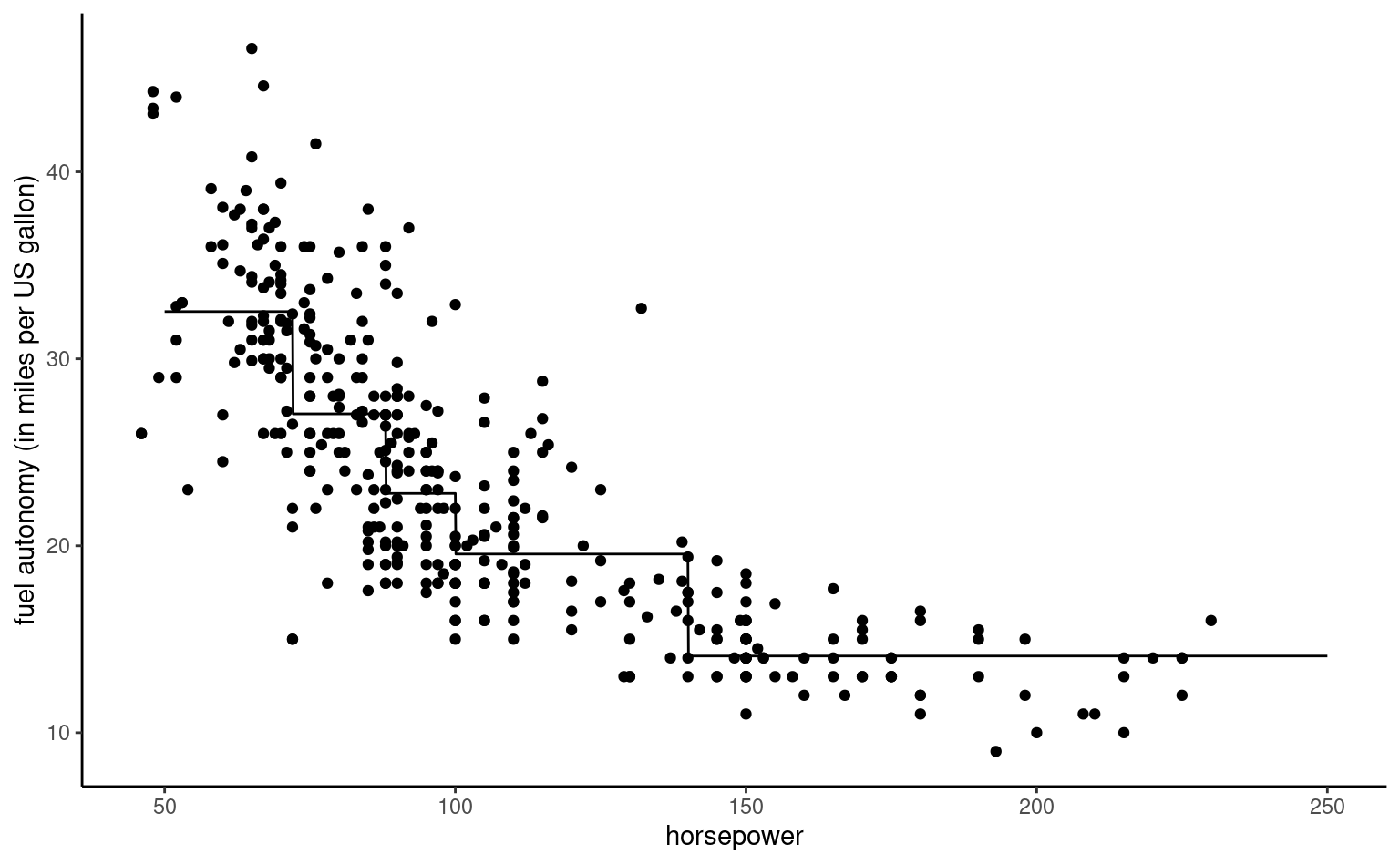

Example 4.8 (Quadratic curve for the automobile data) We consider a linear regression model for the fuel autonomy of cars as a function of the power of their motor (measured in horsepower) from the auto dataset. The postulated model, \[\begin{align*}

\texttt{mpg}_i = \beta_0 + \beta_1 \texttt{horsepower}_i + \beta_2 \texttt{horsepower}_i^2 + \varepsilon_i,

\end{align*}\] includes a quadratic term. Figure 4.3 shows the scatterplot with the fitted regression line, above which the line for the simple linear regression for horsepower is added. The marginal effect of an increase of one unit in horsepower is \(\beta_1 + 2\beta_2 \texttt{horsepower}\), which depends on the value of the explanatory.

To fit higher order polynomials, we use the poly as the latter leads to more numerical stability. For general transformations, the I function tells the software interpret the input “as is”. Thus, lm(y~x+I(x^2)), would fit a linear model with design matrix \([\boldsymbol{1}_n\, \mathbf{x}\, \mathbf{x}^2]\).

It appears graphically that the quadratic model fits better than the simple linear alternative: we will assess this hypothesis formally later. For the degree two polynomial, Figure 4.3 show that fuel autonomy decreases rapidly when power increases between 50 to 100, then more slow until 189.35 hp. After that, the model postulates that autonomy increases again as evidenced by the scatterplot, but beware of extrapolating (weird things can happen beyond the range of the data, as exemplified by Hassett’s cubic model for the number of daily cases of Covid19 in the USA).

The representation in Figure 4.3 may seem counter-intuitive given that we fit a linear model, but it is a 2D projection of 3D coordinates for the equation \(\beta_0 + \beta_1x-y +\beta_2z =0\), where \(x=\texttt{horsepower}\), \(z=\texttt{horsepower}^2\) and \(y=\texttt{mpg}\). Physics and common sense force \(z = x^2\), and so the fitted values lie on a curve in a 2D subspace of the fitted plan, as shown in grey in the three-dimensional Figure 4.4.

auto data.

Remark 4.2 (Discretization of continuous covariates). Another option is to transform a continuous variable \(X\) into a categorical variable by discretizing into bins and fitting a piecewise-linear function of \(X\). The prime example of such option is treating a Likert scale as a categorical variable. While this allows one to fit more flexible functional relations between \(X\) and \(Y\), this comes at the cost of additional coefficients for the same estimation budget (fewer observations to estimate the effect of \(X\) results in lower precision of the coefficients).

4.1.5 Categorical covariates

Dummies are variables (columns of explanatories from the model matrix) which only include \(-1\), \(0\) and \(1\) to give indicator of the level of groups. For a binary outcome, we can create a column that has entries \(1\) for the treatment and \(0\) for the control group.

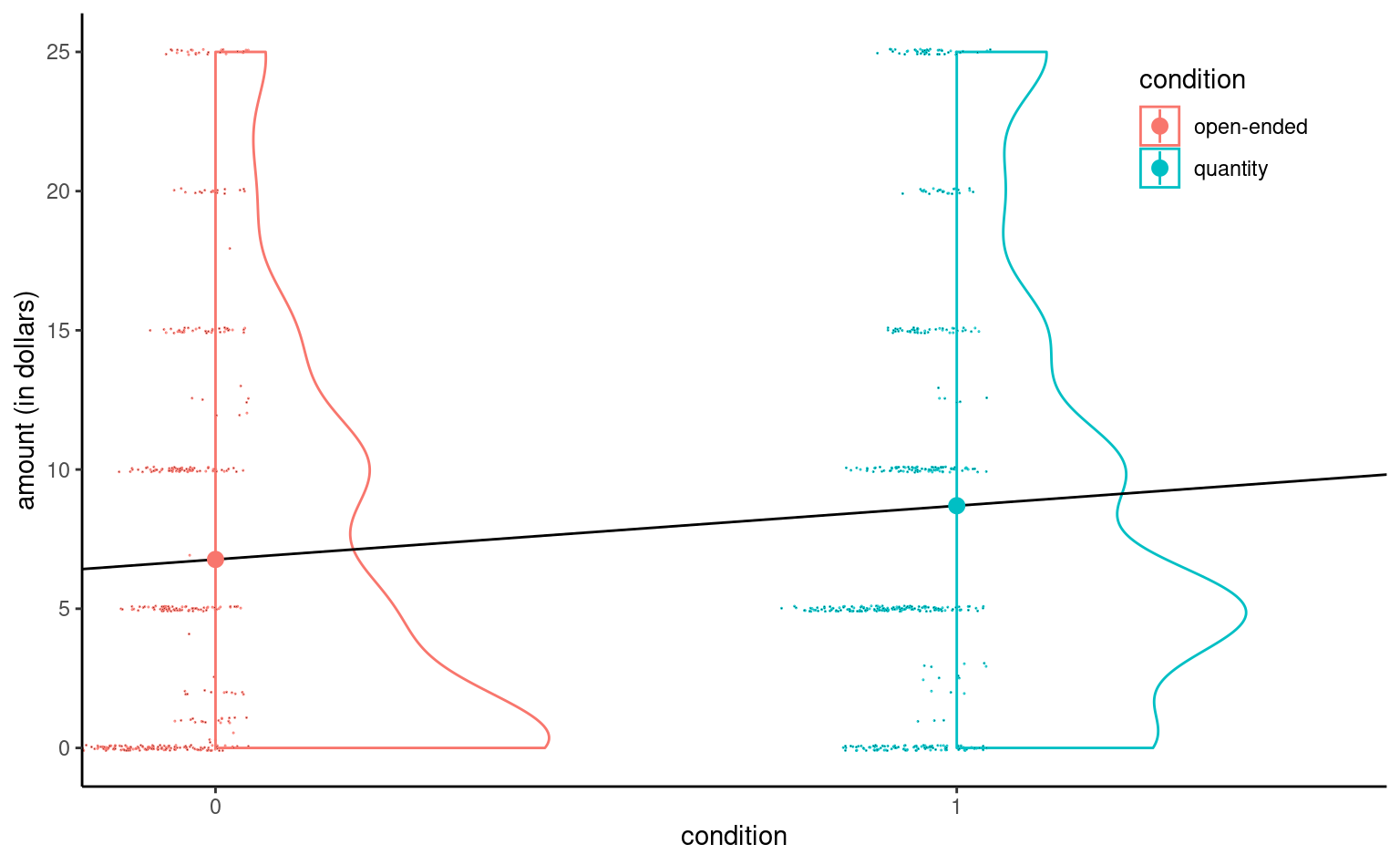

Example 4.9 (Linear models with a single binary variable) Moon and VanEpps (2023) consider the impact of providing suggested amounts for donations to a charity (as opposed to an open-ended request). In Study 1, participants were given the chance of winning 25$ and giving part of this amount to charity.

Consider for example a linear model that includes the amount (in dollars, from 0 for people who did not donate, up to 25 dollars) as a function of \[\begin{align*}\texttt{condition} = \begin{cases} 0 , & \text{open-ended},\\

1, & \text{suggested quantity}

\end{cases}

\end{align*}\] The equation of the simple linear model that includes the binary variable condition is \[\begin{align*}

\mathsf{E}(\texttt{amount} \mid \texttt{condition})&= \beta_0 + \beta_1 \mathbf{1}_{\texttt{condition}=\texttt{quantity}}.

\\&= \begin{cases}

\beta_0, & \texttt{condition}=0, \\

\beta_0 + \beta_1 & \texttt{condition}=1.

\end{cases}

\end{align*}\] Let \(\mu_0\) denote the theoretical average amount for the open-ended amount and \(\mu_1\) that of participants of the treatment quantity group. A linear model that only contains a binary variable \(X\) as regressor amounts to specifying a different mean for each of two groups: the average of the treatment group is \(\beta_0 + \beta_1 = \mu_1\) and \(\beta_1=\mu_1-\mu_0\) represents the difference between the average donation amount of people given open-ended amounts and those who are offered suggested amounts (quantity), including zeros for the amount of people who did not donate. The parametrization of the linear model with \(\beta_0\) and \(\beta_1\) is in terms of pairwise differences relative to the baseline category and is particularly useful if we want to test for mean difference between the groups, as this amounts to testing \(\mathscr{H}_0: \beta_1=0\).

MV23_S1 data using the binary variable condition as explanatory even if the equation defines a line, only its values in \(0/1\) are realistic.

Even if the linear model defines a line, the latter is only meaningful when evaluated at \(0\) or \(1\); Figure 4.6 shows it in addition to sample observations (jittered horizontally) and a density estimate for each condition. The colored dot represents the mean, which will coincide with the estimates.

It is clear that the data are heavily discretized, with lots of ties and zeros. However, given the sample size of 869 observations, we can easily draw conclusions in each group.

Let us consider categorical variables with \(K > 2\) levels, which in R are of class factor. The default parametrization for factors are in terms of treatment contrast: the reference level of the factor (by default, the first value in alphanumerical order) will be treated as the reference category and assimilated to the intercept. The software will then create a set of \(K-1\) dummy variables for a factor with \(K\) levels, each of which will have ones for the relevant value and zero otherwise.

Example 4.10 (Dummy coding for categorical variables) Consider the Baumann, Seifert-Kessell, and Jones (1992) study presented in Example 4.2, where we only include group as explanatory variable. The data are ordered by group: the first 22 observations are for group DR, the 22 next ones for group DRTA and the last 22 for TA. If we fit a model with group as categorical variables

class(BSJ92$group) # Check that group is a factor

#> [1] "factor"

levels(BSJ92$group) # First level shown is reference

#> [1] "DR" "DRTA" "TA"

# Print part of the model matrix

# (three individuals from different groups)

model.matrix(~ group, data = BSJ92)[c(1,23,47),]

#> (Intercept) groupDRTA groupTA

#> 1 1 0 0

#> 23 1 1 0

#> 47 1 0 1

# Compare with levels of factors recorded

BSJ92$group[c(1,23,47)]

#> [1] DR DRTA TA

#> Levels: DR DRTA TAThe mean model specification is \[\mathsf{E}(Y \mid \texttt{group})= \beta_0 + \beta_1\mathbf{1}_{\texttt{group}=\texttt{DRTA}} + \beta_2\mathbf{1}_{\texttt{group}=\texttt{TA}}.\] Since the variable group is categorical with \(K=3\) levels, we need \(K-1 = 2\) dummy explanatories to include the effect and obtain one average per group. With the default parametrization, we obtain

- \(\mathbf{1}_{\texttt{group}=\texttt{DRTA}}=1\) if

group=DRTAand zero otherwise. - \(\mathbf{1}_{\texttt{group}=\texttt{TA}}=1\) if

group=TAand zero otherwise.

Because the model includes an intercept and the model ultimately describes three group averages, we only need two additional variables. With the treatment parametrization, the group mean of the reference group equals the intercept coefficient, \(\mu_{\texttt{DR}}=\beta_0\),

| (Intercept) | groupDRTA | groupTA | |

|---|---|---|---|

| DR | 1 | 0 | 0 |

| DRTA | 1 | 1 | 0 |

| TA | 1 | 0 | 1 |

When group=DR (baseline), both indicator variables groupDRTA and groupTA are zero. The average in each group is \(\mu_{\texttt{DR}} = \beta_0\), \(\mu_{\texttt{DRTA}}=\beta_0 + \beta_1\) and \(\mu_{\texttt{TA}} = \beta_0 + \beta_2\). We thus find that \(\beta_1\) is the difference in mean between group DRTA and group DR, and similarly \(\beta_2=\mu_{\texttt{TA}}- \mu_{\texttt{DR}}\).

Remark 4.3 (Sum-to-zero constraints). The parametrization discussed above, which is the default for the lm function, isn’t the only one available. We consider an alternative ones: rather than comparing each group mean with that of a baseline category, the default parametrization for analysis of variance models is in terms of sum-to-zero constraints, whereby the intercept is the equiweighted average of every group, and the parameters \(\beta_1, \ldots, \beta_{K-1}\) are differences to this average.

model.matrix(

~ group,

data = BSJ92,

contrasts.arg = list(group = "contr.sum"))| (Intercept) | group1 | group2 | |

|---|---|---|---|

| DR | 1 | 1 | 0 |

| DRTA | 1 | 0 | 1 |

| TA | 1 | -1 | -1 |

In the sum-to-zero constraint, we again only get two dummy variables, labelled group1 and group2, along with the intercept. The value of group1 is \(1\) if group=DR, \(0\) if group=DRTA and \(-1\) if group=TA. Using the invariance property, we find \(\mu_{\texttt{DR}} = \beta_0 + \beta_1\), \(\mu_{\texttt{DRTA}}=\beta_0 + \beta_2\) and \(\mu_{\texttt{TA}} = \beta_0 - \beta_1 - \beta_2\) (more generally, the intercept minus the sum of all the other mean coefficients). Some algebraic manipulation reveals that \(\beta_0 = (\mu_{\texttt{DR}} +\mu_{\texttt{DRTA}}+\mu_{\texttt{TA}})/3\).

If we removed the intercept, then we could include three dummies for each treatment group and each parameter would correspond to the average. This isn’t recommended in R because the software treats models without the intercept differently and some output will be nonsensical (e.g., the coefficient of determination will be wrong).

Example 4.11 (Wage inequality in an American college) We consider a linear regression model for the college data that includes sex, academic rank, field of study and the number of years of service as explanatories.

The postulated model is \[\begin{align*} \texttt{salary} &= \beta_0 + \beta_1 \texttt{sex}_{\texttt{woman}} +\beta_2 \texttt{field}_{\texttt{theoretical}} \\&\quad +\beta_3 \texttt{rank}_{\texttt{associate}} +\beta_4 \texttt{rank}_{\texttt{full}} +\beta_5 \texttt{service} + \varepsilon. \end{align*}\]

| \(\widehat{\beta}_0\) | \(\widehat{\beta}_1\) | \(\widehat{\beta}_2\) | \(\widehat{\beta}_3\) | \(\widehat{\beta}_4\) | \(\widehat{\beta}_5\) |

|---|---|---|---|---|---|

| 86596 | -4771 | -13473 | 14560 | 49160 | -89 |

The interpretation of the coefficients is as follows:

- The estimated intercept is \(\widehat{\beta}_0=86596\) dollars; it corresponds to the mean salary of men assistant professors who just started the job and works in an applied domain.

- everything else being equal (same field, academic rank, and number of years of service), the estimated salary difference between a woman and a man is estimated at \(\widehat{\beta}_1=-4771\) dollars.

- ceteris paribus, the salary difference between a professor working in a theoretical field and one working in an applied field is \(\beta_2\) dollars: our estimate of this difference is \(-13473\) dollars, meaning applied pays more than theoretical.

- ceteris paribus, the estimated mean salary difference between associate and assistant professors is \(\widehat{\beta}_3=14560\) dollars.

- ceteris paribus, the estimated mean salary difference between full and assistant professors is \(\widehat{\beta}_4=49160\) dollars.

- within the same academic rank, every additional year of service leads to a mean salary increase of \(\widehat{\beta}_5=-89\) dollars.

Example 4.12 (Parameter interpretation for analysis of covariance) We consider a pre-post model for the error detection task test of Baumann, Seifert-Kessell, and Jones (1992). We fit a linear model with the pre-test score and the experimental condition.

data(BSJ92, package = "hecedsm") #load data

str(BSJ92) # Check that categorical variables are factors

#> tibble [66 × 6] (S3: tbl_df/tbl/data.frame)

#> $ group : Factor w/ 3 levels "DR","DRTA","TA": 1 1 1 1 1 1 1 1 1 1 ...

#> $ pretest1 : int [1:66] 4 6 9 12 16 15 14 12 12 8 ...

#> $ pretest2 : int [1:66] 3 5 4 6 5 13 8 7 3 8 ...

#> $ posttest1: int [1:66] 5 9 5 8 10 9 12 5 8 7 ...

#> $ posttest2: int [1:66] 4 5 3 5 9 8 5 5 7 7 ...

#> $ posttest3: int [1:66] 41 41 43 46 46 45 45 32 33 39 ...

# Check summary statistics for posttest1

BSJ92 |> # compute group average

group_by(group) |>

summarize(mean_pre = mean(pretest1),

mean_post = mean(posttest1),

diff_impr = mean_post - mean_pre)

#> # A tibble: 3 × 4

#> group mean_pre mean_post diff_impr

#> <fct> <dbl> <dbl> <dbl>

#> 1 DR 10.5 6.68 -3.82

#> 2 DRTA 9.73 9.77 0.0455

#> 3 TA 9.14 7.77 -1.36

# Fit the ANOVA for the difference

linmod1 <- lm(

posttest1 - pretest1 ~ group,

data = BSJ92)

coef(linmod1) # Mean model coefficients

#> (Intercept) groupDRTA groupTA

#> -3.82 3.86 2.45

# Fit a linear regression

linmod2 <- lm(

posttest1 ~ pretest1 + group,

data = BSJ92 |>

dplyr::mutate( # mean-center pretest result

pretest1 = pretest1 - mean(pretest1)))

coef(linmod2) # Mean model coefficients

#> (Intercept) pretest1 groupDRTA groupTA

#> 6.188 0.693 3.627 2.036With the ANOVA model for the group as a function of the improvement and using the default treatment parameterization,, the intercept is the average of post-test minus pre-test score for group DR, and the other two coefficients are the difference between groups DRTA and DR, and the difference between groups TA and DR. Thus, the higher average improvement is for DRTA, then TA, then the baseline DR.

Consider next a linear model in which we allow the post-test score to be a linear function of the pre-test. We find that, for each point score on the pre-test, the post-test score increases by 0.693 marks regardless of the group. The DRTA group (respectively TA) has an average, ceteris paribus, that is 3.627 (respectively 2.036) points higher than that of the baseline group DR for two people with the same pre-test score. If we center the continuous covariate pretest1, the intercept \(\beta_0\) is the average post-test score of a person from the DR group who scored the overall average of all 66 students in the pre-test.

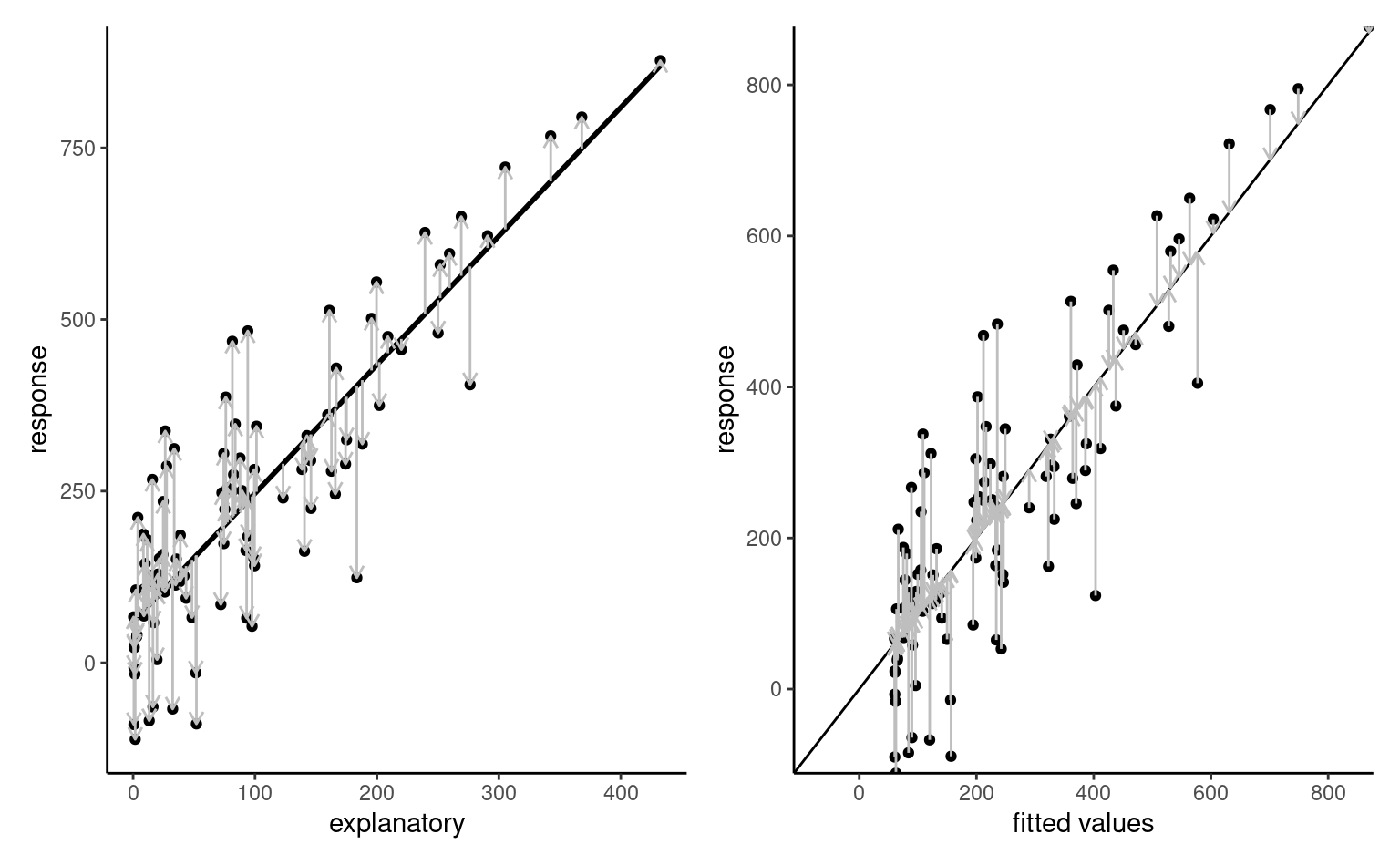

4.2 Parameter estimation

The linear model includes \(p+1\) mean parameters and a standard deviation \(\sigma\), which is assumed constant for all observations. Given a design or model matrix \(\mathbf{X}\) and a linear model formulation \(\mathsf{E}(Y_i) = \mathbf{x}_i\boldsymbol{\beta}\), we can try to find the parameter vector \(\boldsymbol{\beta} \in \mathbb{R}^{p+1}\) that minimizes the mean squared error, i.e., the average squared vertical distance between the fitted values \(\widehat{y}_i=\mathbf{x}_i\widehat{\boldsymbol{\beta}}\) and the observations \(y_i\).

Proposition 4.1 (Ordinary least squares) Consider the optimization problem \[\begin{align*} \widehat{\boldsymbol{\beta}}&=\mathrm{arg min}_{\boldsymbol{\beta} \in \mathbb{R}^{p+1}}\sum_{i=1}^n (y_i-\mathbf{x}_i\boldsymbol{\beta})^2 \\&=(\boldsymbol{y}-\mathbf{X}\boldsymbol{\beta})^\top(\boldsymbol{y}-\mathbf{X}\boldsymbol{\beta}). \end{align*}\] We can compute the derivative of the right hand side with respect to \(\boldsymbol{\beta}\), set it to zero and solve for \(\widehat{\boldsymbol{\beta}}\), \[\begin{align*} \mathbf{0}_n&=\frac{\partial}{\partial\boldsymbol{\beta}}(\boldsymbol{y}-\mathbf{X}\boldsymbol{\beta})^\top(\boldsymbol{y}-\mathbf{X}\boldsymbol{\beta})\\ \\&=\frac{\partial (\boldsymbol{y}-\mathbf{X}\boldsymbol{\beta})}{\partial \boldsymbol{\beta}}\frac{\partial (\boldsymbol{y}-\mathbf{X}\boldsymbol{\beta})^\top(\boldsymbol{y}-\mathbf{X}\boldsymbol{\beta})}{\partial (\boldsymbol{y}-\mathbf{X}\boldsymbol{\beta})}\\ \\&=2\mathbf{X}^\top (\boldsymbol{y}-\mathbf{X}\boldsymbol{\beta}) \end{align*}\] using the chain rule. Distributing the terms leads to the so-called normal equation \[\begin{align*} \mathbf{X}^\top \mathbf{X}\boldsymbol{\beta}&=\mathbf{X}^\top \boldsymbol{y}. \end{align*}\] If the \(n \times p\) matrix \(\mathbf{X}\) is full-rank, meaning that it’s columns are not linear combinations of one another, the quadratic form \(\mathbf{X}^\top \mathbf{X}\) is invertible and we obtain the solution to the least square problems, \[ \widehat{\boldsymbol{\beta}} = \left(\mathbf{X}^\top \mathbf{X}\right)^{-1}\mathbf{X}^\top \boldsymbol{y}. \tag{4.1}\] This is the ordinary least squares estimator (OLS). The explicit solution means that no numerical optimization is needed for linear models.

We could also consider maximum likelihood estimation. Proposition 4.1 shows that, assuming normality of the errors, the least square estimators of \(\boldsymbol{\beta}\) coincide with the maximum likelihood estimator of \(\boldsymbol{\beta}\).

Proposition 4.2 (Maximum likelihood estimation of the normal linear model) The linear regression model specifies that the observations \(Y_i \sim \mathsf{normal}(\mathbf{x}_i\boldsymbol{\beta}, \sigma^2)\) are independent. The linear model has \(p+2\) parameters (\(\boldsymbol{\beta}\) and \(\sigma^2\)) and the log likelihood is, abstracting from constant terms, \[\begin{align*} \ell(\boldsymbol{\beta}, \sigma)&\propto-\frac{n}{2} \ln (\sigma^2) -\frac{1}{2\sigma^2}(\boldsymbol{y}-\mathbf{X}\boldsymbol{\beta})^\top(\boldsymbol{y}-\mathbf{X}\boldsymbol{\beta}). \end{align*}\] Maximizing the log likelihood with respect to \(\boldsymbol{\beta}\) is equivalent to minimizing the sum of squared errors \(\sum_{i=1}^n (y_i - \mathbf{x}_i\boldsymbol{\beta})^2\), regardless of the value of \(\sigma\), and we recover the OLS estimator \(\widehat{\boldsymbol{\beta}}\). The maximum likelihood estimator of the variance \(\widehat{\sigma}^2\) is thus \[\begin{align*} \widehat{\sigma}^2=\mathrm{arg max}_{\sigma^2} \ell(\widehat{\boldsymbol{\beta}}, \sigma^2). \end{align*}\] The profile log likelihood for \(\sigma^2\), excluding constant terms that don’t depend on \(\sigma^2\), is \[\begin{align*} \ell_{\mathrm{p}}(\sigma^2) &\propto-\frac{1}{2}\left\{n\ln\sigma^2+\frac{1}{\sigma^2}(\boldsymbol{y}-\mathbf{X}\hat{\boldsymbol{\beta}})^\top(\boldsymbol{y}-\mathbf{X}\hat{\boldsymbol{\beta}})\right\}. \end{align*}\] Differentiating each term with respect to \(\sigma^2\) and setting the gradient equal to zero yields the maximum likelihood estimator \[\begin{align*} \widehat{\sigma}^2&=\frac{1}{n}(\boldsymbol{Y}-\mathbf{X}\hat{\boldsymbol{\beta}})^\top(\boldsymbol{Y}-\mathbf{X}\hat{\boldsymbol{\beta}})\\&= \frac{1}{n} \sum_{i=1}^n (y_i - \mathbf{x}_i\widehat{\boldsymbol{\beta}})^2\\&= \frac{\mathsf{SS}_e}{n}; \end{align*}\] where \(\mathsf{SS}_e\) is the sum of squared residuals. The usual unbiased estimator of \(\sigma^2\) calculated by software is \(S^2=\mathsf{SS}_e/(n-p-1)\), where the denominator is the sample size \(n\) minus the number of mean parameters \(\boldsymbol{\beta}\), \(p+1\).

Proposition 4.3 (Information matrix for normal linear regression models) The entries of the observed information matrix of the normal linear model are \[\begin{align*} -\frac{\partial^2 \ell(\boldsymbol{\beta}, \sigma^2)}{\partial \boldsymbol{\beta}\partial \boldsymbol{\beta}^\top} &= \frac{1}{\sigma^2} \frac{\partial \mathbf{X}^\top(\boldsymbol{y}-\mathbf{X}\boldsymbol{\beta})}{\partial \boldsymbol{\beta}^\top} = \frac{\mathbf{X}^\top\mathbf{X}}{\sigma^2}\\ -\frac{\partial^2 \ell(\boldsymbol{\beta}, \sigma^2)}{\partial \boldsymbol{\beta}\partial \sigma^2} &=- \frac{\mathbf{X}^\top(\boldsymbol{y}-\mathbf{X}\boldsymbol{\beta})}{\sigma^4}\\ -\frac{\partial^2 \ell(\boldsymbol{\beta}, \sigma^2)}{\partial (\sigma^2)^2} &= -\frac{n}{2\sigma^4} + \frac{(\boldsymbol{y}-\mathbf{X}\boldsymbol{\beta})^\top(\boldsymbol{y}-\mathbf{X}\boldsymbol{\beta})}{\sigma^6}. \end{align*}\] If we evaluate the observed information at the MLE, we get \[\begin{align*} j(\widehat{\boldsymbol{\beta}}, \widehat{\sigma^2}) = \begin{pmatrix} \frac{\mathbf{X}^\top\mathbf{X}}{\widehat{\sigma^2}} & \boldsymbol{0}_{p+1} \\ \boldsymbol{0}_{p+1}^\top & \frac{n}{2\widehat{\sigma^4}} \end{pmatrix} \end{align*}\] since \(\widehat{\sigma}^2=\mathsf{SS}_e/n\) and the residuals are orthogonal to the model matrix. Since \(\mathsf{E}(Y \mid \mathbf{X})=\mathbf{X}\boldsymbol{\beta}\), the Fisher information is \[\begin{align*} i(\boldsymbol{\beta}, \sigma^2) = \begin{pmatrix} \frac{\mathbf{X}^\top\mathbf{X}}{\sigma^2} & \boldsymbol{0}_{p+1} \\ \boldsymbol{0}_{p+1}^\top & \frac{n}{2\sigma^4} \end{pmatrix} \end{align*}\] Since zero off-correlations in normal models amount to independence, the MLE for \(\sigma^2\) and \(\boldsymbol{\beta}\) are independent. Provided the \((p+1)\) square matrix \(\mathbf{X}^\top\mathbf{X}\) is invertible, the large-sample variance of the ordinary least squares estimator is \(\sigma^2(\mathbf{X}^\top\mathbf{X})^{-1}\) and that of the MLE of the variance is \(2\sigma^4/n\).

Proposition 4.4 (Fitting linear models with software) Although we could build the model matrix ourselves and use the least square formula of Equation 4.1, the numerical routines implemented in software are typically better behaved. The lm function in R fits linear models, as does glm with the default arguments. Objects of class lm have multiple methods allow you to extract specific objects from lm objects. For example, the functions coef, resid, fitted, model.matrix will return the coefficients \(\widehat{\boldsymbol{\beta}},\) the ordinary residuals \(\boldsymbol{e},\) the fitted values \(\widehat{\boldsymbol{y}}\) and the model matrix \(\mathbf{X}\).

data(BSJ92, package = "hecedsm") #load data

str(BSJ92) # Check that categorical variables are factors

# Fit the linear regression

linmod <- lm(posttest1 ~ pretest1 + group,

data = BSJ92)

beta_hat <- coef(linmod) # beta coefficients

vcov_beta <- vcov(linmod) # Covariance matrix of betas

summary(linmod) # summary table

beta_ci <- confint(linmod) # Wald confidence intervals for betas

yhat <- fitted(linmod) # fitted values

e <- resid(linmod) # ordinary residuals

# Check OLS formula

X <- model.matrix(linmod) # model matrix

y <- college$salary

isTRUE(all.equal(

c(solve(t(X) %*% X) %*% t(X) %*% y),

as.numeric(coef(linmod))

))The summary method is arguably the most useful: it will print mean parameter estimates along with standard errors, \(t\) values for the Wald test of the hypothesis \(\mathscr{H}_0: \beta_i=0\) and the associated \(p\)-values. Other statistics and information about the sample size, the degrees of freedom, etc., are given at the bottom of the table. Note that the lm function uses the unbiased estimator of the variance \(\sigma^2\), denoted \(S^2\) in this chapter.

4.3 Predictions

When we compute least square estimates, we obtain fitted values \(\widehat{\boldsymbol{y}}\) as \(\mathbf{X}\widehat{\boldsymbol{\beta}}\), where \(\mathbf{X}\) denotes the \(n \times (p+1)\) model matrix. We can also obtain an estimate of the mean surface for any new row vector of explanatories \(\mathbf{x}^* = (1, x^*_1, \ldots, x^*_p)\), knowing that \(\mathsf{E}(Y \mid \mathbf{x}^*)=\mathbf{x}^*\boldsymbol{\beta}\), by replacing the unknown coefficients \(\boldsymbol{\beta}\) by our estimates \(\widehat{\boldsymbol{\beta}}\). This yields the best linear unbiased predictor of the mean.

If we want to predict the value of a new observation, say \(Y^*\), with known explanatories \(\mathbf{x}^*\), the prediction will thus be \(\widehat{y}^* = \mathbf{x}^*\widehat{\boldsymbol{\beta}}\) because \[\begin{align*} \mathsf{E}(\widehat{Y}^* \mid \mathbf{X}, \mathbf{x}^*) = \mathsf{E}(\mathbf{x}^*\widehat{\boldsymbol{\beta}}\mid \mathbf{X}, \mathbf{x}^*) = \mathbf{x}^*\boldsymbol{\beta}. \end{align*}\] However, individual observations vary more than averages (which are themselves based on numerous observations). Intuitively, this is due to the added uncertainty of the error term appearing in the model equation: the variability of new predictions is the sum of uncertainty due to the estimators (based on random data) and the intrinsic variance of the observations assuming the new observation is independent of those used to estimate the coefficients, \[\begin{align*} \mathsf{Va}(Y^*-\widehat{Y}^* \mid \mathbf{X}, \mathbf{x}^*) &= \mathsf{Va}(Y^* - \mathbf{x}^*\widehat{\boldsymbol{\beta}} \mid \mathbf{X}, \mathbf{x}^*) \\&=\mathsf{Va}(Y^* \mid \mathbf{X}, \mathbf{x}^*) + \mathsf{Va}(\mathbf{x}^*\widehat{\boldsymbol{\beta}} \mid \mathbf{X}, \mathbf{x}^*) \\& = \sigma^2\mathbf{x}^{*\vphantom{\top}}(\mathbf{X}^\top\mathbf{X})^{-1}\mathbf{x}^{*\top} + \sigma^2, \end{align*}\] and we can base the prediction interval on the Student distribution, as \[\begin{align*} \frac{Y^*-\mathrm{x}^*\widehat{\boldsymbol{\beta}}}{\sqrt{S^2\{1+\mathrm{x}^*(\mathbf{X}^\top\mathbf{X})^{-1}\mathrm{x}^{*\top}\}}}\sim \mathsf{Student}(n-p-1). \end{align*}\] We obtain \(1-\alpha\) prediction interval for \(Y^*\) by inverting the test statistic, \[\begin{align*} \mathrm{x}^*\widehat{\boldsymbol{\beta}}\pm \mathfrak{t}_{n-p-1}(\alpha/2)\sqrt{S^2\{1+\mathrm{x}^*(\mathbf{X}^\top\mathbf{X})^{-1}\mathrm{x}^{*\top}\}}. \end{align*}\] Similar calculations yield the formula for pointwise confidence intervals for the mean, \[\begin{align*} \mathrm{x}^*\widehat{\boldsymbol{\beta}}\pm \mathfrak{t}_{n-p-1}(\alpha/2)\sqrt{S^2\mathrm{x}^*(\mathbf{X}^\top\mathbf{X})^{-1}\mathrm{x}^{*\top}}. \end{align*}\] The two differ only because of the additional variance of individual observations.

Example 4.13 (Prediction for simple linear regression) Consider the data of Example 4.5. We fit a simple linear regression of the form \(\texttt{pef} = \beta_0 + \beta_1 \texttt{proportion} + \varepsilon\) with \(\varepsilon \sim \mathsf{normal}(0,\sigma^2)\) and observations assumed independent.

Figure 4.8 shows pointwise uncertainty bands for a simple linear regression of the data Sokolova, Krishna, and Döring (2023) as a function of the paper to plastic proportion, with larger values indicating more spurious paper wrapping. The model is not accounting for the fact that our response arises from a bounded discrete distribution with integer values ranging from 1 to 7, and that the ratios tested in the experiment are 0 (no paper), 0.5, 1 and 2. The middle line gives the prediction of individuals as we vary the proportion paper/plastic. Looking at the formulas for the confidence and prediction intervals, it is clear that the bands are not linear (we consider the square root of a function that involves the predictors), but it is not obvious that the uncertainty increases as you move away from the average of the predictors.

This is more easily seen by replicating the potential curves that could have happened with different data: Figure 4.8 shows generated new potential slopes from the asymptotic normal distribution of \(\widehat{\boldsymbol{\beta}}\) estimators. The hyperbolic shape is not surprising: we are basically tilting curves from the average pef/proportion, and they have higher potential from deviating the further we are from the average in each direction. The prediction intervals (pale grey) are very large and essentially cover the whole scope of potential values for the perceived environmental friendliness Likert scale, except for a couple of observations. By contrast, the confidence intervals for the mean are quite narrow, as a result of the large sample size. We can see also that the curves do not deviate much from them.

pef) as a function of the proportion of paper to plastic, with horizontally jittered observations. The plot shows predictions along with pointwise 95% confidence intervals of the mean and the individual predictions. The \(y\)-axis has been truncated.

In R, the generic predict takes as input a model and a newdata argument contains a data frame with the same structure as the original data used to fit the model (or at least the columns of explanatory variables used).

data(SKD23_S2A, package = "hecedsm") # load data

lm_simple <- lm(pef ~ proportion, data = SKD23_S2A) # fit simple linear regression

predict(lm_simple,

newdata = data.frame(proportion = c(0, 0.5, 1, 2)),

interval = "prediction") # prediction intervals

predict(lm_simple,

newdata = data.frame(proportion = c(0, 0.5, 1, 2)),

interval = "confidence") # confidence for meanproportion |

prediction | lower | upper |

|---|---|---|---|

| 0.0 | 2.41 | -0.168 | 4.98 |

| 0.5 | 2.67 | 0.097 | 5.24 |

| 1.0 | 2.93 | 0.361 | 5.51 |

| 2.0 | 3.46 | 0.884 | 6.04 |

| mean | lower CI | upper CI |

|---|---|---|

| 2.41 | 2.27 | 2.55 |

| 2.67 | 2.57 | 2.77 |

| 2.93 | 2.84 | 3.02 |

| 3.46 | 3.30 | 3.62 |

Remark 4.4 (Notation). It is important to distinguish the equation of the stochastic model, expressed in terms of random variables \(\mathsf{E}(Y_i \mid \boldsymbol{x}_i) = \mathbf{x}_i\boldsymbol{\beta} + \varepsilon_i\) and the equation of the fitted values or predictions, \[\begin{align*} \widehat{\mathsf{E}(Y_i \mid \mathbf{x}_i)} =\mathbf{x}_i\widehat{\boldsymbol{\beta}} \end{align*}\] The prediction does not involve unknown error terms.

4.4 Hypothesis testing

Hypothesis testing in linear models and analysis of variance proceeds as usual: we compare two nested models, one of which (the null model) is a simplification of a more complex one obtaining by imposing restrictions on the mean coefficients.

Of particular interest are tests of restrictions for components of \(\boldsymbol{\beta}\). The large sample properties of the maximum likelihood estimator imply that \[\begin{align*} \widehat{\boldsymbol{\beta}} \stackrel{\cdot}{\sim}\mathsf{normal}_{p+1}\left\{\boldsymbol{\beta}, \sigma^2(\mathbf{X}^\top\mathbf{X})^{-1}\right\} \end{align*}\] for sufficiently large sample size, and this result is exact for normal data. One can thus easily estimate the standard errors from the matrix upon replacing \(\sigma^2\) by an estimator. With normal data, one can show that \(\mathsf{SS}_e \sim \sigma^2\chi^2_{n-p-1}\) and \(\mathsf{SS}_e\) is independent of \(\widehat{\boldsymbol{\beta}}\).

In an inferential setting, it’s often important to test whether the effect of an explanatory variable is significant: if \(x_j\) is binary or continuous, the test for \(\mathscr{H}_0: \beta_j=0\) corresponds to a null marginal effect for \(x_j\). The null model is a linear regression in which we remove the \((j+1)\)st column of \(\mathbf{X}\).

Proposition 4.5 (Wald tests in linear regression) Recall that the Wald test statistic for the hypothesis \(\mathscr{H}_0: \beta_j=b\) is \[W = \frac{\widehat{\beta}_j - b}{\mathsf{se}(\widehat{\beta}_j)}.\] The Wald test statistic is reported by most software for the hypothesis \(b=0\). Since \(\mathsf{Var}(\widehat{\beta}_j) = \sigma^2 [(\mathbf{X}^\top\mathbf{X})^{-1}]_{j,j}\), we can estimate standard error from \(S^2\) and derive that the distribution of \(W\) under the null hypothesis is \(\mathsf{Student}(n-p-1)\). This explains the terminology “\(t\) values” in the summary table. In addition to coefficient estimates, it is possible to obtain Wald-based confidence intervals for \(\beta_j\), which are the usual \(\widehat{\beta}_j \pm \mathfrak{t}_{n-p-1,\alpha/2} \mathsf{se}(\widehat{\beta}_j)\), with \(\mathfrak{t}_{n-p-1,\alpha/2}\) denoting the \(1-\alpha/2\) quantile of the \(\mathsf{Student}({n-p-1})\) distribution.

Example 4.14 Consider the data from Example 4.5. If we fit against the simple linear regression model, we can extract the \(p\)-values for the Wald or \(t\)-tests. The test for the intercept is of no interest since data are measured on a scale from 1 to 7, so the mean response when proportion=0 cannot be zero. The coefficient for proportion suggests a trend of 0.5 point per unit ratio, and this is significantly different from zero, indicating that the pef score changes with the paper to plastic ratio.

summary(lm_simple)$coefficients # t-tests (Wald) for beta=0 with p-values

#> Estimate Std. Error t value Pr(>|t|)

#> (Intercept) 2.407 0.0723 33.31 2.56e-153

#> proportion 0.526 0.0618 8.51 8.40e-17

confint(lm_simple) # confidence intervals for betas

#> 2.5 % 97.5 %

#> (Intercept) 2.266 2.549

#> proportion 0.405 0.648For categorical variables with more than two levels, testing if \(\beta_j=0\) is typically not of interest because the coefficient represents the difference between the category \(x_j\) and the baseline with the treatment contrast parametrization: these two categories could have a small difference, but the categorical variable as a whole may still be a useful predictor given the other explanatories. The hypothesis of zero contrast is awkward because it implies a null model in which selected categories are merged, but then depends on the reference category. Rather, we wish to compare a model in which all variables are present with one in which the categorical explanatory is omitted.

Proposition 4.6 (F-tests for comparison of nested linear models) Consider the full linear model which contains \(p\) predictors, \[\begin{align*} \mathbb{M}_1: Y=\beta_0+\beta_1 x_1 + \cdots + \beta_g x_g + \beta_{k+1}x_{k+1} + \ldots + \beta_p x_p + \varepsilon. \end{align*}\] Suppose without loss of generality that we want to test \(\mathscr{H}_0: \beta_{k+1}=\beta_{k+2}=\cdots=\beta_p=0\) (one could permute columns of the model matrix to achieve this configuration). The global hypothesis specifies that \((p-k)\) of the \(\beta\) parameters are zero. The restricted model corresponding to the null hypothesis contains only the covariates for which \(\beta_j \neq 0\), \[\begin{align*} \mathbb{M}_0: Y=\beta_0+\beta_1 x_1 + \ldots + \beta_k x_k + \varepsilon. \end{align*}\] Let \(\mathsf{SS}_e(\mathbb{M}_1)\) be the residuals sum of squares for model \(\mathbb{M}_1\), \[\begin{align*} \mathsf{SS}_e(\mathbb{M}_1)=\sum_{i=1}^n (Y_i-\widehat{Y}_i^{\mathbb{M}_1})^2, \end{align*}\] where \(\widehat{Y}_i^{\mathbb{M}_1}\) is the \(i\)th fitted value from \(\mathbb{M}_1\). Similarly define \(\mathsf{SS}_e(\mathbb{M}_0)\) for the residuals sum of square of \(\mathbb{M}_0\). Clearly, \(\mathsf{SS}_e(\mathbb{M}_0) \geq \mathsf{SS}_e(\mathbb{M}_1)\) (why?)

The \(F\)-test statistic is \[\begin{align*} F=\frac{\{\mathsf{SS}_e(\mathbb{M}_0)-\mathsf{SS}_e(\mathbb{M}_1)\}/(p-k)}{\mathsf{SS}_e(\mathbb{M}_1)/(n-p-1)}. \end{align*}\] Under \(\mathscr{H}_0\), the \(F\) statistic follows a Fisher distribution (Definition 1.15) with \((p-k)\) and \((n-p-1)\) degrees of freedom, \(\mathsf{Fisher}(p-k, n-p-1)\) — \(p-k\) is the number of restrictions, and \(n-p-1\) is sample size minus the number of coefficients for the mean of \(\mathbb{M}_1\).

It turns out that both \(F\) and \(t\)-statistics are equivalent for testing a single coefficient \(\beta_j\): the \(F\)-statistic is the square of the Wald statistic and they lead to the same inference — the \(p\)-value for the test are identical. While it may get reported in tables, the test for \(\beta_0=0\) is not of interest; we keep the intercept merely to centre the residuals.

Remark 4.5 (F-tests versus likelihood ratio tests). For normal linear regression, the likelihood ratio test for comparing models \(\mathbb{M}_1\) and \(\mathbb{M}_0\) is a function of the sum of squared residuals: the usual formula simplifies to \[\begin{align*} R &= n\ln\{\mathsf{SS}_e(\mathbb{M}_0)/\mathsf{SS}_e(\mathbb{M}_1)\}\\ &= n \ln \left( 1+ \frac{p-k}{n-p-1}F\right) \end{align*}\] Both the likelihood ratio test and the \(F\) tests are related via an monotone transformation, and we can use the \(\mathsf{Fisher}\) distribution for comparison, rather than the large-sample \(\chi^2\) approximation. The \(t\)-tests and \(F\)-tests presented above could thus both be viewed as particular cases of likelihood-ratio tests but using Student-\(t\) versus normal distribution when \(p-k=1\), and \(\mathsf{Fisher}\) versus \(\chi^2\) when \(p-k \ge 1\). When \(n\) is large, results are roughly the same.

4.4.1 Contrasts

Suppose we perform an analysis of variance and the \(F\)-test for the (global) null hypothesis that the averages of all groups are equal is very large: we reject the null hypothesis in favor of the alternative, which states that at least one of the group average is different. The follow-up question will be where these differences lie. Indeed, in an experimental context, this implies one or more of the manipulation has a different effect from the others on the mean response. Oftentimes, this isn’t interesting in itself: we could be interested in comparing different options relative to a control group or determine whether specific combinations work better than separately, or find the best treatment by comparing all pairs.

The scientific question of interest that warranted the experiment may lead to a specific set of hypotheses, which can be formulated by researchers as comparisons between means of different subgroups. We can normally express these as contrasts. As Dr. Lukas Meier puts it, if the global \(F\)-test for equality of means is equivalent to a dimly lit room, contrasts are akin to spotlight that let one focus on particular aspects of differences in treatments. Formally speaking, a contrast is a linear combination of averages: in plain English, this means we assign a weight to each group average and add them up, and then compare that summary to a postulated value \(a\), typically zero. Contrasts encode research question of interest: if \(c_i\) denotes the weight of group average \(\mu_i\) \((i=1, \ldots, K)\), then we can write the contrast as \(C = c_1 \mu_1 + \cdots + c_K \mu_K\) with the null hypothesis \(\mathscr{H}_0: C=a\) for a two-sided alternative. The sample estimate of the linear contrast is obtained by replacing the unknown population average \(\mu_i\) by the sample average of that group, \(\widehat{\mu}_i = \overline{y}_{i}\). We can easily obtain the standard error of the linear combination \(C\): assuming subsample size of \(n_1, \ldots, n_K\) and a common variance \(\sigma^2\), the standard error is the square root of \[\mathsf{Va}(\widehat{C}) = \widehat{\sigma}^2\left(\frac{c_1^2}{n_1} + \cdots + \frac{c_K^2}{n_K}\right).\] We can then build a \(t\) statistic as usual by looking at the difference between our postulated value and the observed weighted mean, suitably standardized. If the global \(F\)-test leads to rejection of the null, there exists a contrast which is significant at the same level. Whenever the contrasts vectors are orthogonal, the tests will be uncorrelated. Mathematically, if we let \(c_{i}\) and \(c^{*}_{i}\) denote weights attached to the mean of group \(i\) comprising \(n_i\) observations, contrasts are orthogonal if \(c_{1}c^{*}_{1}/n_1 + \cdots + c_{K}c^{*}_K/n_K = 0\); if the sample is balanced with the same number of observations in each group, \(n/K = n_1 =\cdots = n_K\), we can consider the dot product of the two contrast vectors and neglect the subsample sizes.

If we have \(K\) groups, there are \(K-1\) contrasts for pairwise differences, the last one being captured by the sample mean for the overall effect1. If we care only about difference between groups (as opposed to the overall effect of all treatments), we impose a sum-to-zero constraint on the weights so \(c_1 + \cdots + c_K=0\).

4.4.2 Examples of tests

Example 4.15 (Testing for amount of donations) Consider Example 4.9, whereby we test for differences between open-ended amounts and pre-specified amounts for proposals (quantity). The test of interest is \(\mathscr{H}_0: \beta_1=0\), where \(\beta_1=\mu_{\texttt{oe}} - \mu_{\texttt{qty}}\) is the mean difference between groups. Beyond the fact the difference is statistically significant at the 5% level, we also want to report the marginal means, which when we have a single categorical explanatory variable is the group sample mean.

data("MV23_S1", package = "hecedsm")

MV23_S1 <- MV23_S1 |>

dplyr::mutate(amount2 = ifelse(is.na(amount), 0, amount))

linmod_MV23 <- lm(amount2 ~ condition, data = MV23_S1)

# Wald tests with coefficients

summary(linmod_MV23)

#>

#> Call:

#> lm(formula = amount2 ~ condition, data = MV23_S1)

#>

#> Residuals:

#> Min 1Q Median 3Q Max

#> -8.70 -6.77 -1.77 3.23 18.23

#>

#> Coefficients:

#> Estimate Std. Error t value Pr(>|t|)

#> (Intercept) 6.771 0.377 17.95 <2e-16 ***

#> conditionquantity 1.929 0.517 3.73 0.0002 ***

#> ---

#> Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

#>

#> Residual standard error: 7.61 on 867 degrees of freedom

#> Multiple R-squared: 0.0158, Adjusted R-squared: 0.0147

#> F-statistic: 13.9 on 1 and 867 DF, p-value: 0.000205

# Analysis of variance table with F tests

anova(linmod_MV23)

#> Analysis of Variance Table

#>

#> Response: amount2

#> Df Sum Sq Mean Sq F value Pr(>F)

#> condition 1 805 805 13.9 0.0002 ***

#> Residuals 867 50214 58

#> ---

#> Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

# Marginal means

(emm <- emmeans::emmeans(linmod_MV23, spec = "condition"))

#> condition emmean SE df lower.CL upper.CL

#> open-ended 6.77 0.377 867 6.03 7.51

#> quantity 8.70 0.354 867 8.01 9.40

#>

#> Confidence level used: 0.95

emm |> emmeans::contrast(method = "pairwise") # contrast vector c(1,-1)

#> contrast estimate SE df t.ratio p.value

#> (open-ended) - quantity -1.93 0.517 867 -3.730 0.0002Example 4.16 (Tests and contrasts for reading comprehension methods) We consider now testing for the Example 4.2 and Example 4.12. The purpose of Baumann, Seifert-Kessell, and Jones (1992) was to make a particular comparison between treatment groups. From the abstract:

The primary quantitative analyses involved two planned orthogonal contrasts—effect of instruction (TA + DRTA vs. 2 x DRA) and intensity of instruction (TA vs. DRTA).

With a pre-post model, we will want to compare the means for a common value of pretest1, below taken to be the overall mean of the pretest1 score.

library(emmeans) #load package

data(BSJ92, package = "hecedsm")

mod_post <- lm(posttest1 ~ group + pretest1,

data = BSJ92)

car::Anova(mod_post, type = 3) # F-tests

#> Anova Table (Type III tests)

#>

#> Response: posttest1

#> Sum Sq Df F value Pr(>F)

#> (Intercept) 1 1 0.25 0.62

#> group 143 2 12.17 3.5e-05 ***

#> pretest1 275 1 46.67 4.2e-09 ***

#> Residuals 365 62

#> ---

#> Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

emmeans_post <- emmeans(object = mod_post,

specs = "group") # which variable to keepThe result of the analysis of variance table shows that there are indeed differences between groups. We can thus look at the estimated marginal means, which are the average of each group.

| terms | marg. mean | std. err. | dof | lower (CI) | upper (CI) |

|---|---|---|---|---|---|

| DR | 6.19 | 0.52 | 62 | 5.14 | 7.23 |

| DRTA | 9.81 | 0.52 | 62 | 8.78 | 10.85 |

| TA | 8.22 | 0.52 | 62 | 7.18 | 9.27 |

The hypothesis of Baumann, Seifert-Kessell, and Jones (1992) is \(\mathscr{H}_0: \mu_{\mathrm{TA}} + \mu_{\mathrm{DRTA}} = 2 \mu_{\mathrm{DRA}}\) or, rewritten slightly, \[\begin{align*} \mathscr{H}_0: - 2 \mu_{\mathrm{DR}} + \mu_{\mathrm{DRTA}} + \mu_{\mathrm{TA}} = 0. \end{align*}\] with weights \((-2, 1, 1)\); the order of the levels for the treatment are (\(\mathrm{DRA}\), \(\mathrm{DRTA}\), \(\mathrm{TA}\)) and it must match that of the coefficients. An equivalent formulation is \((2, -1, -1)\) or \((1, -1/2, -1/2)\): in either case, the estimated differences will be different (up to a constant multiple or a sign change). The vector of weights for \(\mathscr{H}_0: \mu_{\mathrm{TA}} = \mu_{\mathrm{DRTA}}\) is (\(0\), \(-1\), \(1\)): the zero appears because the first component, \(\mathrm{DRA}\) doesn’t appear. The two contrasts are orthogonal since \((-2 \times 0) + (1 \times -1) + (1 \times 1) = 0\).

# Identify the order of the level of the variables

with(BSJ92, levels(group))

#> [1] "DR" "DRTA" "TA"

# DR, DRTA, TA (alphabetical)

contrasts_list <- list(

# Contrasts: linear combination of means, coefficients sum to zero

"C1: average (DRTA+TA) vs DR" = c(-1, 0.5, 0.5),

"C2: DRTA vs TA" = c(0, 1, -1)

)

contrasts_post <-

contrast(object = emmeans_post,

method = contrasts_list)

contrasts_summary_post <- summary(contrasts_post)| contrast | estimate | std. err. | dof | stat | p-value |

|---|---|---|---|---|---|

| C1: average (DRTA+TA) vs DR | 2.83 | 0.64 | 62 | 4.40 | 0.00 |

| C2: DRTA vs TA | 1.59 | 0.73 | 62 | 2.17 | 0.03 |

We can look at these differences; since DRTA versus TA is a pairwise difference, we could have obtained the \(t\)-statistic directly from the pairwise contrasts using pairs(emmeans_post).

What is the conclusion of our analysis of contrasts? It looks like the methods involving thinking aloud have a strong impact on reading comprehension relative to only directed reading. The evidence is not as strong when we compare the method that combines directed reading-thinking activity and thinking aloud, but the difference is statistically significant at level 5%.

# Extract coefficients and standard errors

beta_pre <- coefficients(mod_post)['pretest1']

se_pre <- sqrt(c(vcov(mod_post)['pretest1', 'pretest1']))

wald <- (beta_pre - 1)/se_pre # Wald statistic, signed version

# P-value based on Student-t distribution, with n-p-1 dof

pval <- 2*pt(abs(wald), df = mod_post$df.residual, lower.tail = FALSE)

# Model comparison via 'anova' call

mod0 <- lm(posttest1 ~ offset(pretest1) + group, data = BSJ92)

# The 'offset' fixes the term and so this is equivalent to a coefficient of 1

aov_tab <- anova(mod0, mod_post)Another potential hypothesis of interest is testing whether the coefficient of pretest1 is unity. This amounts to the Wald test \(w = (\widehat{\beta}_{\texttt{pretest1}}-1)/\mathsf{se}(\widehat{\beta}_{\texttt{pretest1}})= -3.024\), or alternatively a model comparison with the anova, which yields a test statistic of \(F=9.143\). Distribution theory shows that if \(Z \sim \mathsf{Student}(\nu)\), then \(Z^2 \sim \mathsf{Fisher}(1, \nu)\), it follows that both tests are equivalent and the \(p\)-values are exactly the same.

Example 4.17 (Tests and contrasts for paper vs plastic) Let \(\mu_{0}, \mu_{0.5}, \mu_{1}, \mu_2\) denote the true mean of the PEF score as a function of the proportion of paper for the data from Example 4.5. There are several tests that could be of interest here, but we focus on contrasts performed by authors and an hypothesis test of linearity as a function of the proportion of plastic. For the latter, we could compare the linear regression model (in which the PEF score increases linearly with the proportion of paper to plastic) against the ANOVA which allows each of the four groups to have different means.

If we use \(\boldsymbol{\alpha} \in \mathbb{R}^4\) to denote the parameter vector of the analysis of variance model using the treatment parametrization and \(\boldsymbol{\beta} \in \mathbb{R}^2\) for the simple linear regression model, then we have \[\begin{align*} \mu_0 &= \beta_0=\alpha_0 \\ \mu_{0.5} &= \beta_0 + 0.5 \beta_1 = \alpha_0 + \alpha_1\\ \mu_1 &= \beta_0 + \beta_1 = \alpha_0 + \alpha_2 \\ \mu_2 &= \beta_0 + 2 \beta_1= \alpha_0 + \alpha_3. \end{align*}\] The test comparing the simple linear regression with the analysis of variance imposes two simultaneous restrictions, with \(\mathscr{H}_0: \alpha_3 = 2\alpha_2= 4\alpha_1\), so the null distribution is \(\mathsf{Fisher}(2, 798)\) or roughly \(\chi^2_2\).

data(SKD23_S2A, package = "hecedsm") # load data

linmod <- lm(pef ~ proportion, data = SKD23_S2A) # fit simple linear regression

coef(linmod) # extract intercept and slope

#> (Intercept) proportion

#> 2.407 0.526

anovamod <- lm(pef ~ factor(proportion), # one-way ANOVA

data = SKD23_S2A)

# Compare simple linear regression with ANOVA

anova(linmod, anovamod) # is the change in PEF linear?

#> Analysis of Variance Table

#>

#> Model 1: pef ~ proportion

#> Model 2: pef ~ factor(proportion)

#> Res.Df RSS Df Sum of Sq F Pr(>F)

#> 1 800 1373

#> 2 798 1343 2 29.3 8.69 0.00018 ***

#> ---

#> Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

# Specifying the weights of the contrasts

# these contrasts encode the mean (so don't sum to zero)

car::linearHypothesis(model = anovamod,

hypothesis = rbind(c(0, -2, 1, 0),

c(0, 0, -2, 1)))

#>

#> Linear hypothesis test:

#> - 2 factor(proportion)0.5 + factor(proportion)1 = 0

#> - 2 factor(proportion)1 + factor(proportion)2 = 0

#>

#> Model 1: restricted model

#> Model 2: pef ~ factor(proportion)

#>

#> Res.Df RSS Df Sum of Sq F Pr(>F)

#> 1 800 1373

#> 2 798 1343 2 29.3 8.69 0.00018 ***

#> ---

#> Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1We see from the output that the \(F\) tests and the \(p\)-values are identical, whether we impose the constraints manually or simply feed the two nested models to the anova method.

The authors were interested in comparing none with other choices: we are interested in pairwise differences, but only relative to the reference \(\mu_{0}\): \[\begin{align*} \mu_0 = \mu_{0.5} & \iff 1\mu_0 - 1\mu_{0.5} + 0\mu_{1} + 0 \mu_{2} = 0\\ \mu_0 = \mu_{1} & \iff 1\mu_0 + 0\mu_{0.5} -1\mu_{1} + 0 \mu_{2} = 0\\ \mu_0 = \mu_{2} & \iff 1\mu_0 + 0\mu_{0.5} + 0\mu_{1} -1 \mu_{2} = 0 \end{align*}\] so contrast vectors \((1, -1, 0, 0)\), \((1, 0, -1, 0)\) and \((1, 0, 0, -1)\) for the marginal means would allow one to test the hypothesis.

margmean <- anovamod |>

emmeans::emmeans(specs = "proportion") # group means

contrastlist <- list( # specify contrast vectors

refvshalf = c(1, -1, 0, 0),

refvsone = c(1, 0, -1, 0),

refvstwo = c(1, 0, 0, -1))

# compute contrasts relative to reference

margmean |> emmeans::contrast(method = contrastlist)

#> contrast estimate SE df t.ratio p.value

#> refvshalf -0.749 0.131 798 -5.710 <.0001

#> refvsone -0.901 0.131 798 -6.890 <.0001

#> refvstwo -1.182 0.129 798 -9.200 <.0001The group averages are reported in Table 4.6, match those reported by the authors in the paper. They suggest an increased perceived environmental friendliness as the amount of paper used in the wrapping increases. We could fit a simple regression model to assess the average change, treating the proportion as a continuous explanatory variable. The estimated slope for the change in PEF score, which ranges from 1 to 7 in increments of 0.25, is 0.53 point per ratio of paper/plastic. There is however strong evidence, given the data, that the change isn’t quite linear, as the fit of the linear regression model is significantly worse than the corresponding linear model.

| proportion | marg. mean | std. err. | dof | lower (CI) | upper (CI) |

|---|---|---|---|---|---|

| 0.0 | 2.16 | 0.093 | 798 | 1.98 | 2.34 |

| 0.5 | 2.91 | 0.093 | 798 | 2.73 | 3.09 |

| 1.0 | 3.06 | 0.092 | 798 | 2.88 | 3.24 |

| 2.0 | 3.34 | 0.089 | 798 | 3.17 | 3.52 |

| contrast | estimate | std. err. | dof | stat | p-value |

|---|---|---|---|---|---|

| refvshalf | -0.75 | 0.13 | 798 | -5.71 | 0 |

| refvsone | -0.90 | 0.13 | 798 | -6.89 | 0 |

| refvstwo | -1.18 | 0.13 | 798 | -9.20 | 0 |

All differences reported in Table 4.7 are significant and positive, in line with the researcher’s hypothesis.

Example 4.18 (Testing for the college wage discrimination) Consider the college data example and the associated linear model with rank, sex, years of service and field as covariates.

data(college, package = "hecstatmod")

mod1_college <- lm(salary ~ sex + field + rank + service, data = college)

mod0_college <- lm(salary ~ field + rank + service , data = college)

# F-test with ANOVA table comparing nested models

aov_tab_college <- anova(mod0_college, mod1_college)

# Wald t-test - extracted from the output of the 'summary' table

wald_college <- summary(mod1_college)$coefficients[2,]

# Likelihood ratio test with chi-square approximation

pval_lrt <- pchisq(q = as.numeric(2*(logLik(mod1_college) - logLik(mod0_college))),

df = 1, lower.tail = FALSE)The only test of interest here is \(\mathscr{H}_0: \beta_{\texttt{sex}} = 0\) against the two-sided alternative \(\mathscr{H}_a: \beta_{\texttt{sex}} \neq 0\). The Wald \(t\)-test statistic is \(-1.23\), with a \(p\)-value of \(0.219\) based on a Student-\(t\) distribution with \(391\) degrees of freedom. The \(p\)-value in the output from the \(F\)-test is the same, and that obtained from the likelihood ratio test the same up to two decimal places.

| term | estimate | std. error | Wald stat. | p-value |

|---|---|---|---|---|

| (Intercept) | 86.596 | 2.96 | 29.25 | < 0.001 |

| sex [woman] | -4.771 | 3.878 | -1.23 | 0.22 |

| field [theoretical] | -13.473 | 2.315 | -5.82 | < 0.001 |

| rank [associate] | 14.56 | 4.098 | 3.55 | < 0.001 |

| rank [full] | 49.16 | 3.834 | 12.82 | < 0.001 |

| service | -0.089 | 0.112 | -0.8 | 0.43 |

4.5 Factorial designs and interactions

The additive mean model with linear terms (including categorical variables) specifies that the marginal effect of one variable is independent of others. We may wish to relax this assumption by including interaction terms.

Definition 4.1 (Interaction) An interaction occurs if some explanatory variables, when coupled together, have different impacts than the superposition of each, i.e., if \(X_j\) and \(X_k\) interact, the marginal effect of \(\mathsf{E}(Y \mid \boldsymbol{X})\) with respect to \(X_j\) is a function of \(X_k\) or vice-versa.

We will restrict attention to the cases where one or more of the explanatories is a categorical variable (factor).

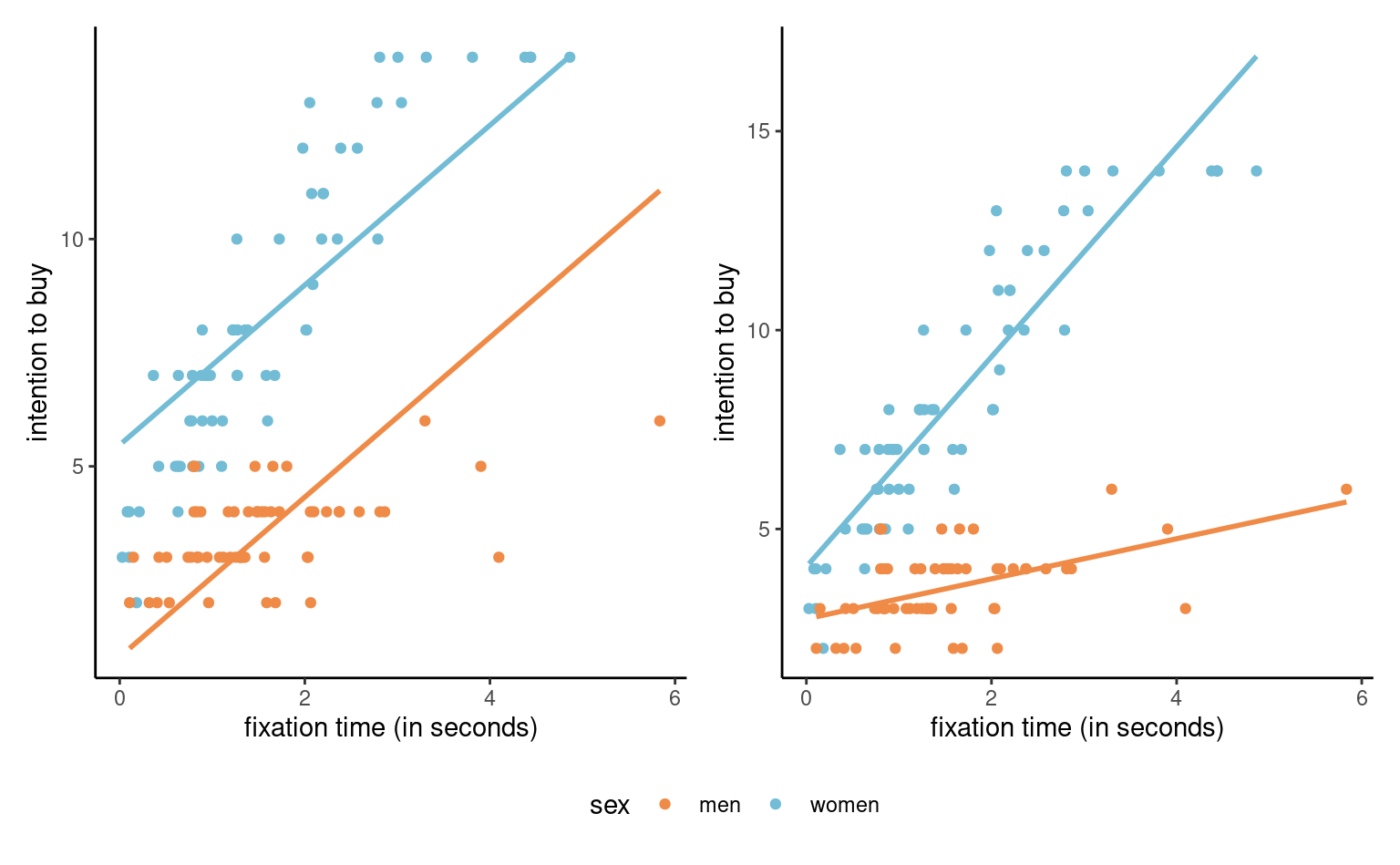

Example 4.19 (Intention to buy) We consider a toy model for the interaction data, and model the intention to buy a product as a function of sex and fixation. The base model, without interaction, is \[\begin{align*}

\texttt{intention}=\beta_0 + \beta_1 \texttt{sex} + \beta_2 \texttt{fixation} + \varepsilon,

\end{align*}\] where is a binary variable taking value unity for female and zero for male. The model assumes that the effect of the continuous variable \(\texttt{fixation}\) is the same for the two values of the binary variable. Likewise, the effect of the binary variable is assumed to be the same for all possible values of the continuous variable. We can see this on the plot, as the difference between the lines represents the effect of \(\texttt{sex}\), is the same for all values of \(\texttt{fixation}\); the lines are parallel: see the left panel of Figure 4.9.

In order to add a different slope for men and women, we can create a new variable equal to the product fixation*sex and add it to the model, \[\begin{align*}

\texttt{intention} &= \beta_0 + \beta_1 \texttt{sex} + \beta_2\texttt{fixation} \\&\quad + \beta_3 \texttt{fixation}\cdot \texttt{sex} + \varepsilon.

\end{align*}\] Depending on the value of the binary variable , we get \[\begin{align*}

&\mathsf{E}(\texttt{intention} \mid \texttt{fixation}, \texttt{sex}) \\\quad&=

\begin{cases}

(\beta_0 + \beta_1) + (\beta_2 + \beta_3)\texttt{fixation}, & \texttt{sex}=1,\\

\beta_0 + \beta_2 \texttt{fixation}, & \texttt{sex}=0.

\end{cases}

\end{align*}\] The interpretation of the coefficients in the model is as usual with the treatment contrast parametrization:

- \(\beta_0\) is the average buying intention when the fixation time is zero for men,

- \(\beta_1\) is the difference in intercept for women vs men (mean difference women vs men when the fixation time in zero),

- \(\beta_2\) is the unit increase per second of fixation for men,

- \(\beta_3\) is the difference in slope for women vs men (mean difference for women vs men of an increase of one additional second of fixation).

Testing whether the interaction is significant boils down to using the test \(\mathscr{H}_0: \beta_3=0\).

data(interaction, package = "hecstatmod")

# To specify an interaction, use the symbol :

mod <- lm(intention ~ fixation + sex + sex:fixation,

data = interaction)

# Another option is the star *,

# So A*B is a shortcut that expands to A + B + A:B

summary(mod)$coefficients

#> Estimate Std. Error t value Pr(>|t|)

#> (Intercept) 2.741 0.282 9.73 1.02e-16

#> fixation 0.504 0.153 3.29 1.33e-03

#> sex 1.312 0.380 3.45 7.74e-04

#> fixation:sex 2.135 0.200 10.69 5.61e-19The model with the interaction is significantly better, meaning that the effect of fixation time on intention to buy varies according to sex.

Remark 4.6 (Marginality). In the model with buying intention as a function of sex and fixation time, we would not remove the main effect of fixation while keeping the interaction term fixation*sex, even if we fail to reject \(\mathscr{H}_0:\beta_2=0\). Without it, the model would become \[\begin{align*}

&\mathsf{E}(\texttt{intention} \mid \texttt{fixation}, \texttt{sex}) \\\quad&=

\begin{cases}

(\beta_0 + \beta_1) + \beta_3\texttt{fixation}, & \texttt{sex}=1,\\

\beta_0, &\texttt{sex}=0;

\end{cases}

\end{align*}\]

implying that intention to buy is constant for men, regardless of the fixation time. As the choice of baseline is arbitrary, but changing the dummy sex (0 for women, 1 for men), would yield a different model and so potentially different inferences, we never consider removal of the main effect term that is involved in an interaction. The marginality principle states that all lower interaction terms should be included.

The concept of interactions readily extends to categorical variables with \(k\) levels/categories. In this case, we need to use the global \(F\)-test to check if the interaction is statistically significant.

Definition 4.2 (Analysis of variance) An analysis of variance is a linear model in which the mean is a function of categorical explanatory variables. If we have data for all different combinations of factors, the factors are crossed and we can consider inclusion of their interactions.

Consider a two-way analysis of variance model. This is a linear model with two factors, \(A\) and \(B\), with respectively \(n_a\) and \(n_b\) levels. The model with interaction can be written as \[ \underset{\text{response}\vphantom{b}}{Y_{ijk}} = \underset{\text{subgroup mean}}{\mu_{ij}} + \underset{\text{error term}}{\varepsilon_{ijk}} \tag{4.2}\] where

- \(Y_{ijk}\) is the \(k\)th replicate for \(i\)th level of factor \(A\) and \(j\)th level of factor \(B\)

- \(\mu_{ij}\) is the average response of measurements in group \((a_i, b_j)\)

- \(\varepsilon_{ijk}\) are independent error terms with mean zero and standard deviation \(\sigma\).

In a full factorial design with interactions, we can write the mean response as \(\mathsf{E}(Y \mid A=a_i, B=b_j) = \mu_{ij}\). This model can be reduced to a single one-way ANOVA with a single factor having \(n_an_b\) levels. This may be useful to specify contrast weights, or when there is an additional control group in an experimental setting. However, preserving the structure helps setting up hypotheses of interest.

We can equivalently express this in terms of an intercept, main effects of either variables, and interaction terms. The additive model, with no interaction, has average for cell \((i,j)\) of

\[\begin{align*} \mathsf{E}(Y_{ij} \mid A = a_i, B=b_j) = \mu + \alpha_i + \beta_j. \end{align*}\]

We can consider model simplifications from bottom up. Removing the interaction leads to a model with \(1 + (n_a-1) + (n_b-1)\) parameters, relative to \(n_a\times n_b\) for the model with the interaction. We can use an \(F\)-test to check for the significance of the latter. If the factors don’t interact, the mean in the cell is given by the sum of the main effects. Only once we have a removed this term can we consider if all row means or column means are the same.

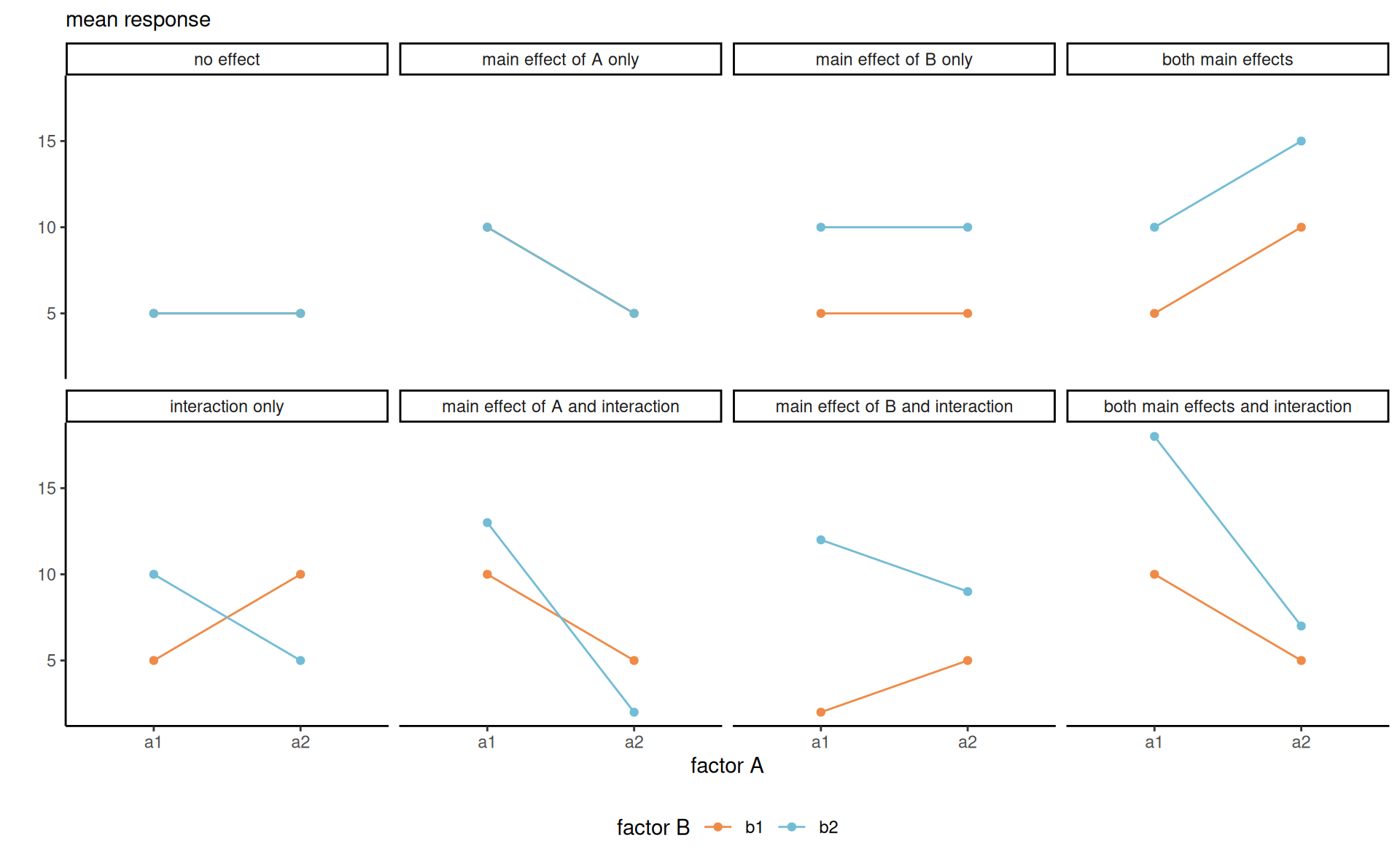

While formal testing is needed to check for interactions, the concept can be better understood by looking at graphs (at least in a setting where the means are known with little to no uncertainty).

Definition 4.3 (Interaction plot) We can try to detect interactions visually by plotting the (mean) response as a function of one of the covariates, using a so-called interaction plot. When there are more than two categorical variables, we can use colors, symbols or panels to represent the categories. Lack of interaction in those plots implies parallel lines, but one must account for the uncertainty.

Definition 4.4 (Simple effects and main effects) When interactions do not exist, it makes sense to abstract from one or more variable and consider marginal effects, obtained by pooling data from the omitted factors and averaging out. Suppose without loss of generality that we are interested in comparing levels of \(A\). When interactions between \(A\) and \(B\) are not significant, we can consider lower order terms and report estimated marginal means and contrasts between means of \(A\). If the interaction with \(B\) has an impact, we can rather compute the subcell average of \(A \mid B=b_j\), and similarly for contrasts. We thus distinguish between the following:

- simple effects: difference between levels of one in a fixed combination of others. Simple effects are comparing cell averages within a given row or column.

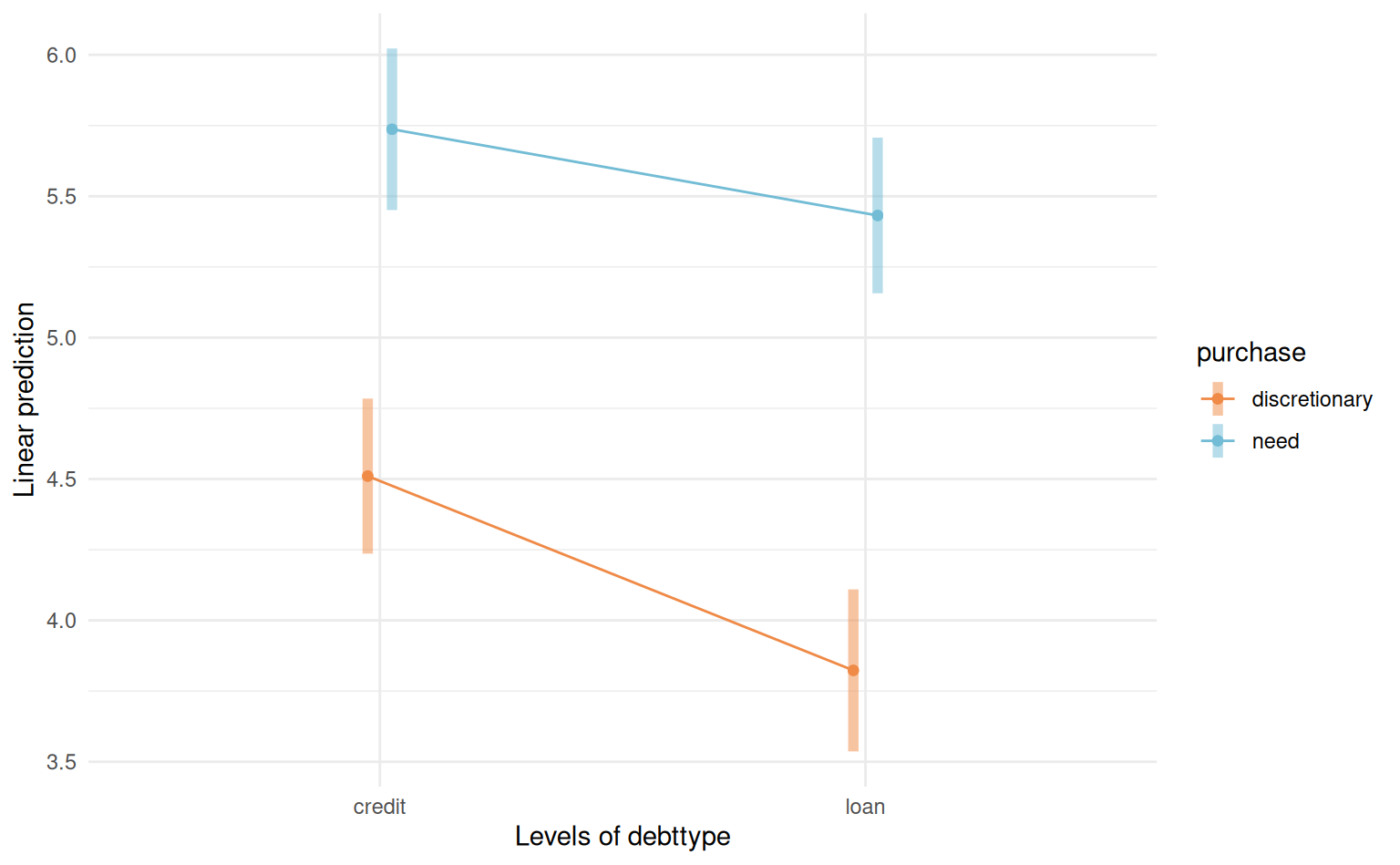

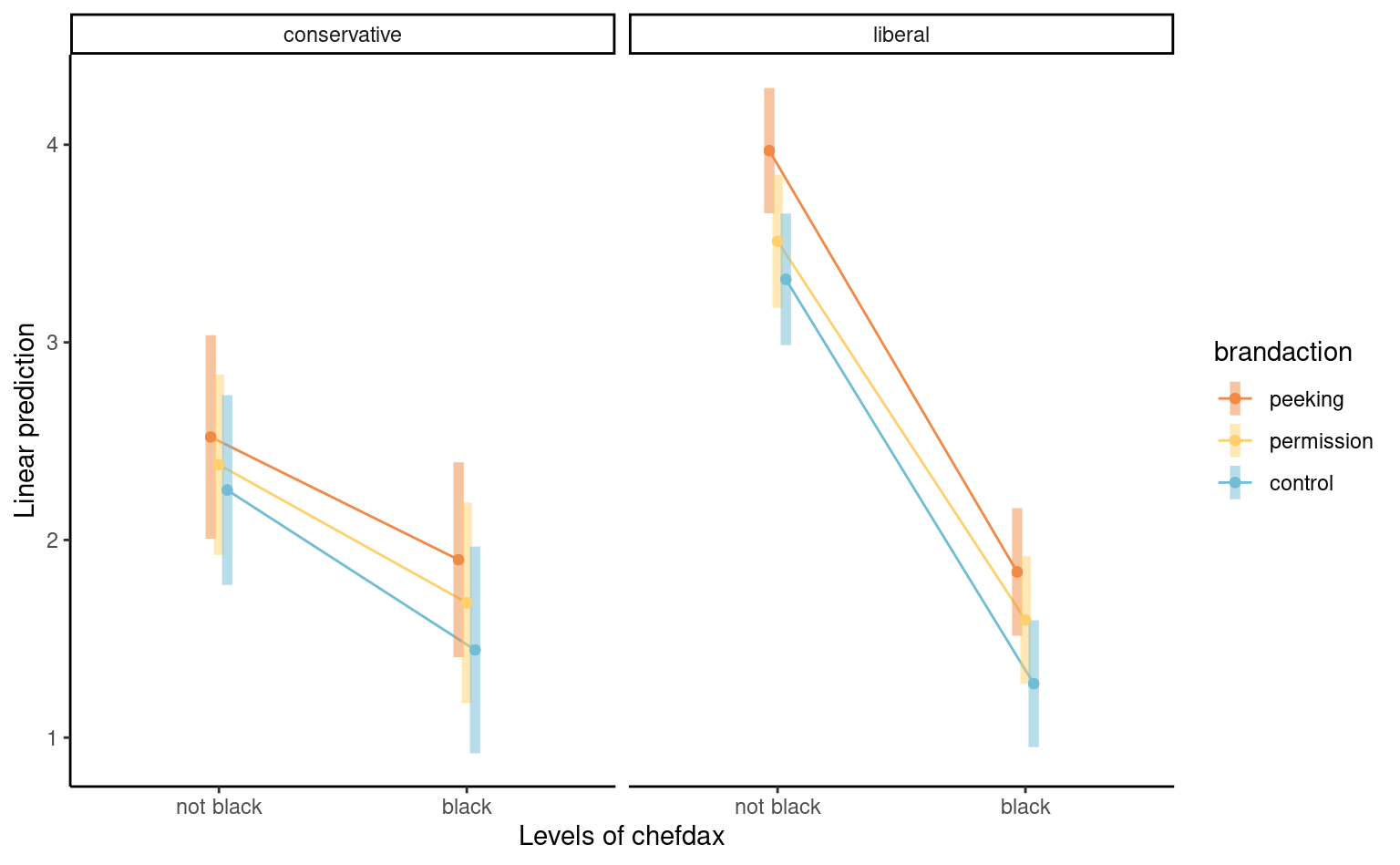

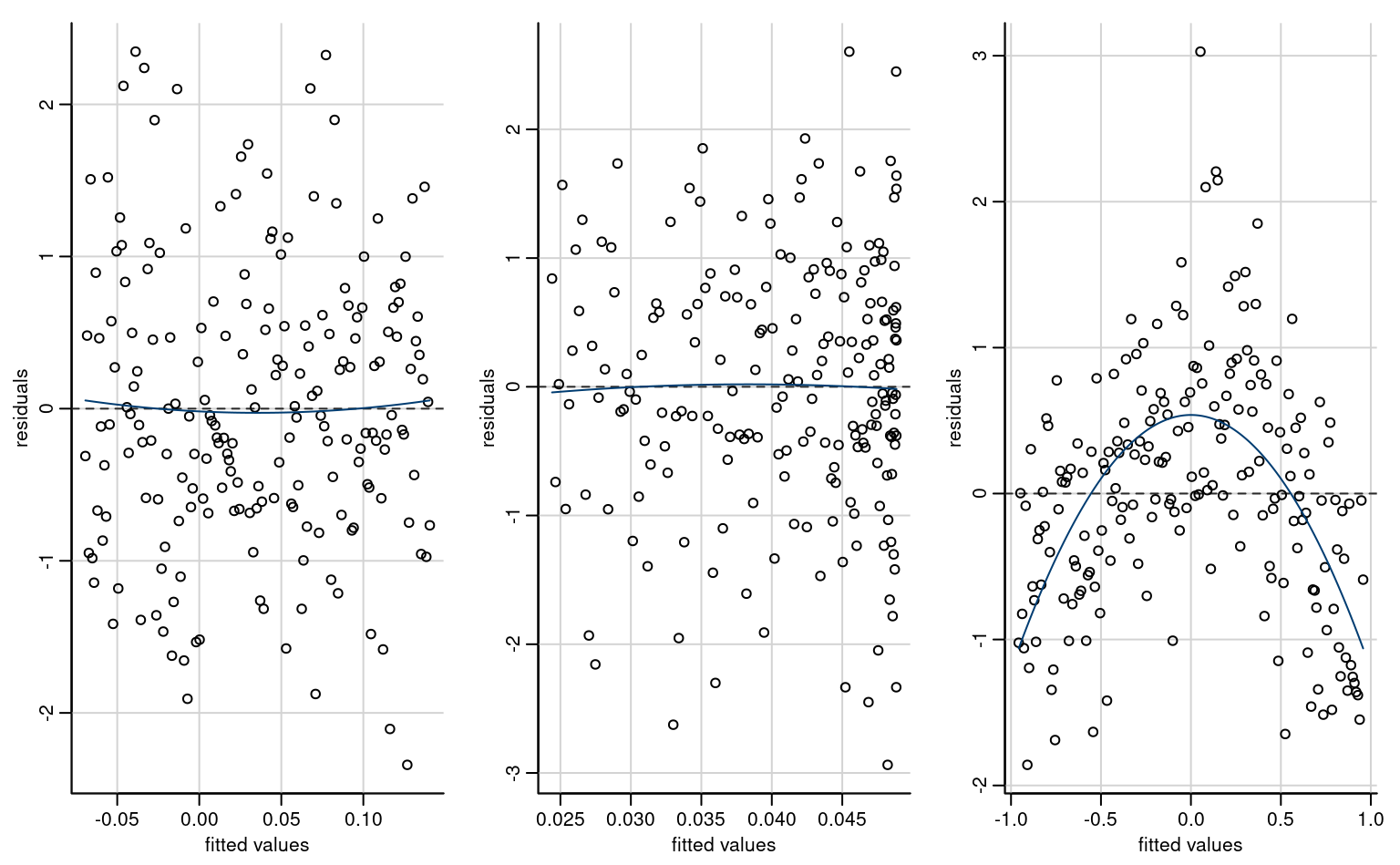

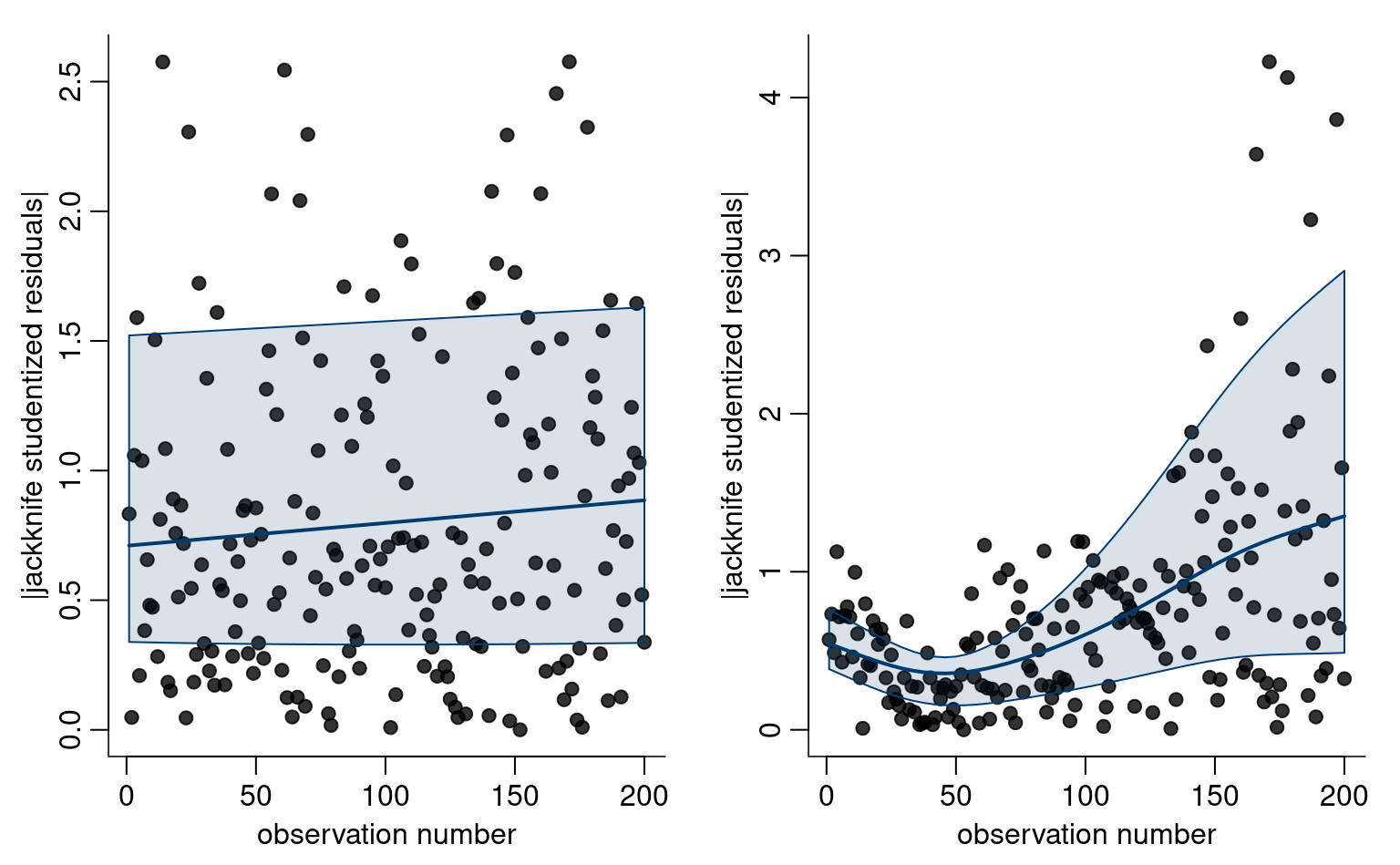

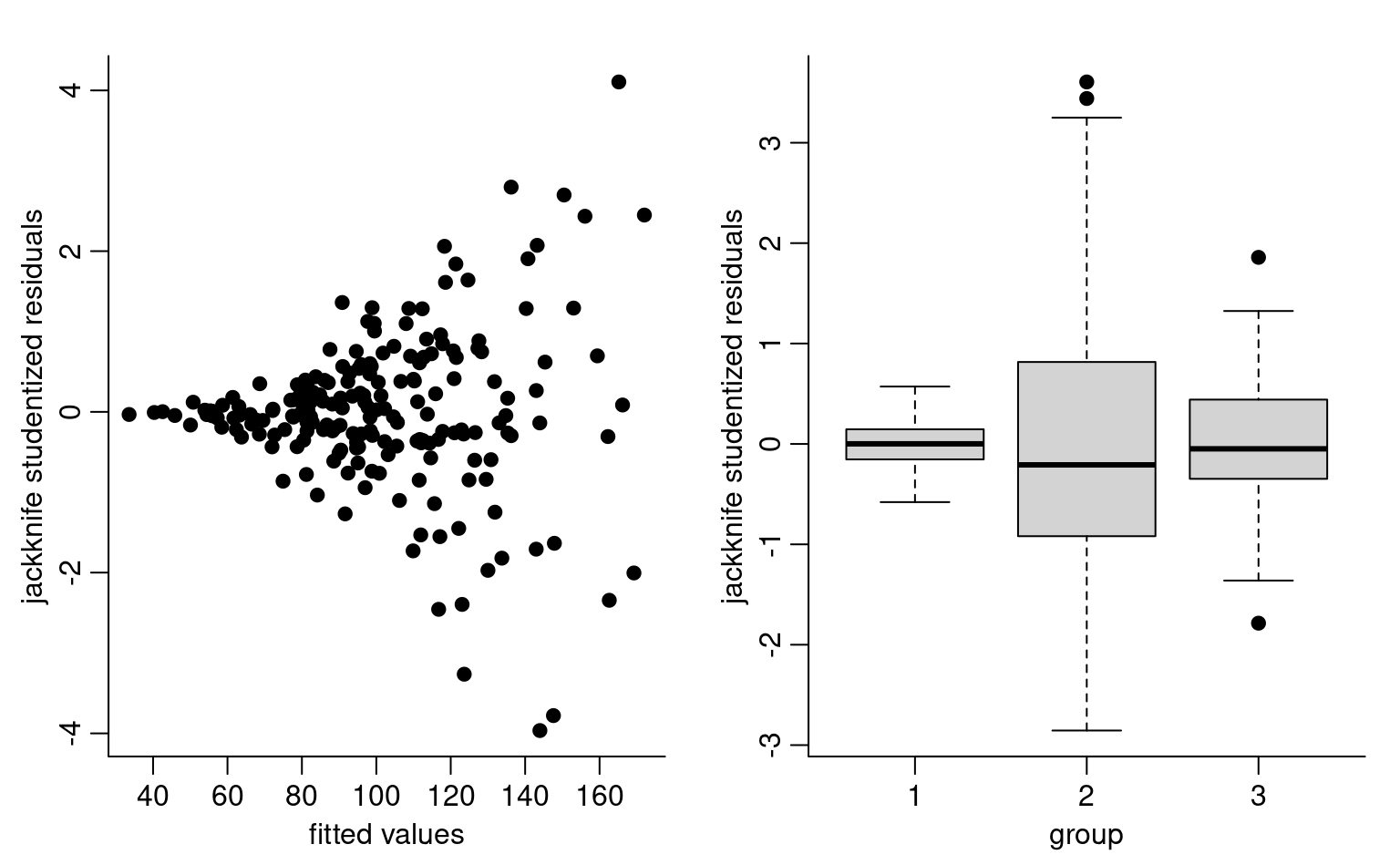

- main effects: differences relative to average for each condition of a factor. Main effects are row/column averages.