1.7 Solutions to Exercises

1.7.1 Solutions 1: Beaver temperature

- Load the

beav2data from the libraryMASS. - Examine the data frame using

summary,head,tail. Query the help with?beav2for a description of the dataset - Transform the temperature data into a time series object and plot the latter.

- Fit a linear model using

lmand the variableactivas factor, viz.lin_mod <- lm(temp~as.factor(activ), data=beav2). Overlay the means on your plot withlines(fitted(lin_mod))replacinglin_modwith yourlmresult. - Inspect the residuals (

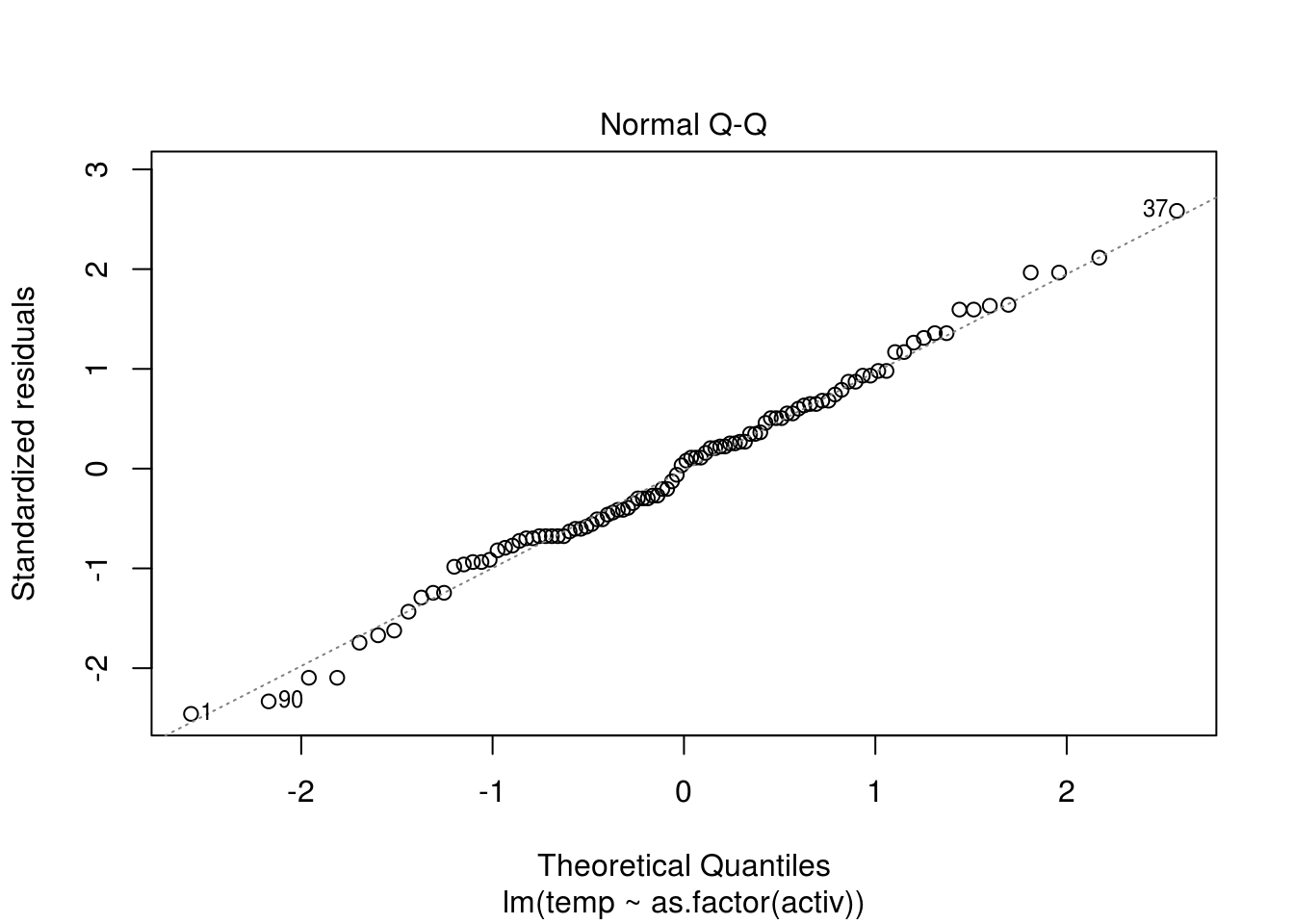

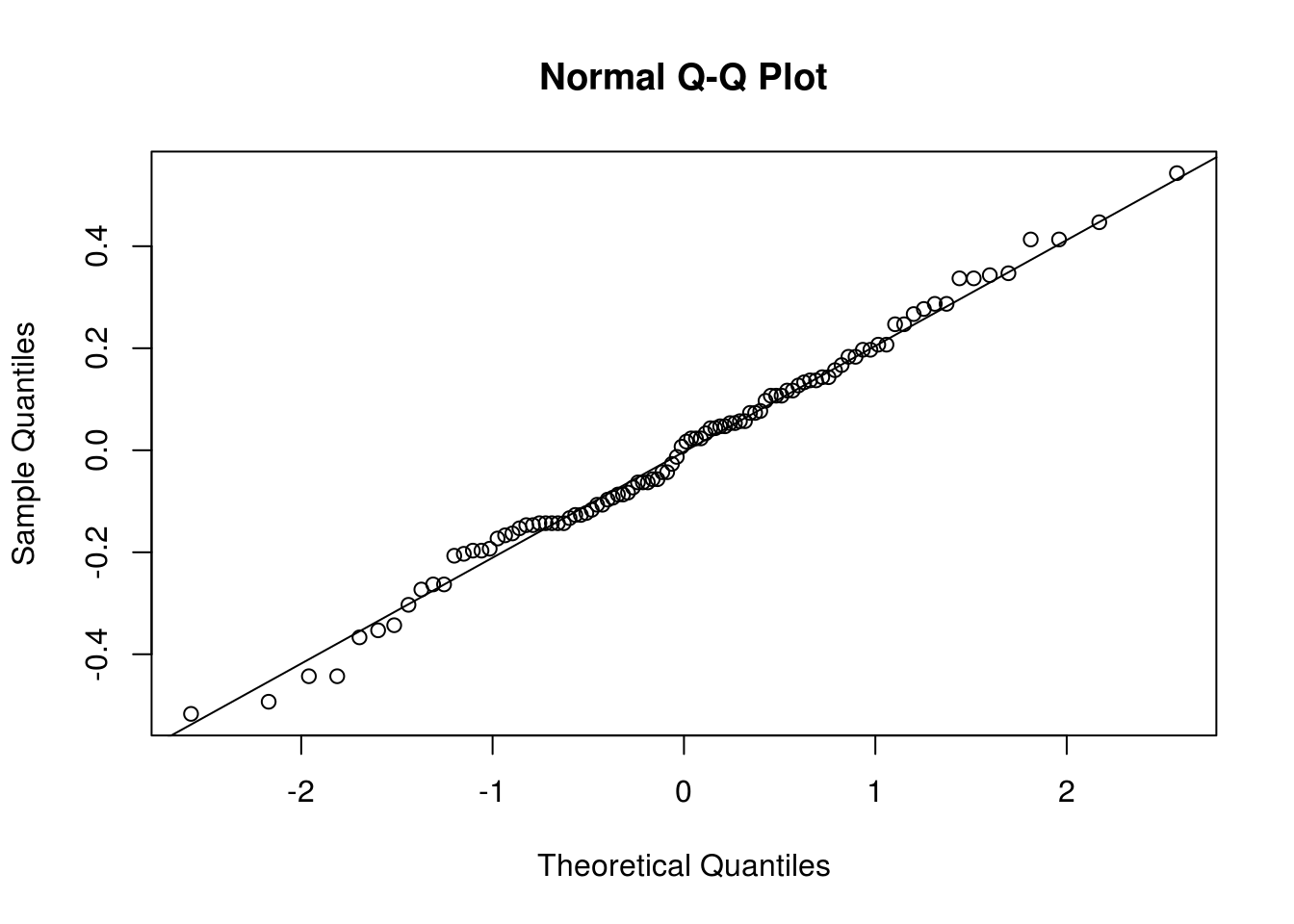

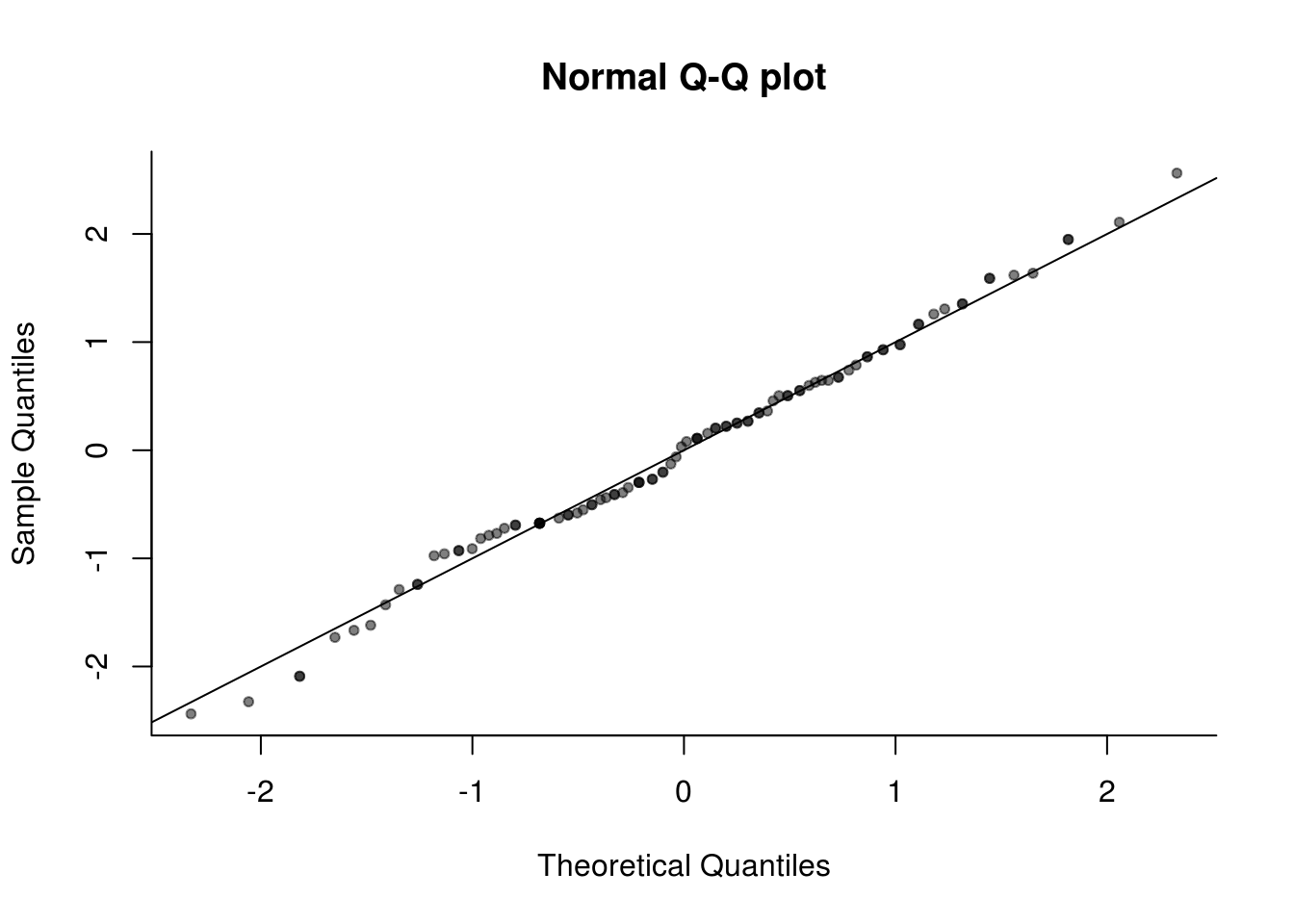

resid(lin_mod)) and determine whether there is any evidence of trend or seasonality. - Look at a quantile-quantile (Q-Q) plot to assess normality. You can use the command

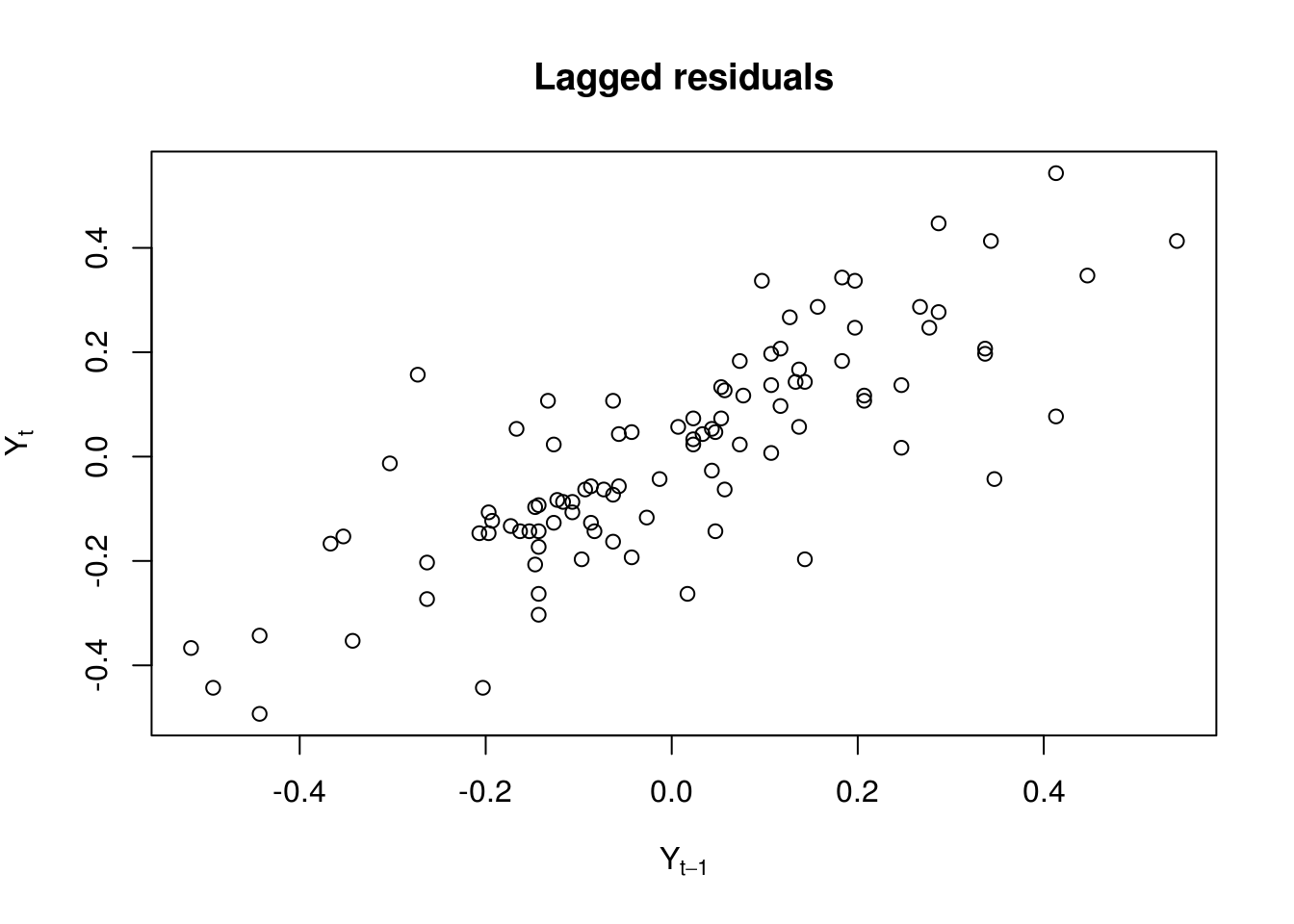

qqnormif you don’t want to transform manually the residuals withqqlineor useplot(lin_mod, which=2). - Plot the lag-one residuals at time \(t\) and \(t-1\). Is the dependence approximately linear?

data(beav2, package = "MASS")

`?`(MASS::beav2)

beav2$hours <- with(beav2, 24 * (day - 307) + trunc(time/100) + (time%%100)/60)

summary(beav2) day time temp activ

Min. :307.0 Min. : 0 Min. :36.58 Min. :0.00

1st Qu.:307.0 1st Qu.:1128 1st Qu.:37.15 1st Qu.:0.00

Median :307.0 Median :1535 Median :37.73 Median :1.00

Mean :307.1 Mean :1446 Mean :37.60 Mean :0.62

3rd Qu.:307.0 3rd Qu.:1942 3rd Qu.:37.98 3rd Qu.:1.00

Max. :308.0 Max. :2350 Max. :38.35 Max. :1.00

hours

Min. : 9.50

1st Qu.:13.62

Median :17.75

Mean :17.75

3rd Qu.:21.88

Max. :26.00 head(beav2) day time temp activ hours

1 307 930 36.58 0 9.500000

2 307 940 36.73 0 9.666667

3 307 950 36.93 0 9.833333

4 307 1000 37.15 0 10.000000

5 307 1010 37.23 0 10.166667

6 307 1020 37.24 0 10.333333tail(beav2) day time temp activ hours

95 308 110 37.76 1 25.16667

96 308 120 37.73 1 25.33333

97 308 130 37.77 1 25.50000

98 308 140 38.01 1 25.66667

99 308 150 38.04 1 25.83333

100 308 200 38.07 1 26.00000# Fancy time series object

hours <- seq(ISOdatetime(1990, 11, 3, 9, 30, 0), ISOdatetime(1990, 11, 4, 2,

0, 0), by = (60 * 10))

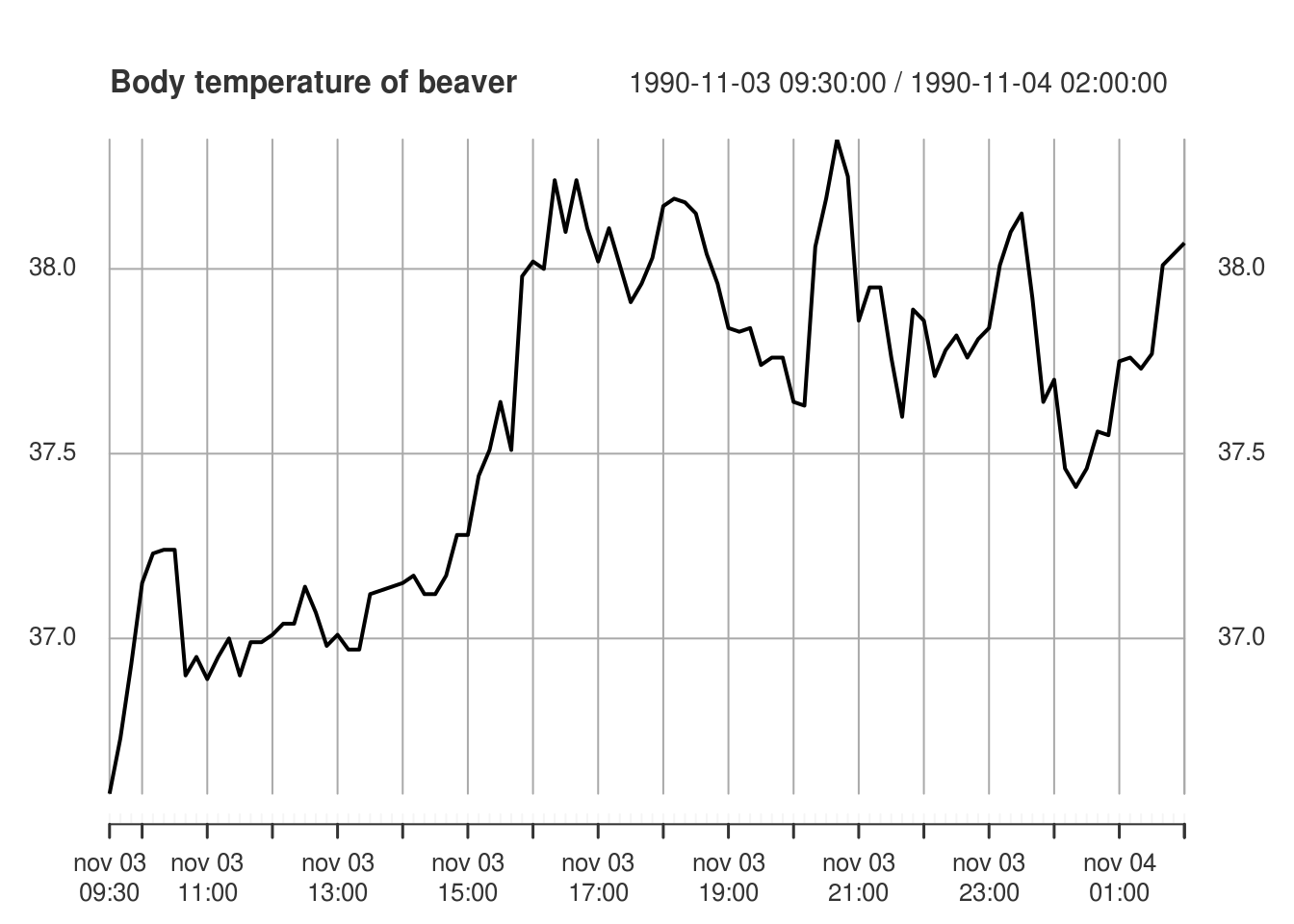

plot(xts::xts(beav2[, "temp"], hours), main = "Body temperature of beaver",

ylab = "Temperature (in degree Celcius)")

# Vanilla ts - works ok for regular time series

temp <- ts(beav2[, "temp"], start = 9.5, frequency = 6)

plot(temp, main = "Body temperature of beaver", ylab = "Temperature (in degree Celcius)")

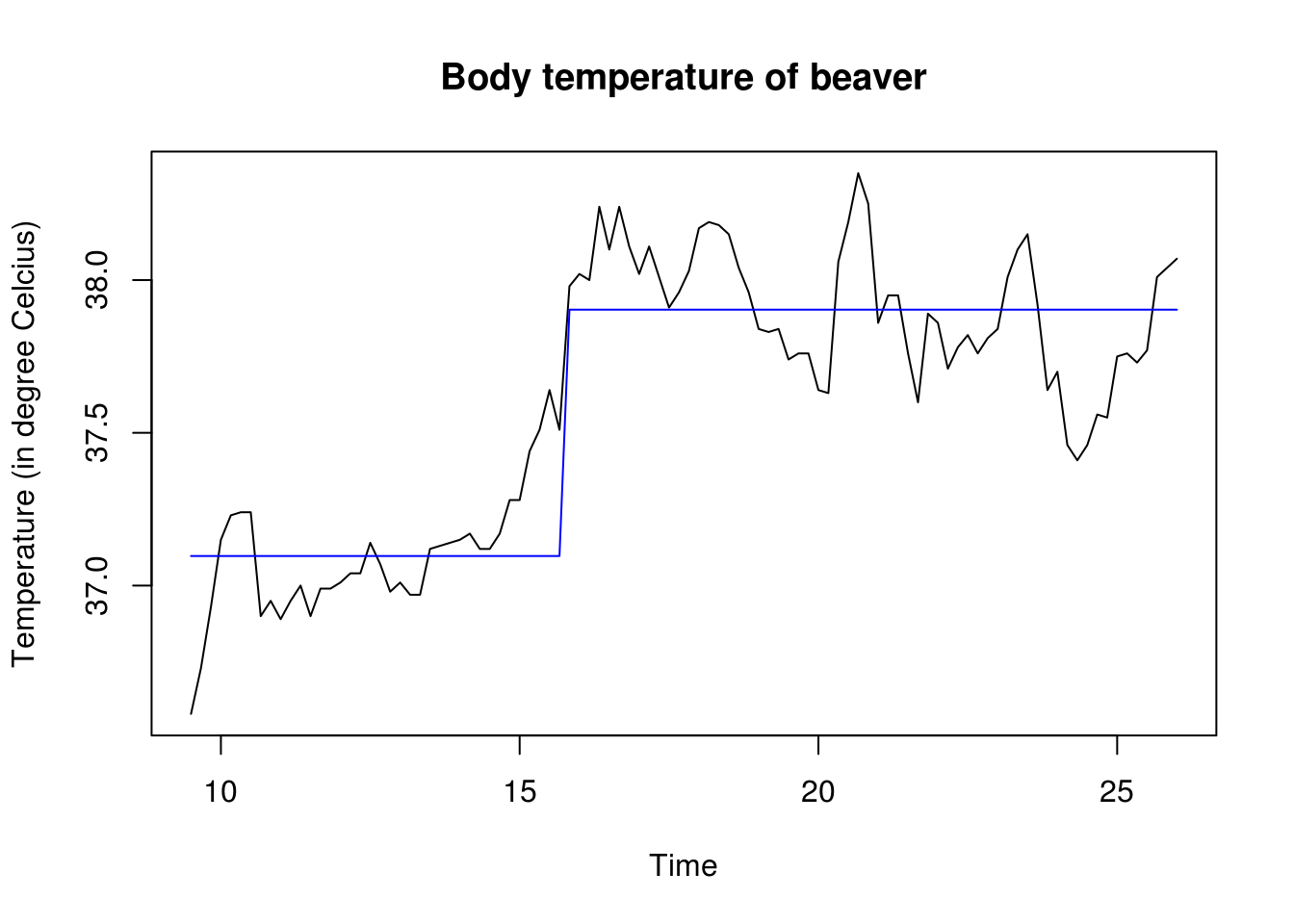

lin_mod <- lm(temp ~ as.factor(activ), data = beav2)

lines(beav2[, "hours"], fitted(lin_mod), col = "blue")

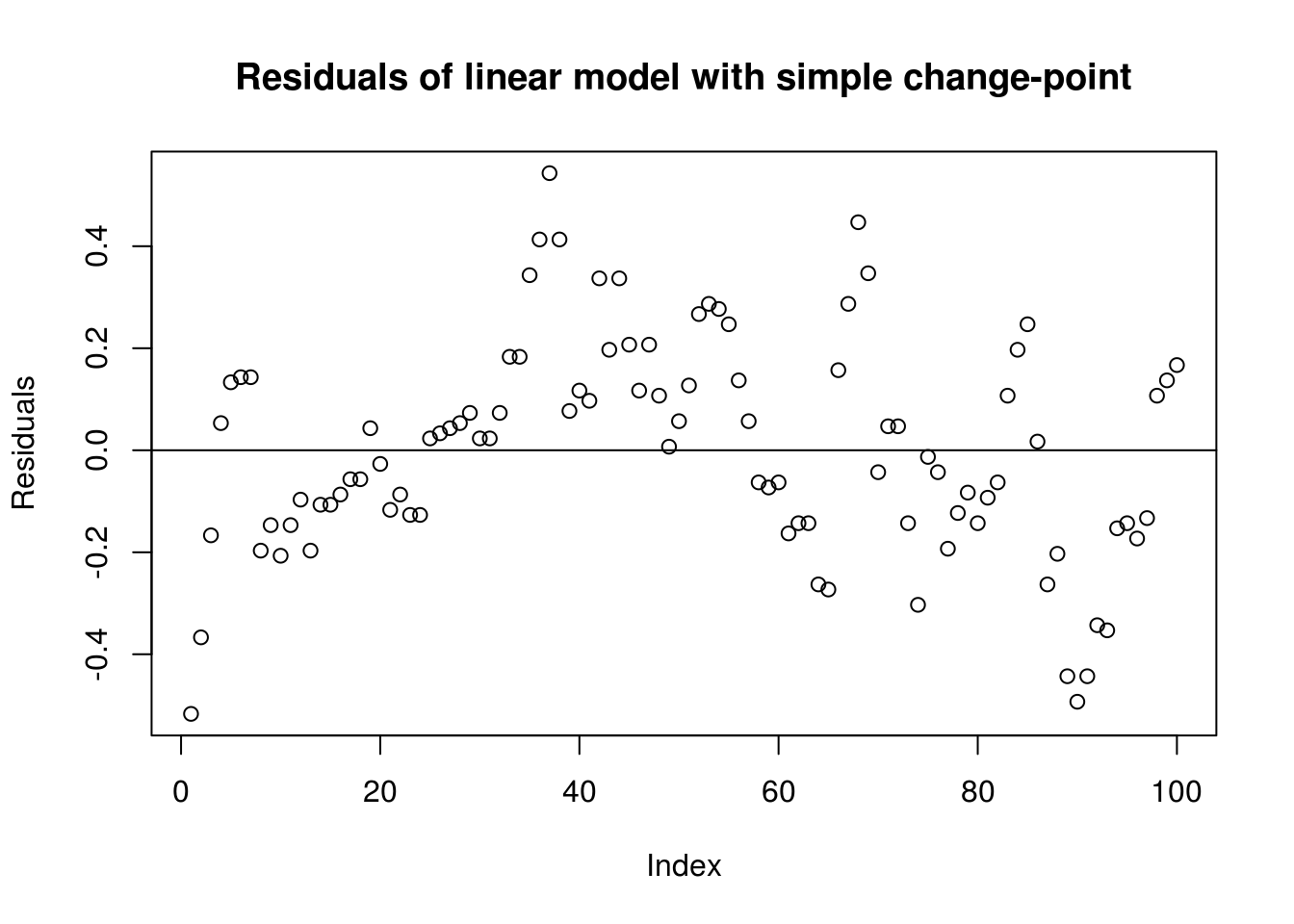

# Some trend remaining in the first part, before timeplot(residuals(lin_mod), ylab = "Residuals", main = "Residuals of linear model with simple change-point")

abline(h = 0)

# Q-Q plot (1) with output from lm

plot(lin_mod, which = 2)

# (2) with qqnorm and tentative line with quartiles

qqnorm(residuals(lin_mod))

qqline(residuals(lin_mod))

# (3) standardized manually

res <- residuals(lin_mod)

plot(qnorm(rank(res)/(length(res) + 1)), res/sd(res), pty = "s", bty = "l",

xlab = "Theoretical Quantiles", ylab = "Sample Quantiles", main = "Normal Q-Q plot",

pch = 20, col = rgb(0, 0, 0, 0.5))

abline(a = 0, b = 1)

plot(res[-length(res)], res[-1], xlab = expression(Y[t - 1]), ylab = expression(Y[t]),

main = "Lagged residuals")

1.7.2 Solutions 2: SP500 daily returns

- Download the dataset using the following command

- Obtain the daily percent return series and plot the latter against time.

- With the help of graphs, discuss evidences of seasonality and nonstationarity. Are there seasons of returns?

- Plot the (partial) correlogram of both the raw and the return series. Try the acf with

na.action=na.passand without (by e.g. converting the series to a vector usingas.vector. Comment on the impact of ignoring time stamps. - Plot the (partial) correlogram of the absolute value of the return series and of the squared return series. What do you see?

sp500 <- tseries::get.hist.quote(instrument = "^GSPC", start = "2000-01-01",

end = "2016-12-31", quote = "AdjClose", provider = "yahoo", origin = "1970-01-01",

compression = "d", retclass = "zoo")time series starts 2000-01-03

time series ends 2016-12-30library(xts)

library(lubridate)

# Daily return in percentage

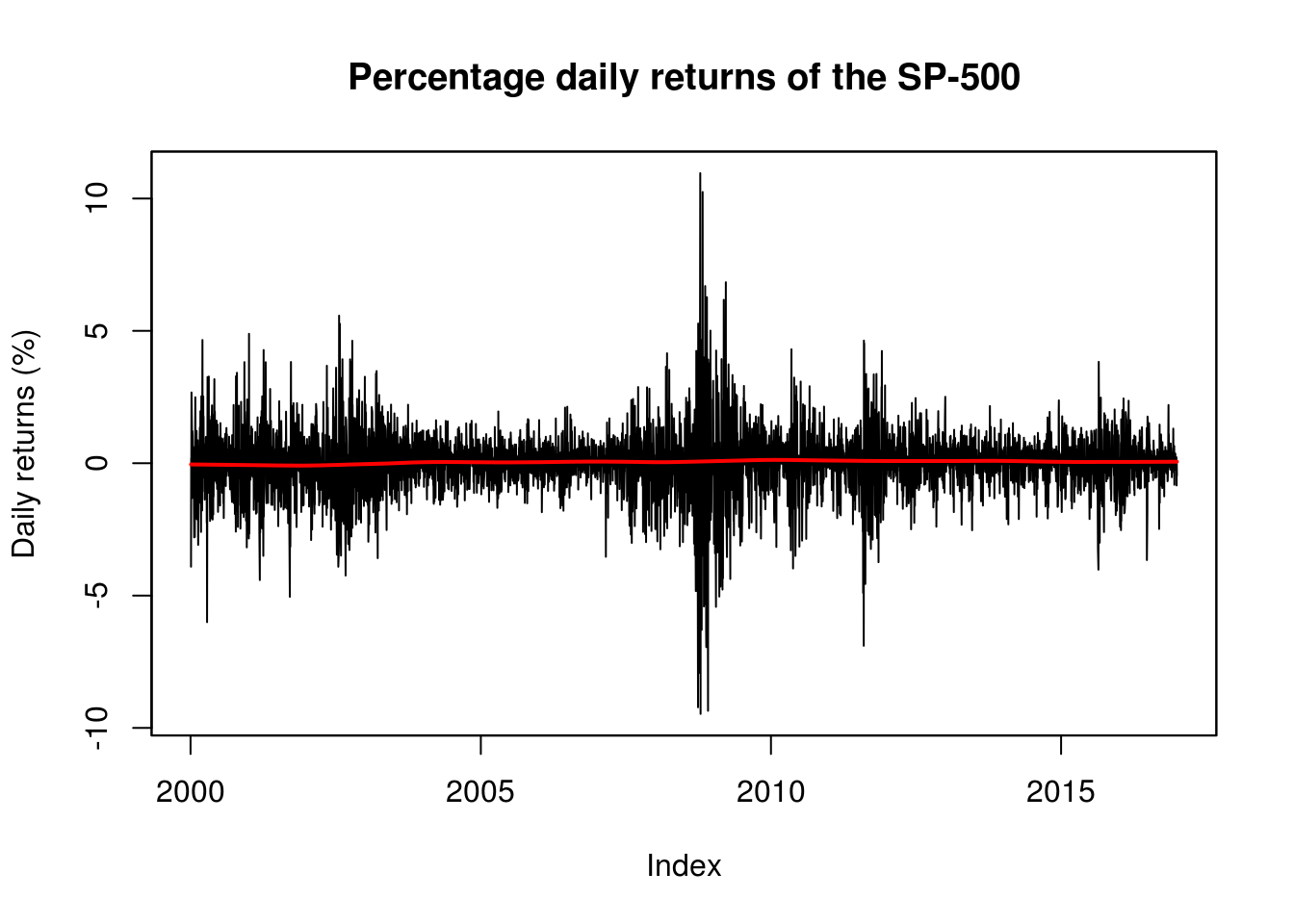

spret <- 100 * diff(log(sp500))

plot(spret, ylab = "Daily returns (%)", main = "Percentage daily returns of the SP-500")

# local trend to see if there is any evidence of non-zero trend

lines(index(spret), lowess(spret, f = 1/5)$y, col = 2, lwd = 2)

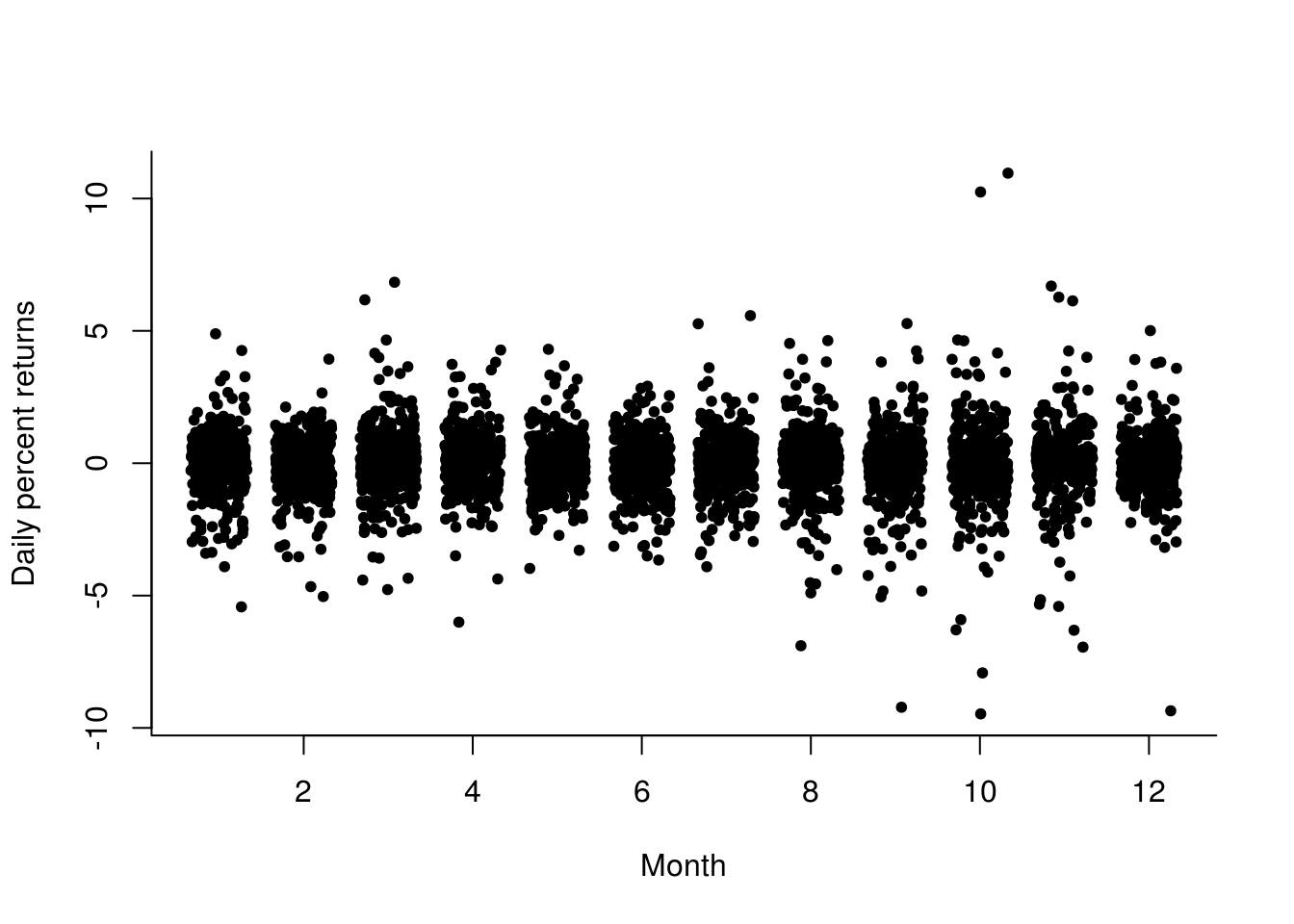

# Volatility as function of month

plot(jitter(month(spret), amount = 1/3), spret, pch = 20, ylab = "Daily percent returns",

xlab = "Month", bty = "l")

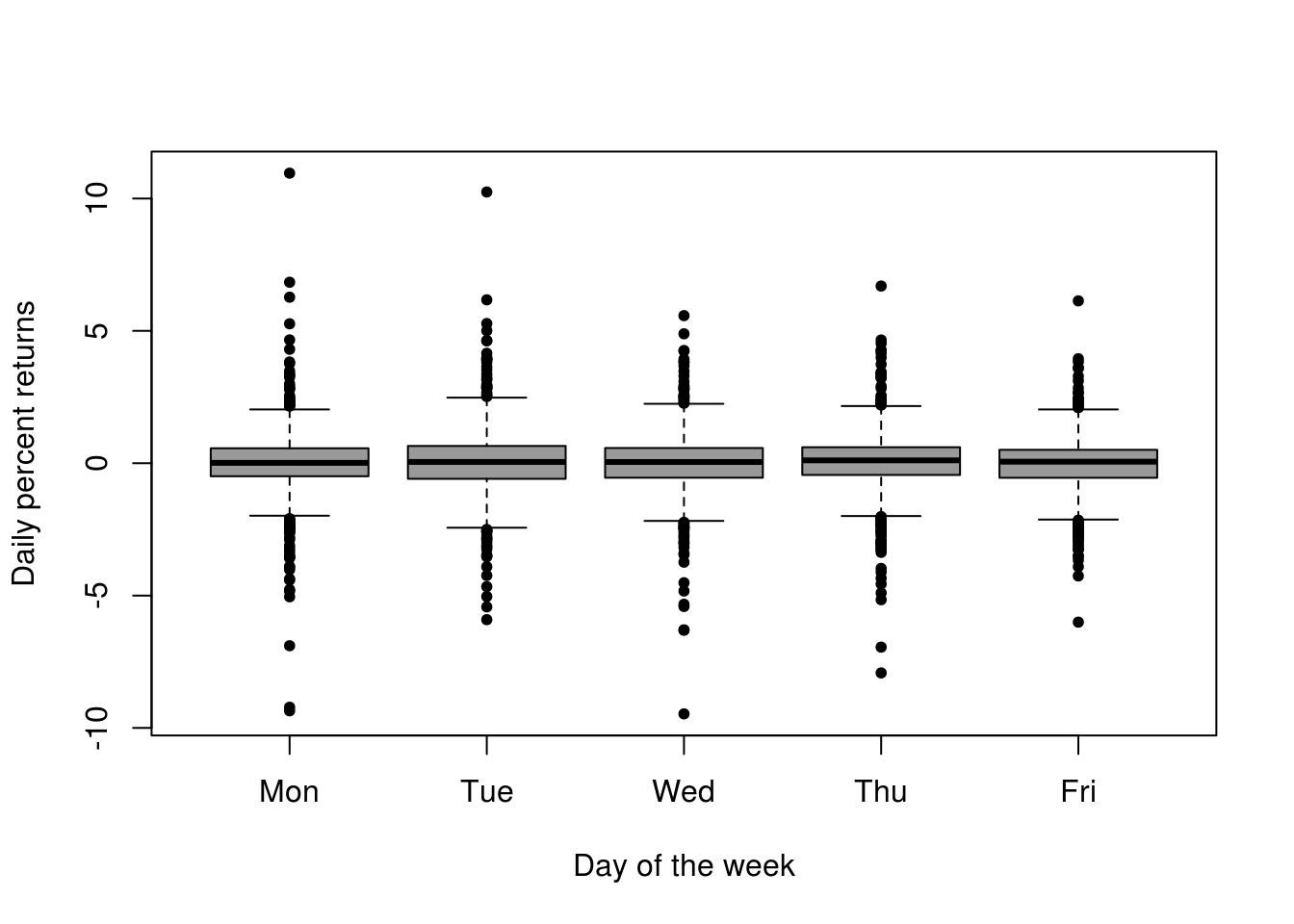

boxplot(as.vector(spret) ~ factor(wday(spret), labels = c("Mon", "Tue", "Wed",

"Thu", "Fri")), xlab = "Day of the week", pch = 20, col = rgb(0, 0, 0, 0.4),

ylab = "Daily percent returns", bty = "l")

# More uncertainty in March-May and August-November Some more extremes early

# in the week

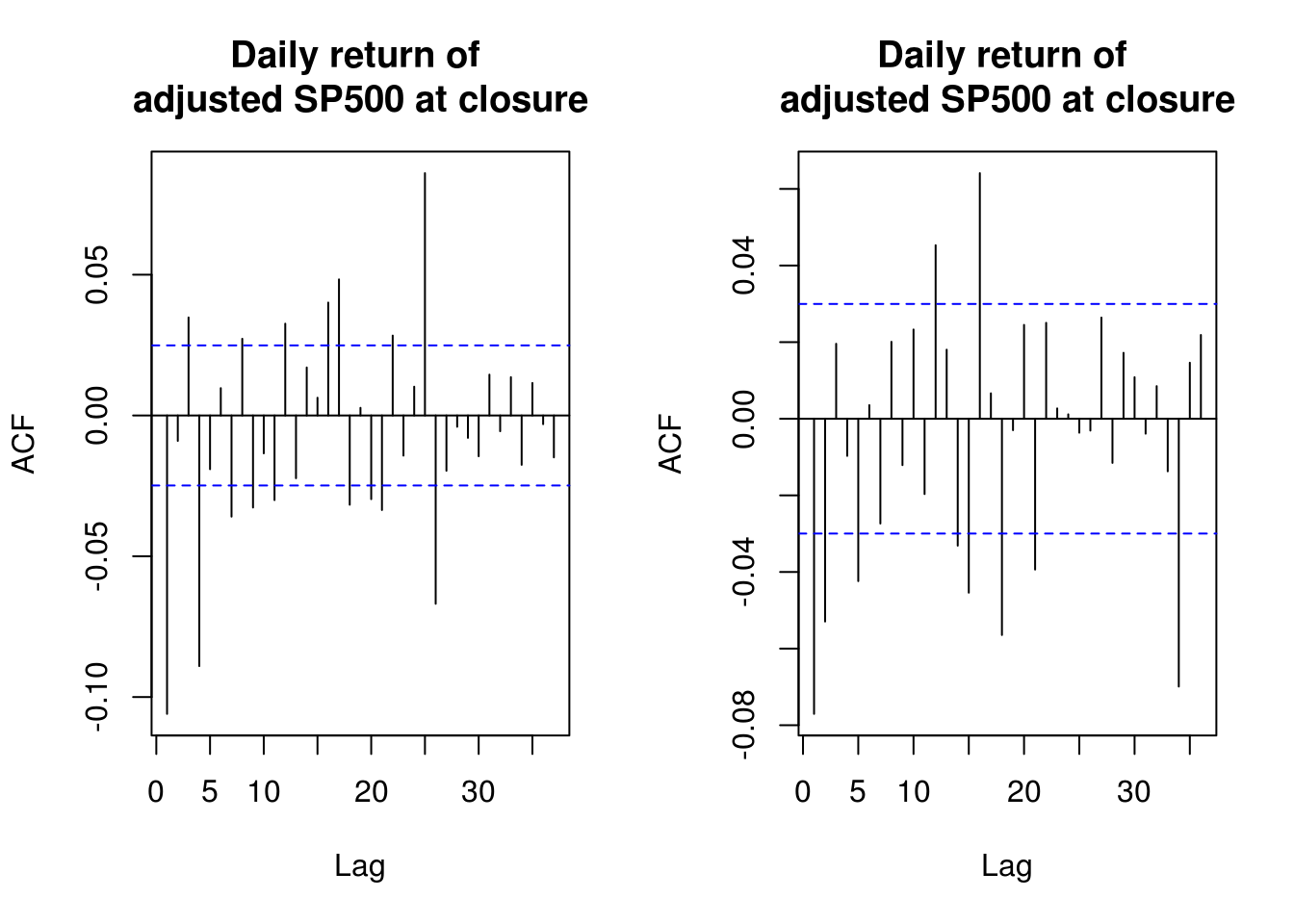

par(mfrow = c(1, 2))

title_sp <- "Daily return of \nadjusted SP500 at closure"

TSA::acf(spret, na.action = na.pass, main = title_sp)

TSA::acf(na.omit(as.vector(spret)), main = title_sp)

dev.off()null device

1 pacf(spret, na.action = na.pass, main = title_sp)

# (P)ACF of absolute value of daily returns

TSA::acf(abs(spret), na.action = na.pass, main = title_sp)

pacf(abs(spret), na.action = na.pass, main = title_sp)

# (P)ACF of squared daily returns

TSA::acf(I(spret^2), na.action = na.pass, main = title_sp)

pacf(I(spret^2), na.action = na.pass, main = title_sp)1.7.3 Solutions 3: Simulated data

The first 5 parts of the question are straightforward and left to the reader.

- Simulate 500 observations from an AR(1) process with parameter values \(\alpha \in \{0.1, 0.5, 0.9, 0.99\}\).

- Repeat for MA processes of different orders. There is no restriction on the coefficients of the latter for stationarity, unlike the AR process.

- Sample from an ARCH(1) process with Gaussian innovations and an ARCH(1) process with Student-\(t\) innovations with

df=4. Look at the correlogram of the absolute residuals and the squared residuals. - The dataset

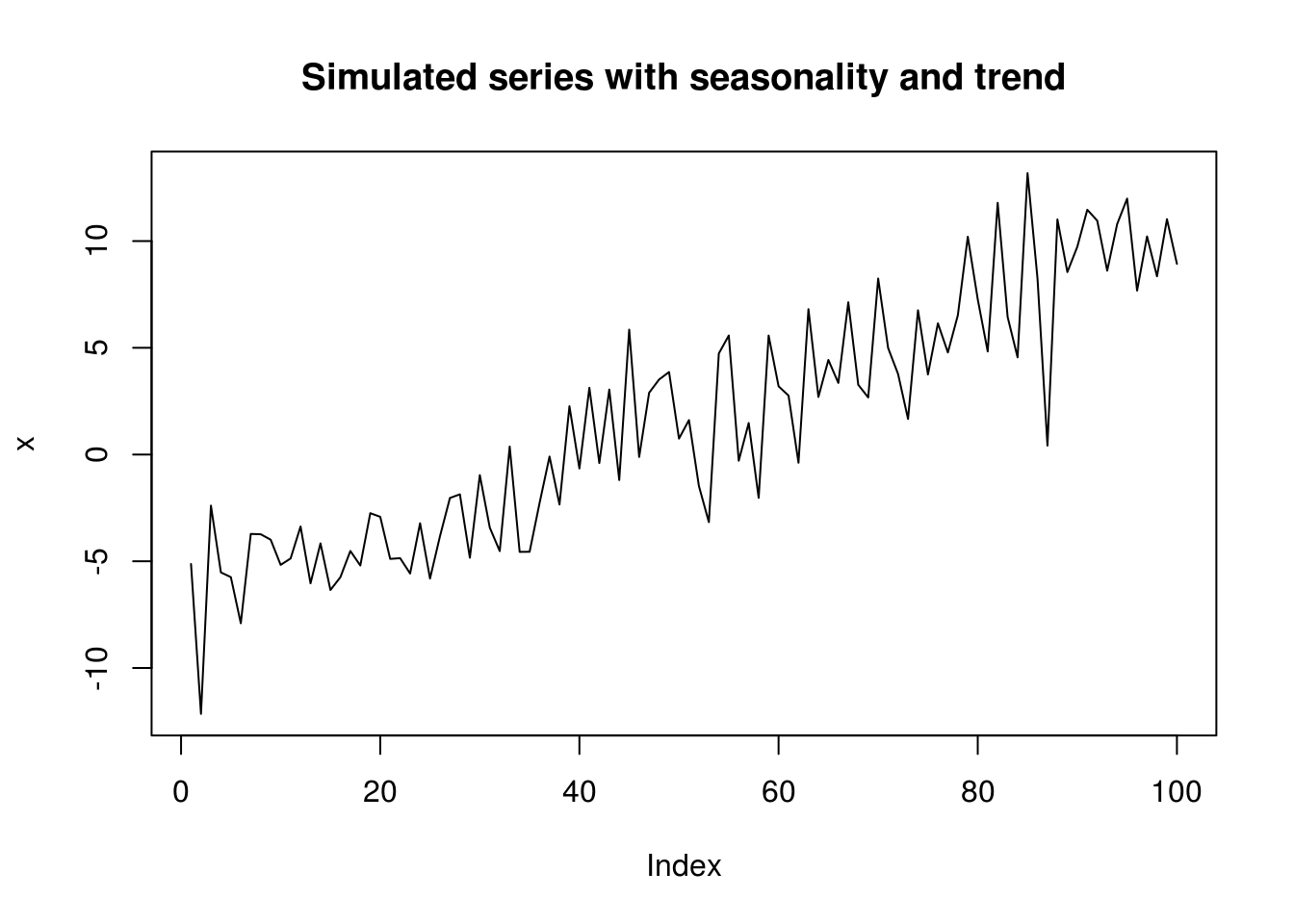

EuStockMarketscontains the daily closing prices of major European stock indices. Type?EuStockMarketsfor more details andplot(EuStockMarkets)to plot the four series (DAX, SMI, CAC and FTSE). Useplot(ftse <- EuStockMarkets[,"FTSE"])to plot the FTSE series andplot(100*diff(log(ftse)))to plot its daily log return. Play with the ARCH simulation functions to generate some similar processes. - Simulate a white noise series with trend \(t\) and \(\cos(t)\), of the form \(X_t=M_t+S_t+Z_t\), where \(Z_t \sim \mathsf{N}(0,\sigma^2)\) for different values of \(\sigma^2\). Analyze the log-periodogram and the (partial) correlograms. What happens if you forget to remove the trend?

- Do the same for multiplicative model with lognormal margins, with structure \(X_t=M_tS_tZ_t\).

- For steps 5 and 6, plot the series and test the assumptions that they are white noise using the Ljung-Box test. Note you need to adjust the degrees of freedom when working with residuals from e.g. ARMA models.

n <- 100

tim <- scale(1:n)

x <- 5 * tim + cos(2 * pi * tim/n) + rnorm(n, sd = 3)

plot(x, type = "l", main = "Simulated series with seasonality and trend")

Box.test(x, type = "L")

Box-Ljung test

data: x

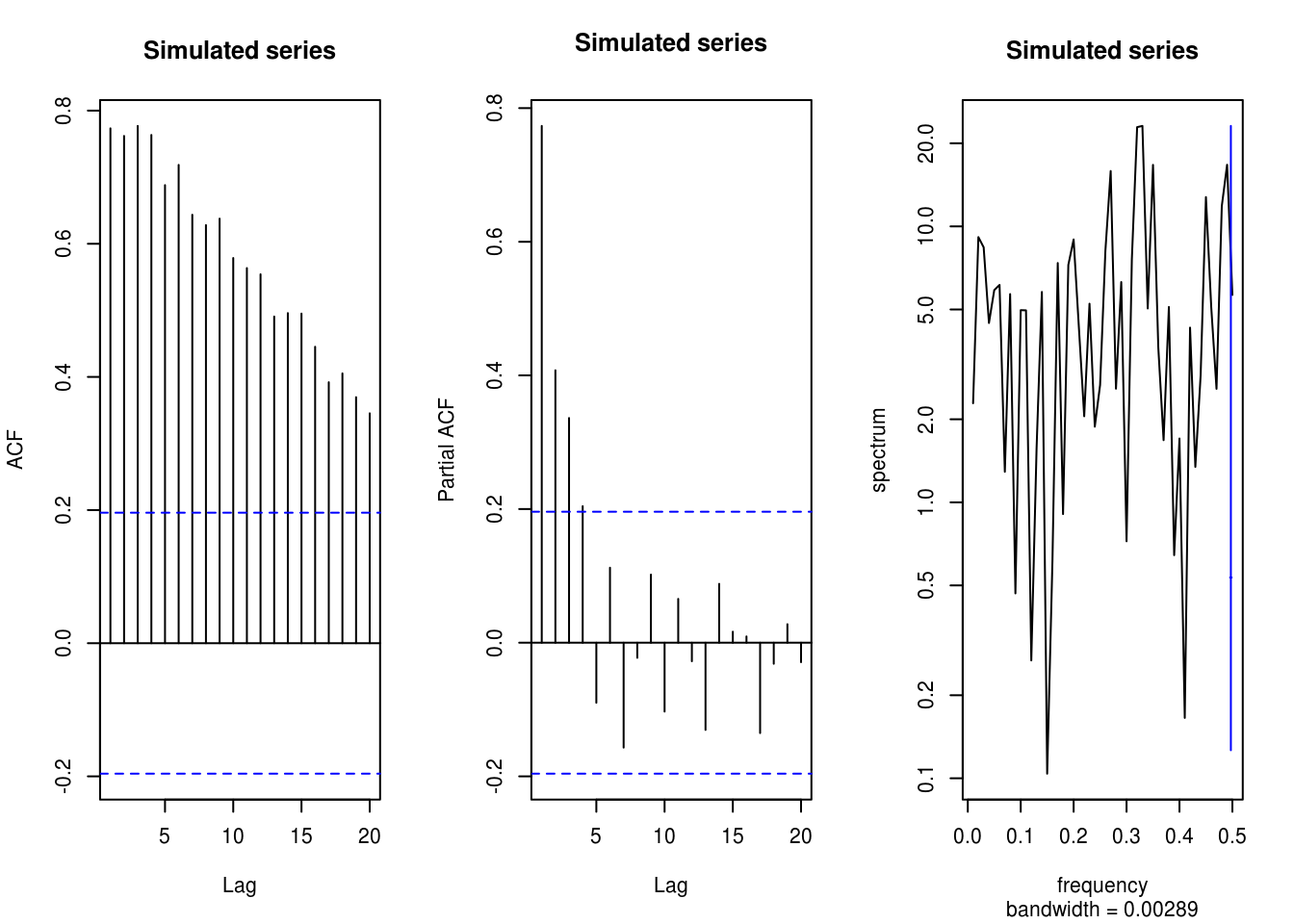

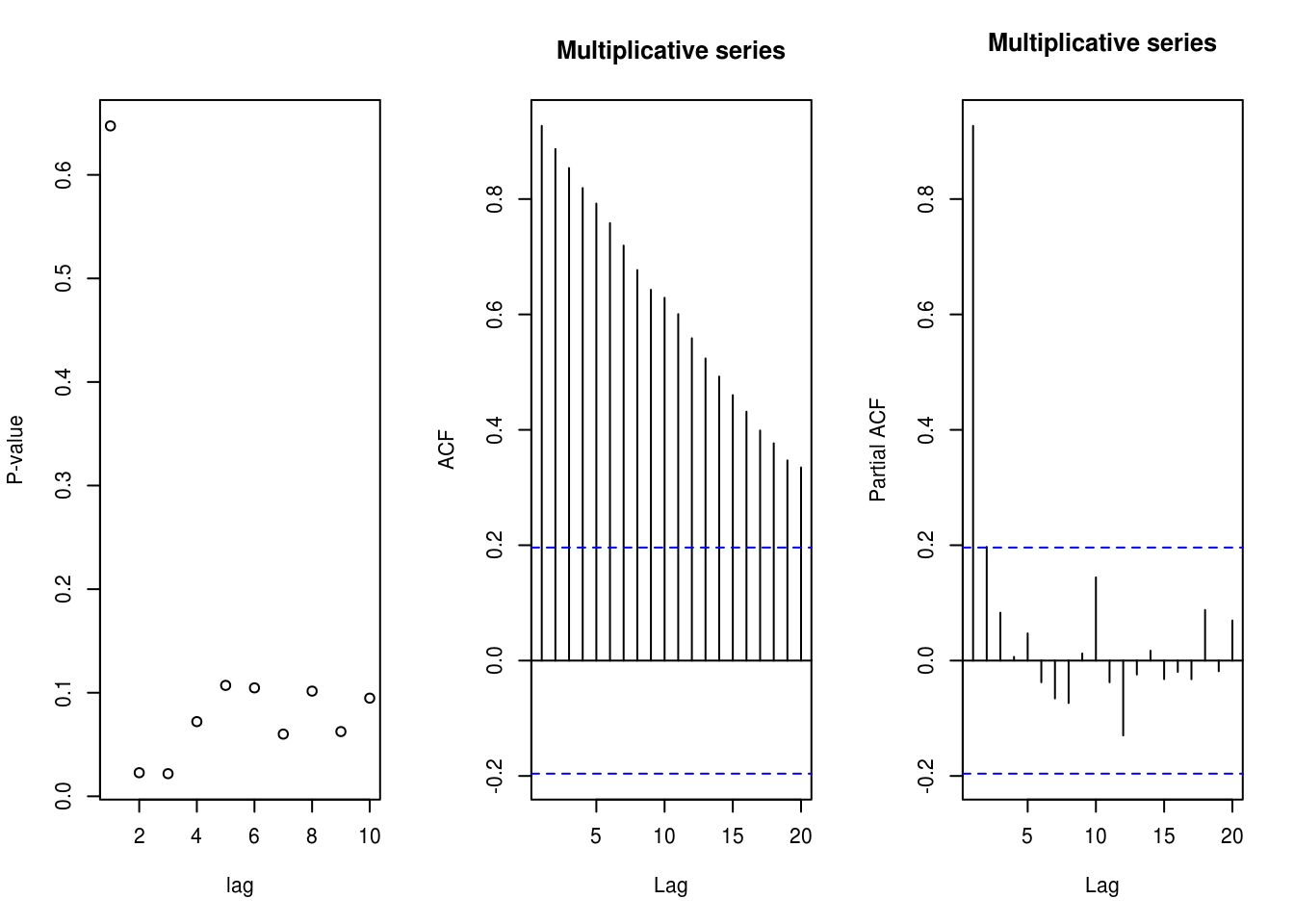

X-squared = 61.616, df = 1, p-value = 4.219e-15par(mfrow = c(1, 3)) # plots side by side

TSA::acf(x, main = "Simulated series")

pacf(x, main = "Simulated series")

spectrum(x, main = "Simulated series")

# Nothing in spectrum, persistence in the (p)acf

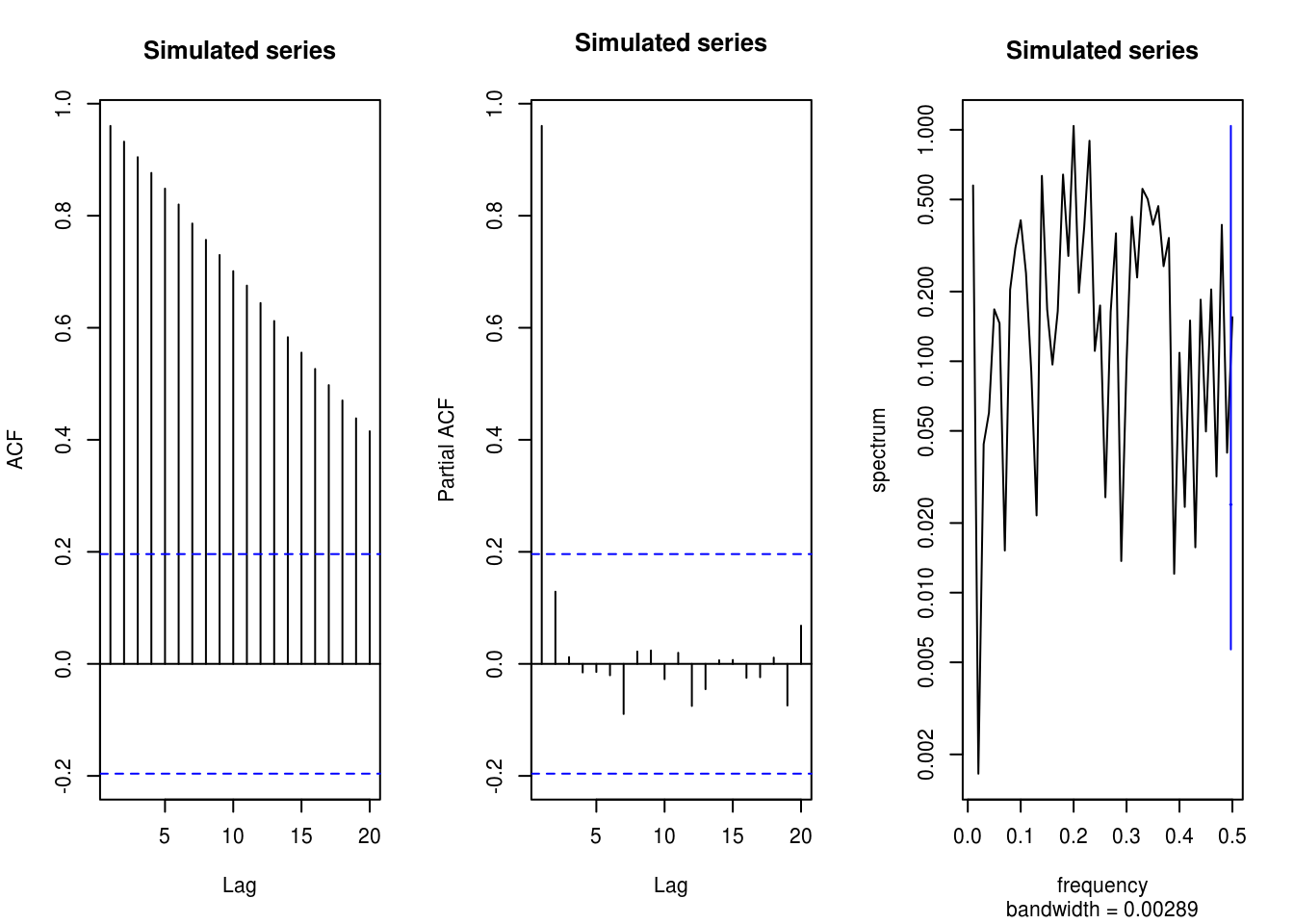

x <- 5 * tim + cos(2 * pi * tim/n) + rnorm(n, sd = 0.5)

TSA::acf(x, main = "Simulated series")

pacf(x, main = "Simulated series")

spectrum(x, main = "Simulated series")

# Worst if the signal is strong relative to noise

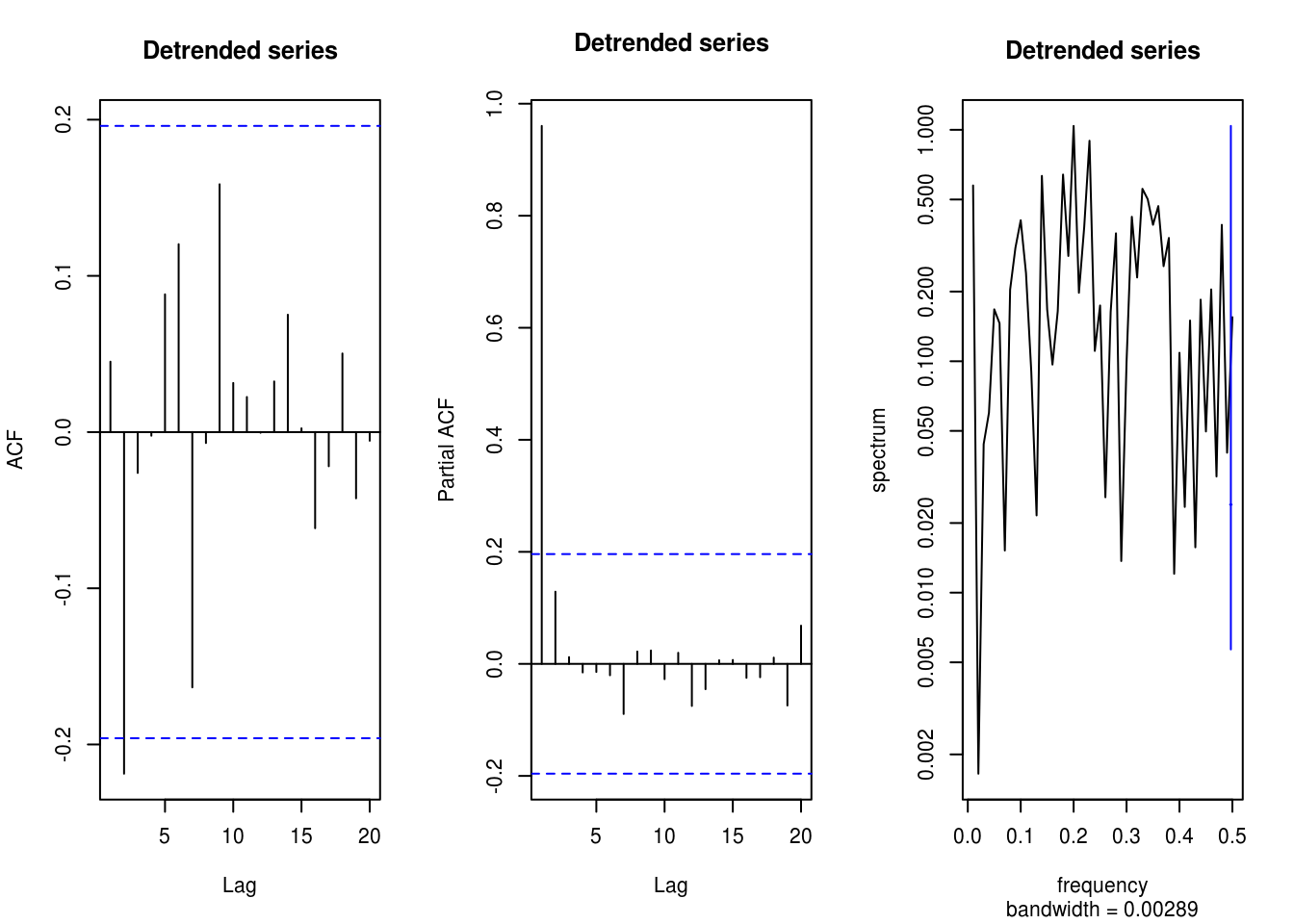

y <- residuals(lm(x ~ 1 + tim))

TSA::acf(y, main = "Detrended series")

pacf(x, main = "Detrended series")

spectrum(y, main = "Detrended series")

# The cosine still induces some lag-one dependence in pacf

plot(1:10, sapply(1:10, function(i) {

Box.test(y, lag = i, type = "Ljung", fitdf = min(i - 1, 2))$p.value

}), ylab = "P-value", xlab = "lag")

# These low p-values at large lags are due to the cosine term

mult <- exp(scale(x))

TSA::acf(mult, main = "Multiplicative series")

pacf(mult, main = "Multiplicative series")

spectrum(mult, main = "Multiplicative series")

Box.test(mult, type = "L")

Box-Ljung test

data: mult

X-squared = 88.489, df = 1, p-value < 2.2e-16graphics.off()

# Now large impact on spectrum, and nonlinear features!

plot(mult, main = "Multiplicative series with lognormal margins", ylab = "",

xlab = "Time")

# Note that decompose has an option type='multiplicative' for seasonal

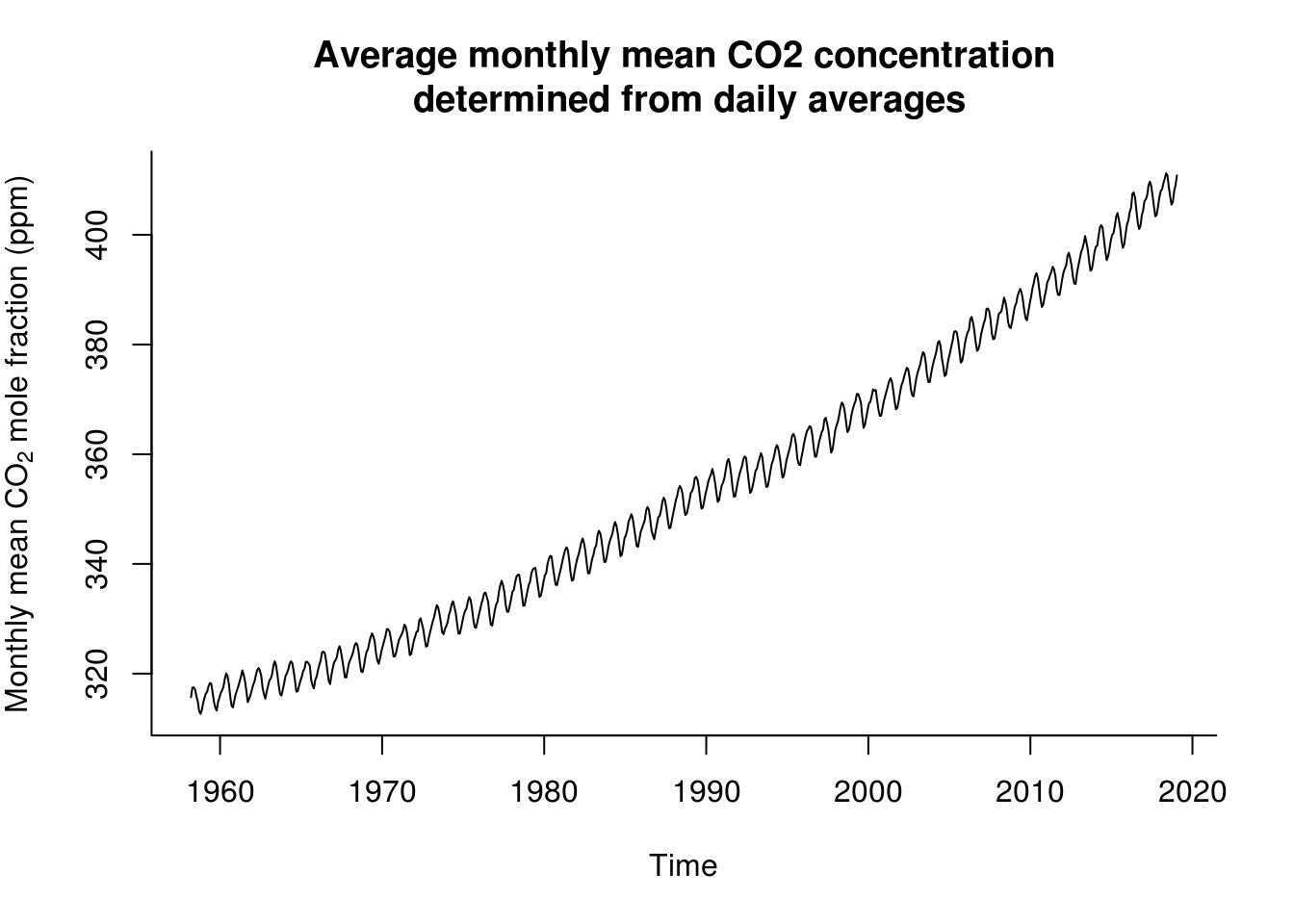

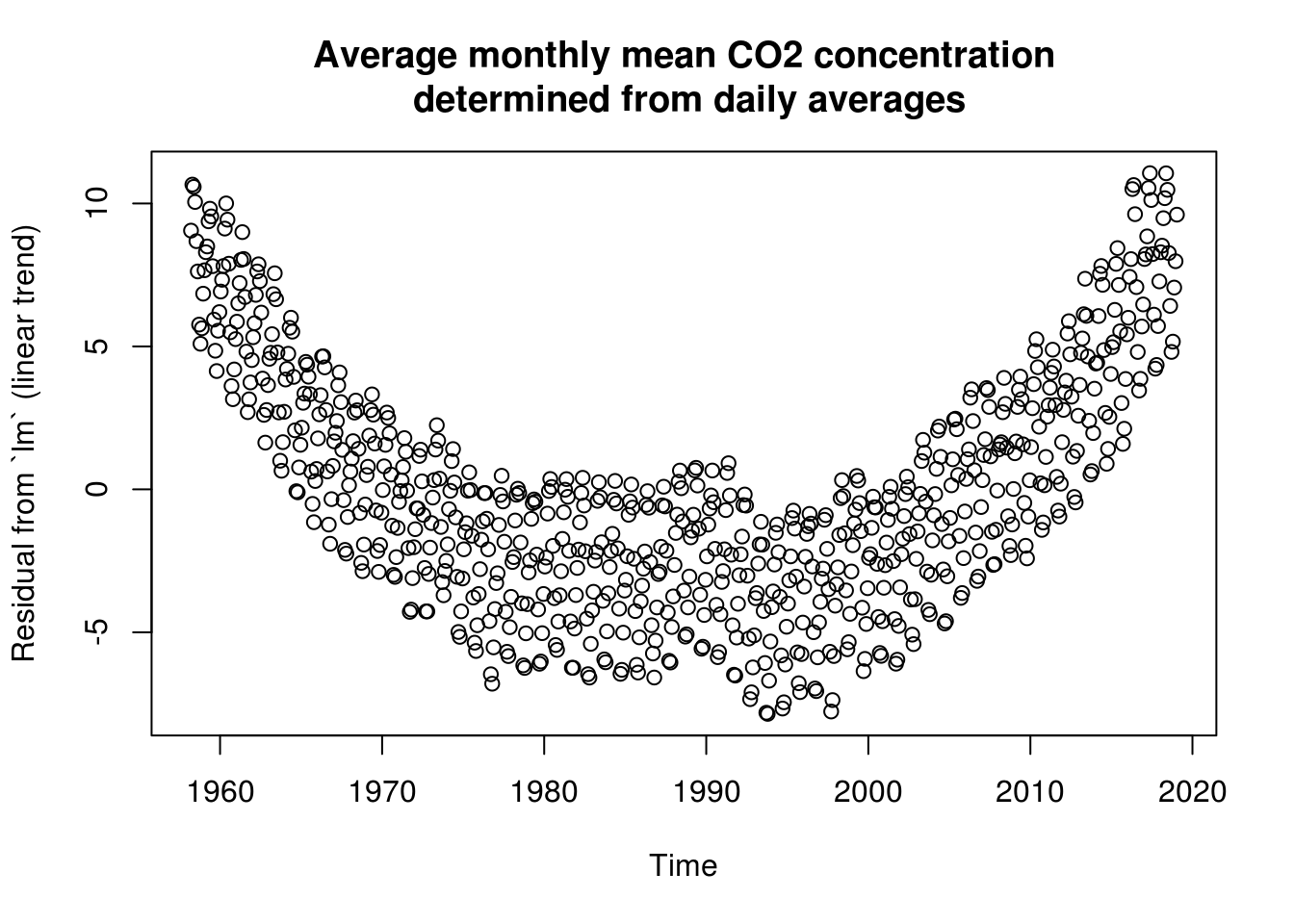

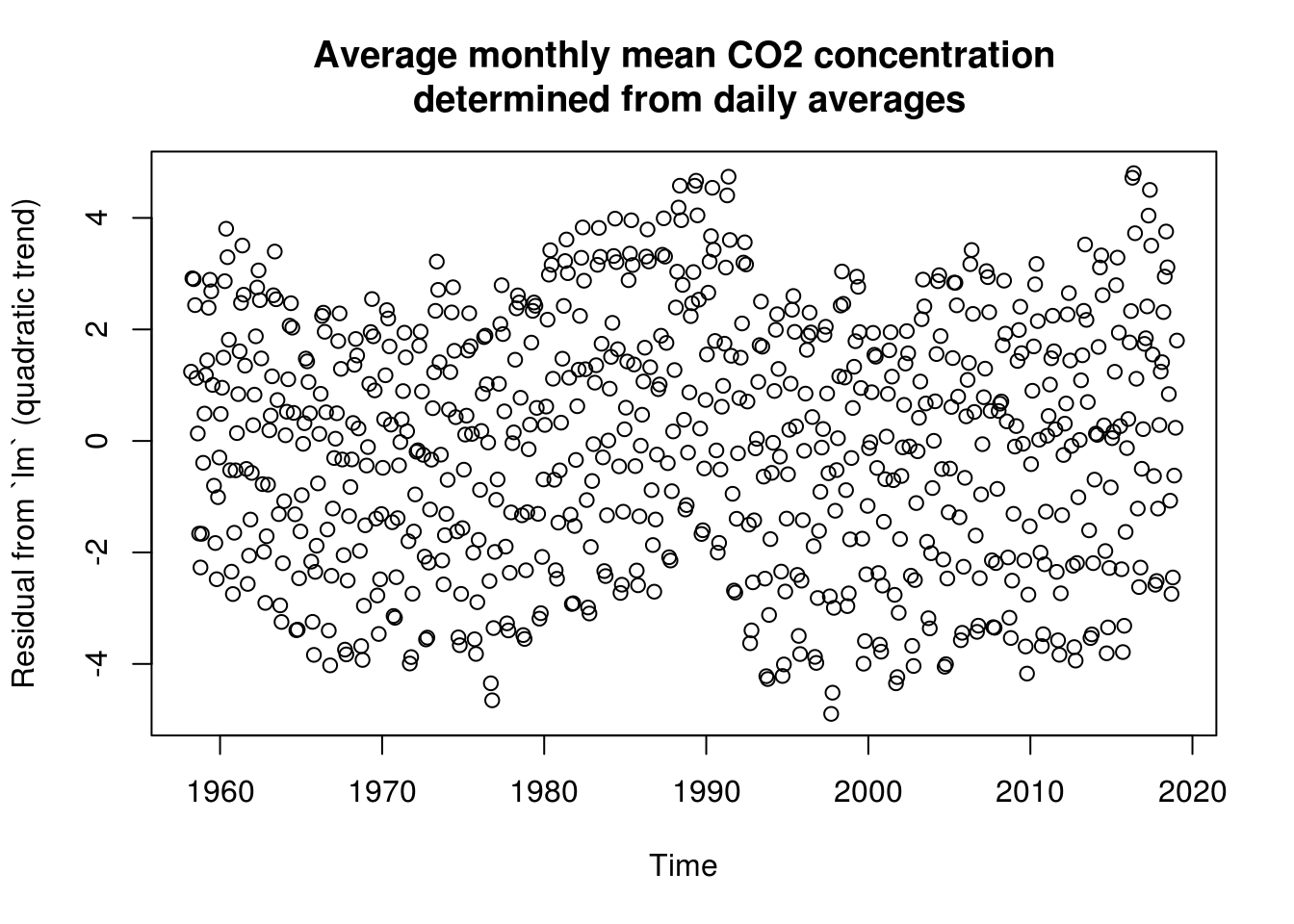

# components1.7.4 Solutions 4: Mauna Loa Atmospheric CO2 Concentration

- Load and plot the CO2 dataset from NOAA. Pay special attention to the format, missing values, the handling of string and the description. Use

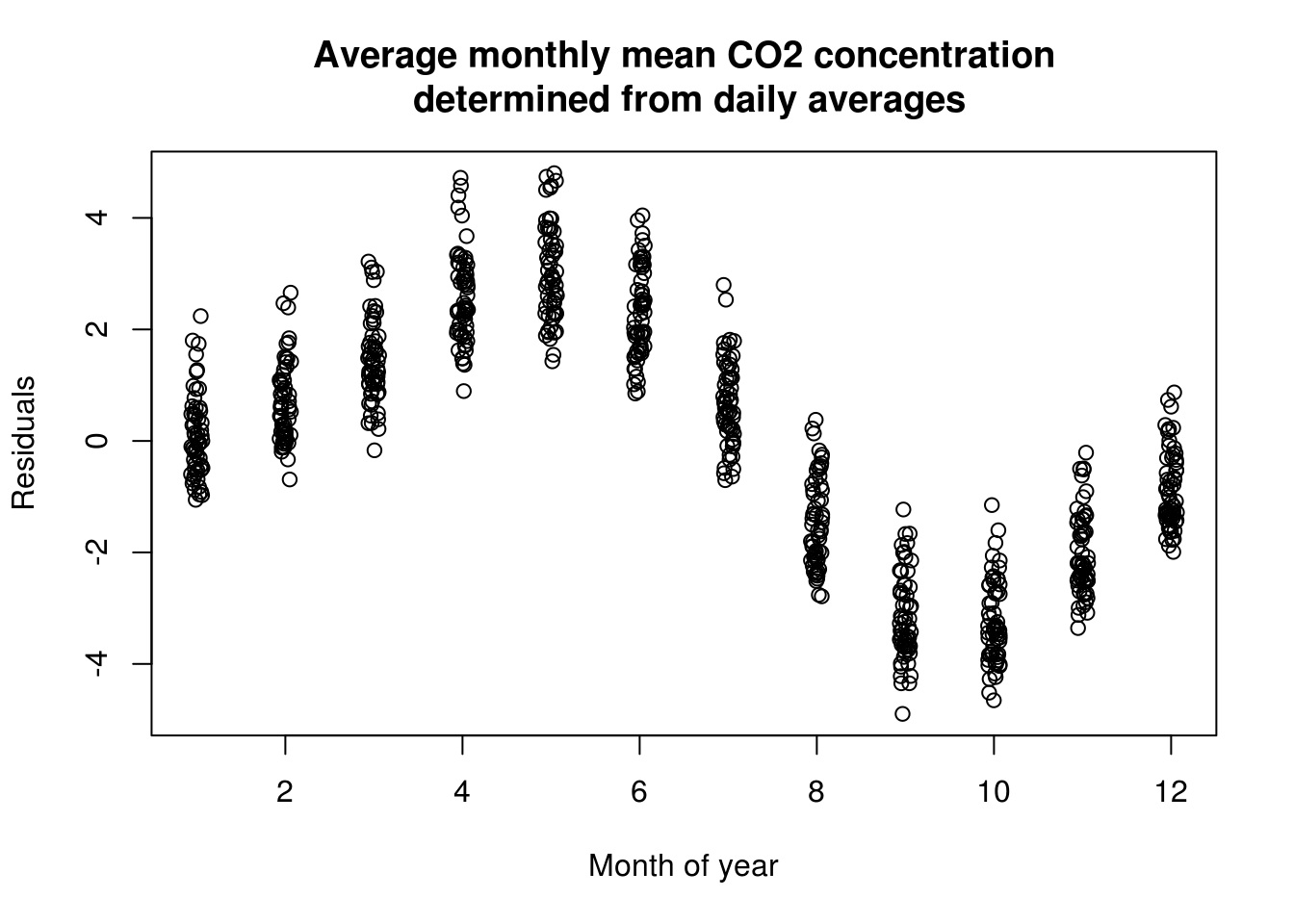

?read.tablefor help, and look carefully at argumentsfile,sep,na.strings,skipandstringsAsFactors. From now on, we will work with the complete series (termed interpolated in the description). - Try removing the trend using a linear model. Plot the residuals against month of the year.

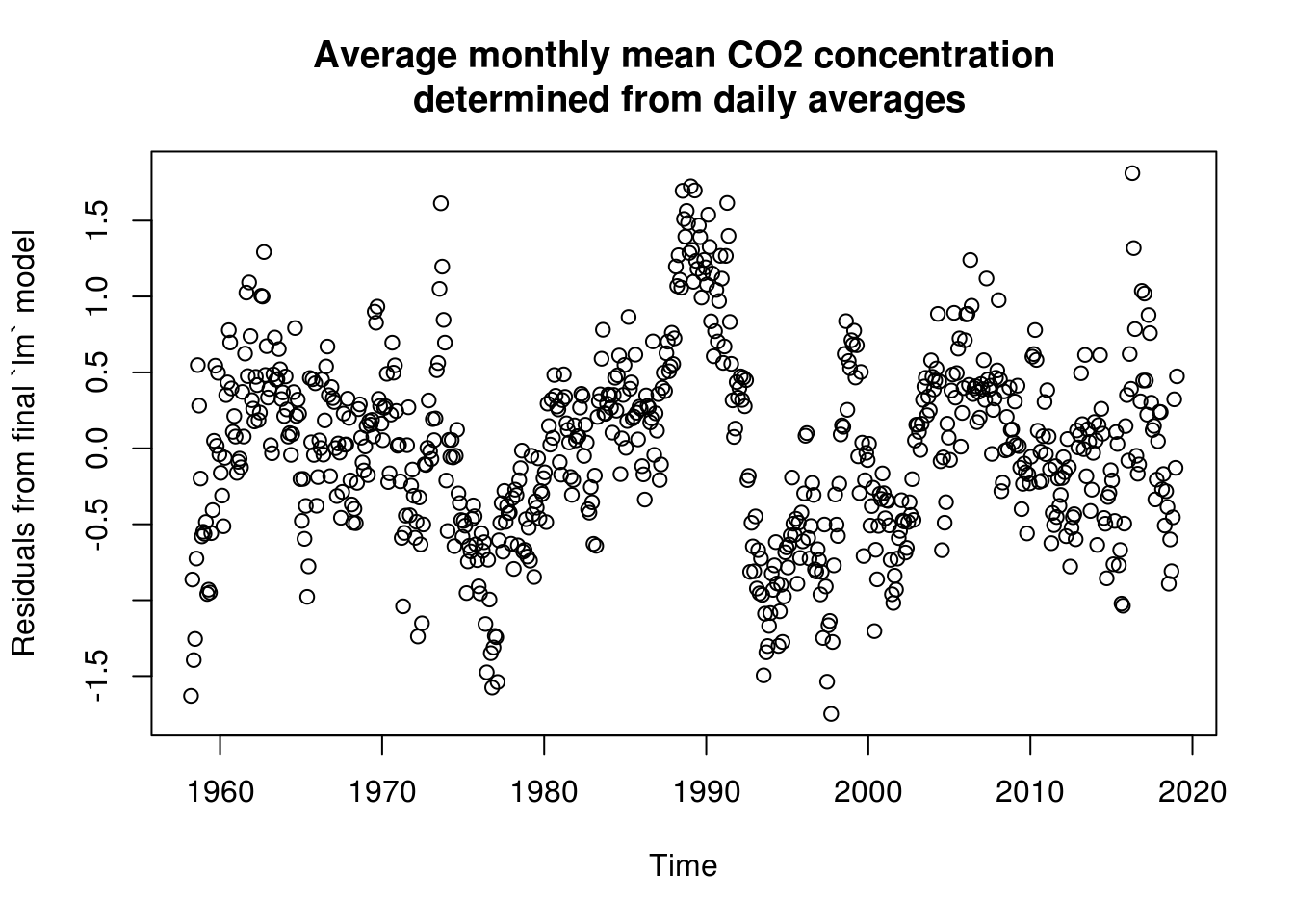

- Remove the trend and the periodicity with a Fourier basis (with period 12). Be sure to include both

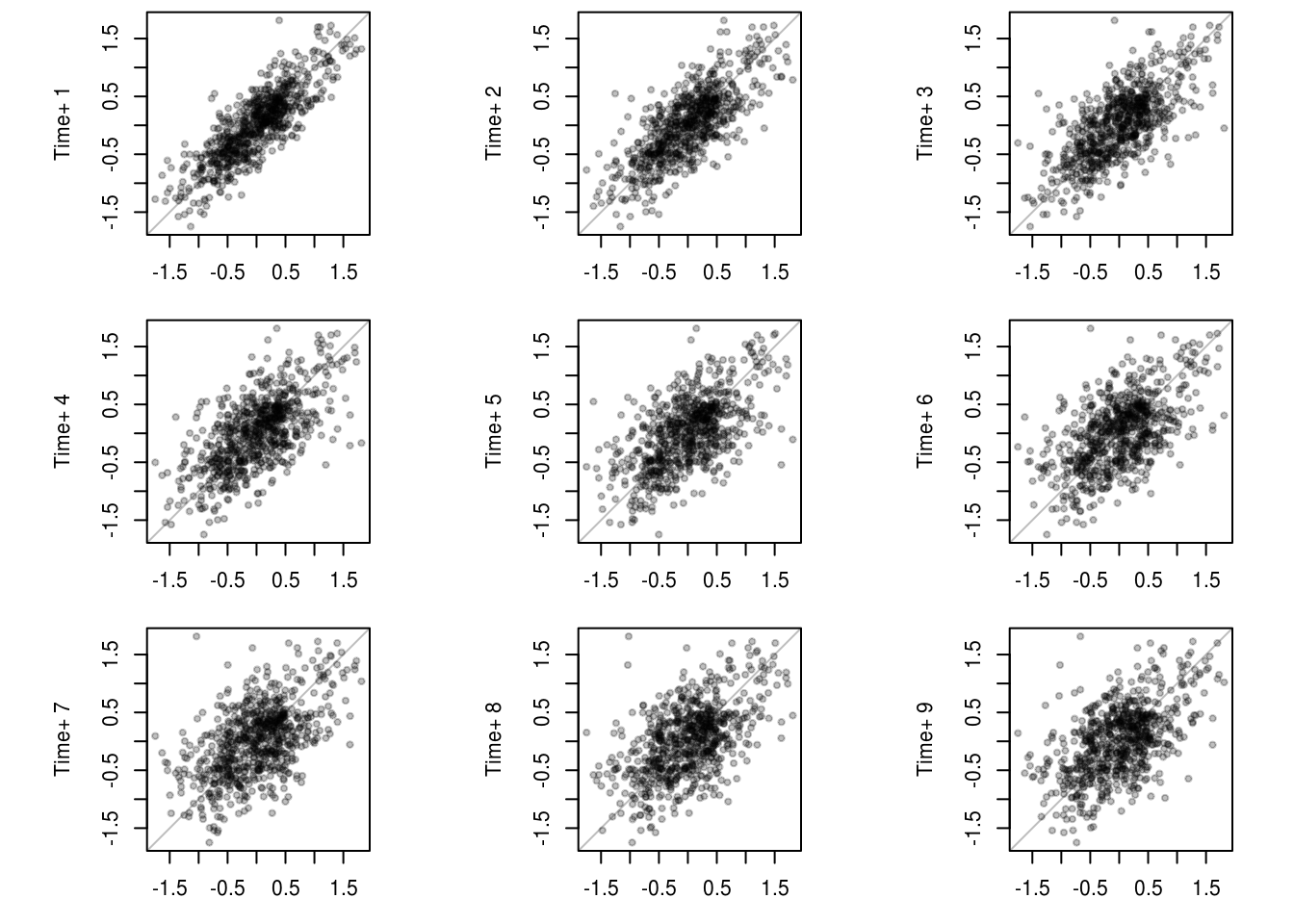

sinandcosterms together. Recall that the standard Wald tests for the coefficients is not valid in the presence of autocorrelation! You could also usepolyorsplines::bsto fit polynomials or splines to your series. - Plot the lagged residuals. Are there evidence of correlation?

- Use the function

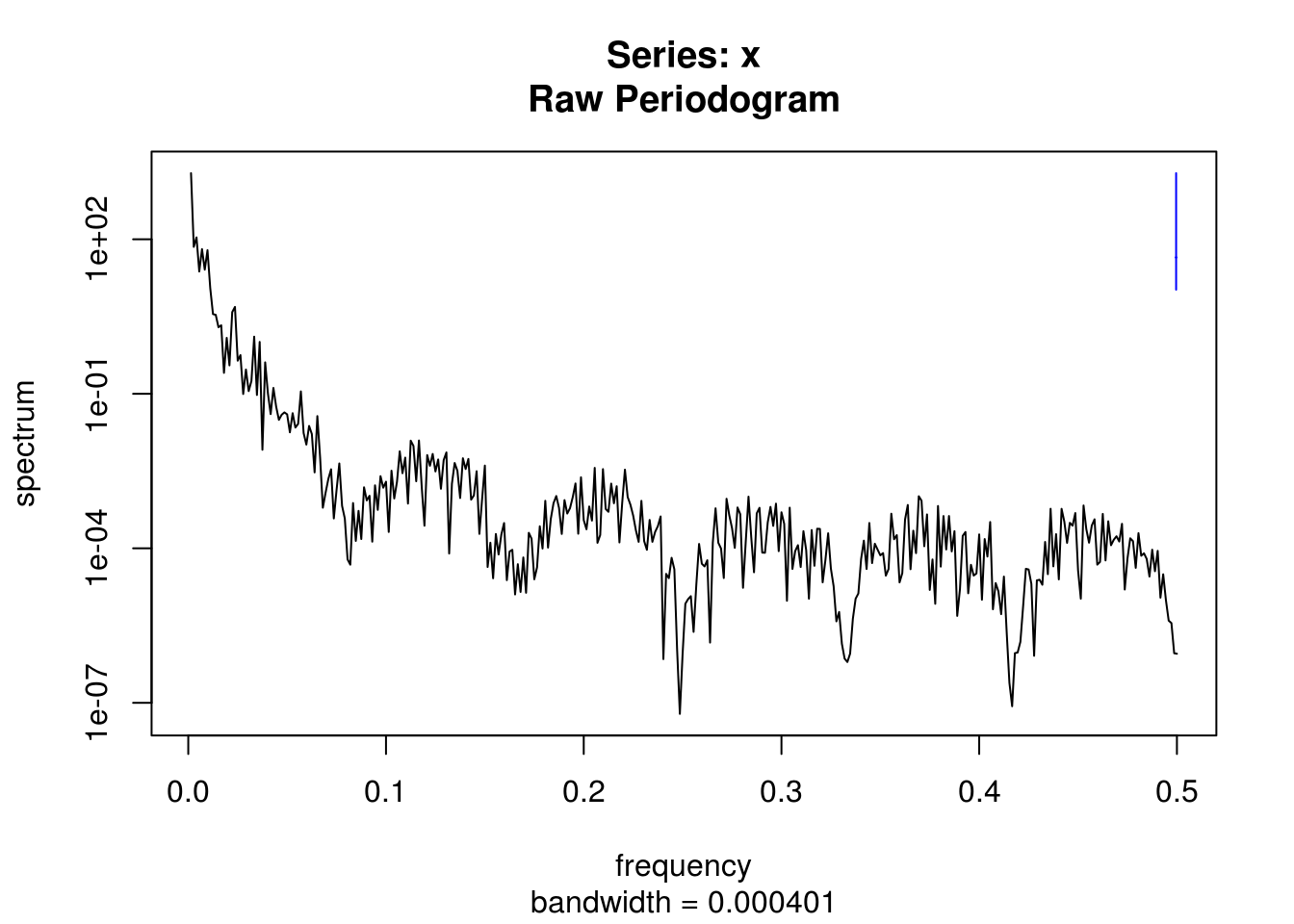

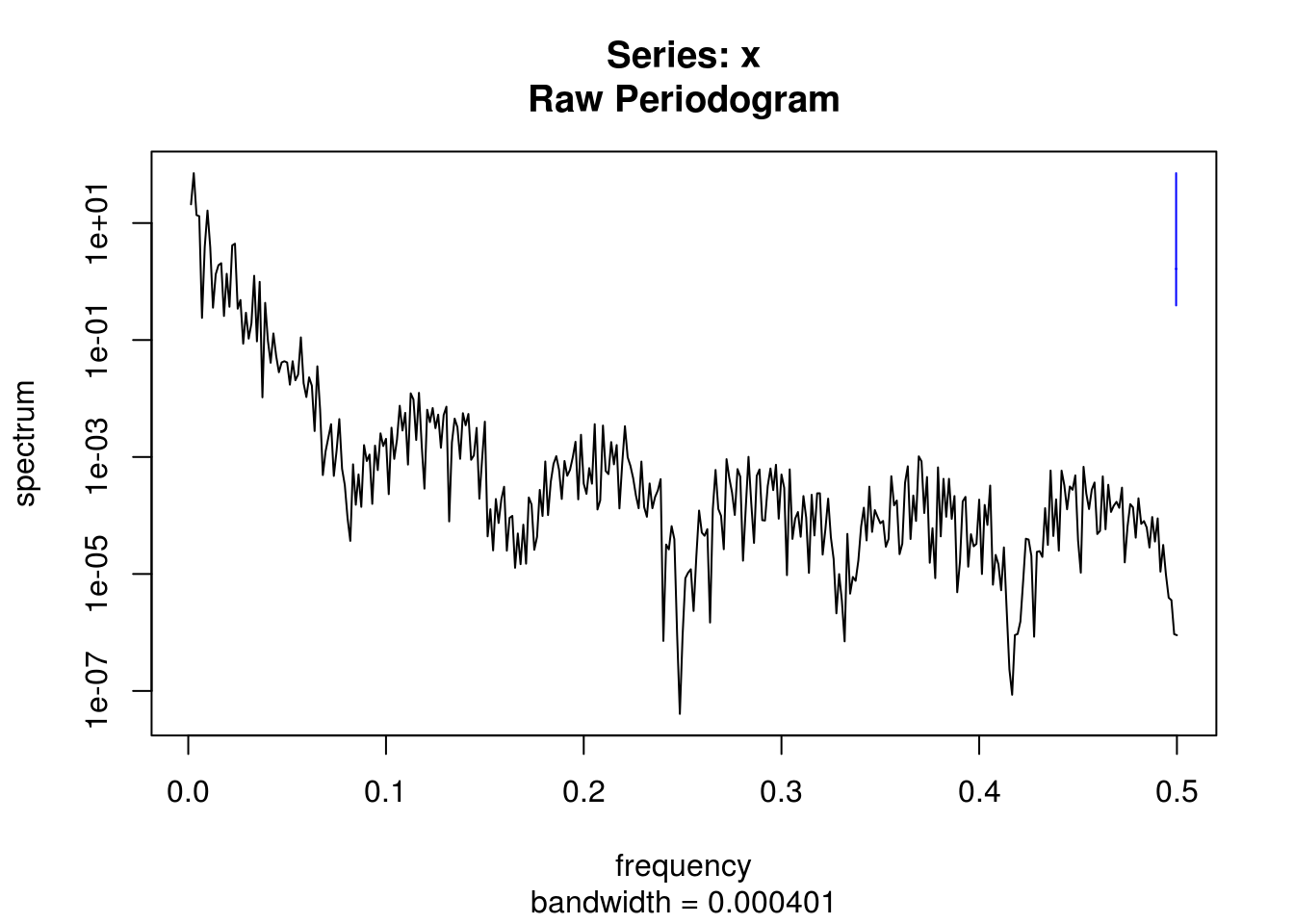

filterto smooth the series using a 12 period moving average. - Inspect the spectrum of the raw series and of the smoothed version.

- Inspect the spectrum of the detrended raw series.

- Test for stationarity of the deseasonalized and detrended residuals using the KPSS test viz.

tseries::kpss.test. - Use the

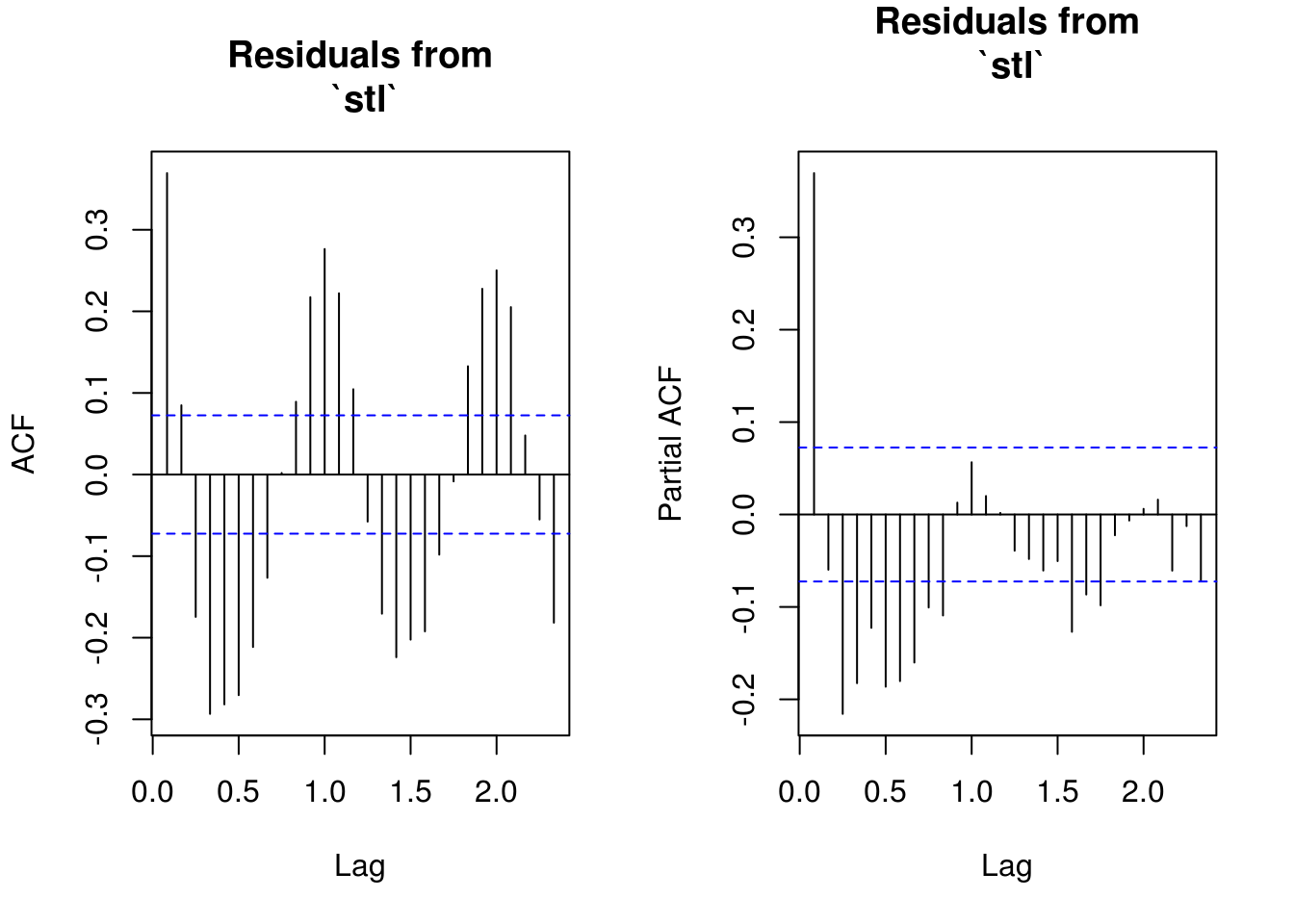

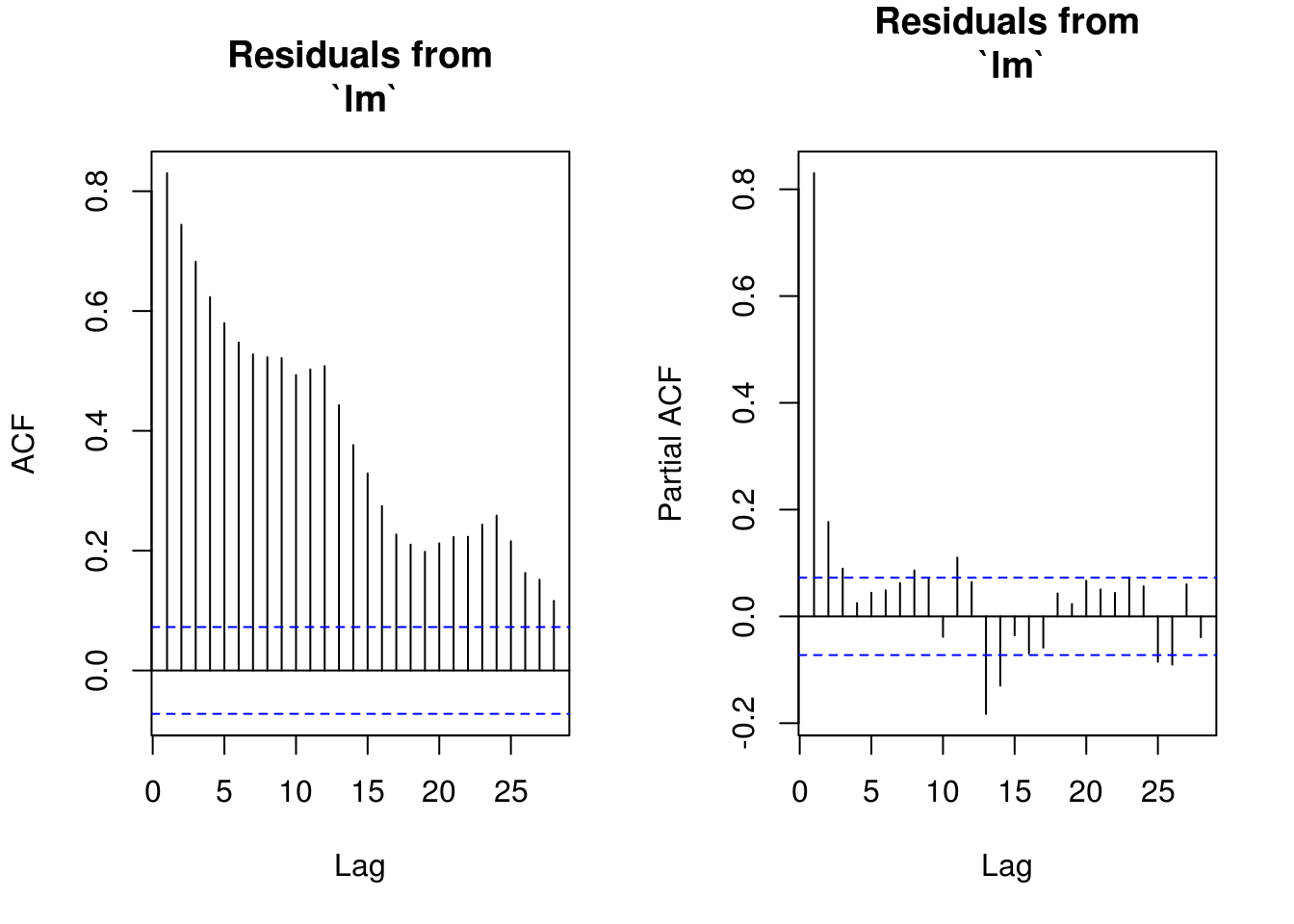

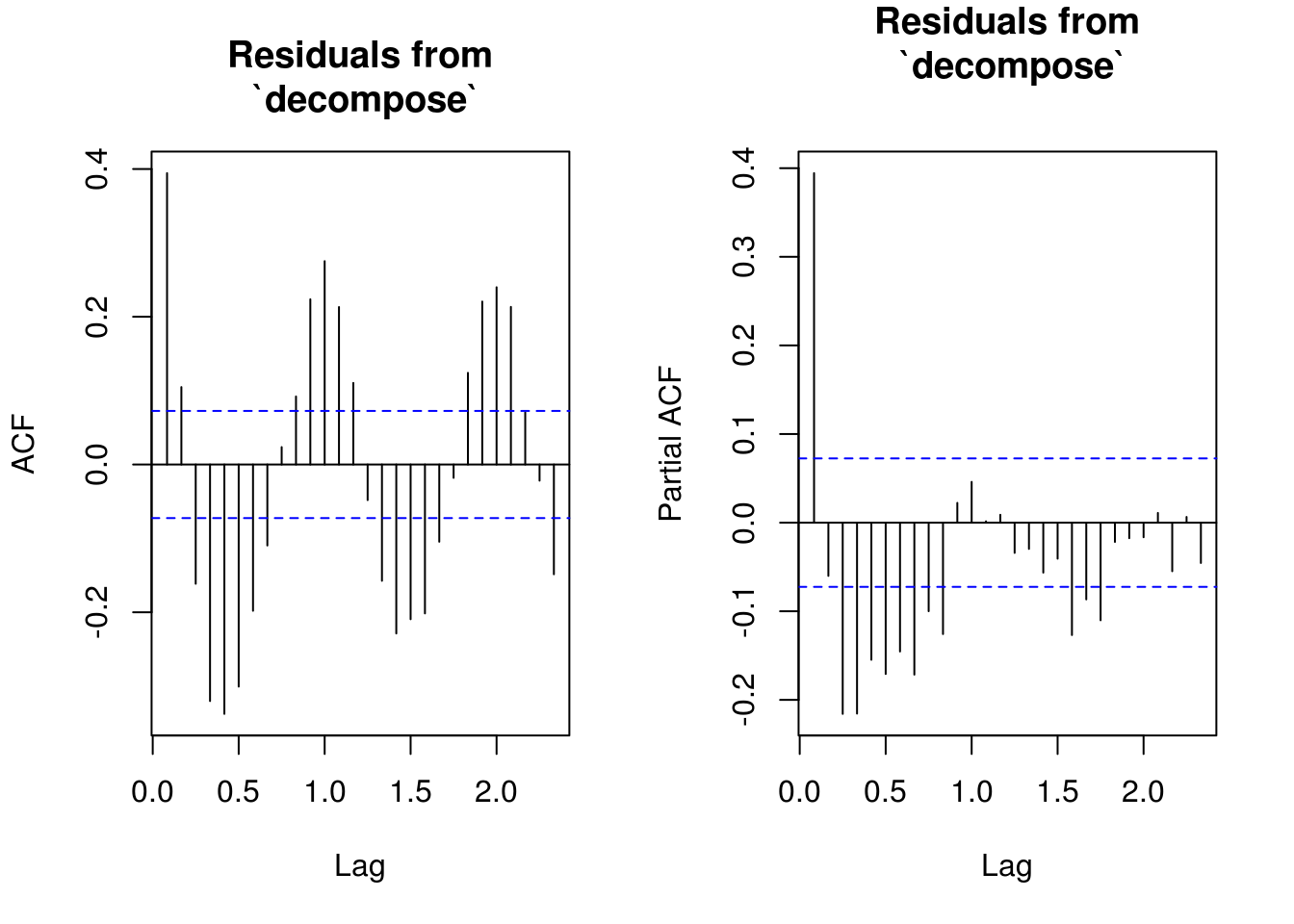

decomposeand thestlfunctions to obtain residuals. - Plot the (partial) correlogram for both decomposition and compare them with the output of the linear model.

# Because of comment.char=#, all the first lines are skipped But we lose the

# header

co2 <- read.table(file = "ftp://aftp.cmdl.noaa.gov/products/trends/co2/co2_mm_mlo.txt",

na.strings = "-99.99", stringsAsFactors = FALSE, col.names = c("year", "month",

"time", "average", "interpolated", "trend", "monthly_mean"))

# install.packages('stlplus') #this package offers a version of stl that

# deals with NAs

ycap <- expression(paste("Monthly mean ", CO[2], " mole fraction (ppm)"))

mcap <- "Average monthly mean CO2 concentration\n determined from daily averages"

lin_mod <- lm(data = co2, interpolated ~ time)

with(co2, plot(interpolated ~ time, type = "l", xlab = "Time", bty = "l", ylab = ycap,

main = mcap))

plot(co2$time, residuals(lin_mod), ylab = "Residual from `lm` (linear trend)",

xlab = "Time", main = mcap)

lin_mod <- update(lin_mod, . ~ . + I(time^2))

# same as lm(data=co2, interpolated ~ poly(time, degree = 2))

plot(co2$time, residuals(lin_mod), main = mcap, ylab = "Residual from `lm` (quadratic trend)",

xlab = "Time")

# Cast the full time series into a ts object

co2_ts <- with(co2, ts(data = interpolated, start = c(year[1], month[1]), end = c(tail(year,

1), tail(month, 1)), frequency = 12))

with(co2, plot(jitter(month, 1/3), residuals(lin_mod), ylab = "Residuals", xlab = "Month of year",

main = mcap))

# Could create the basis manually

f_bs <- with(co2, fda::fourier(month, nbasis = 4, period = 12))[, -1]

lin_mod <- with(co2, lm(interpolated ~ splines::bs(time, df = 5, degree = 3) +

f_bs))

# summary(lin_mod) Is there structure left in the residuals?

plot(co2$time, residuals(lin_mod), ylab = "Residuals from final `lm` model",

xlab = "Time", main = mcap)

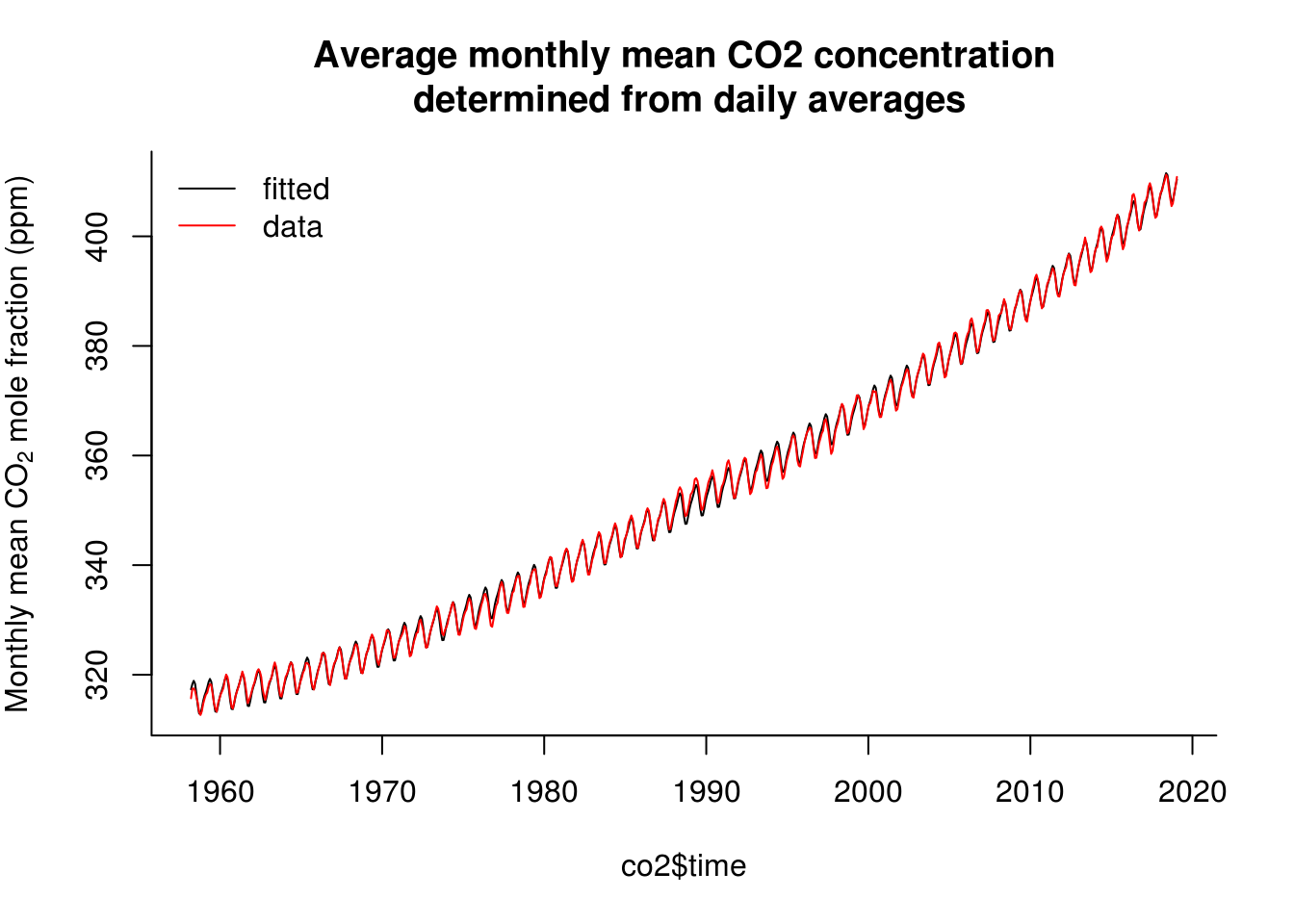

plot(co2$time, fitted(lin_mod), type = "l", ylab = ycap, main = mcap, bty = "l")

with(co2, lines(time, interpolated, col = 2))

legend(x = "topleft", legend = c("fitted", "data"), col = c(1, 2), lty = c(1,

1), bty = "n")

# Trend not quite adequate because more exponential growth. The trend does

# poorly in low-high observations Some discrepancy between the frequencies

# and the fitted Creates residual harmonic patterns - because trend minus

# fitted

res <- residuals(lin_mod)

pairs.ts <- function(d, lag.max = 10) {

old_par <- par(no.readonly = TRUE)

n <- length(d)

X <- matrix(NA, n - lag.max, lag.max)

col.names <- paste("Time+", 1:lag.max)

for (i in 1:lag.max) X[, i] <- d[i - 1 + 1:(n - lag.max)]

par(mfrow = c(3, 3), pty = "s", mar = c(3, 4, 0.5, 0.5))

lims <- range(X)

for (i in 2:lag.max) plot(X[, 1], X[, i], panel.first = {

abline(0, 1, col = "grey")

}, xlab = "Time", ylab = col.names[i - 1], xlim = lims, ylim = lims, pch = 20,

col = rgb(0, 0, 0, 0.25))

par(old_par)

}

pairs.ts(res)

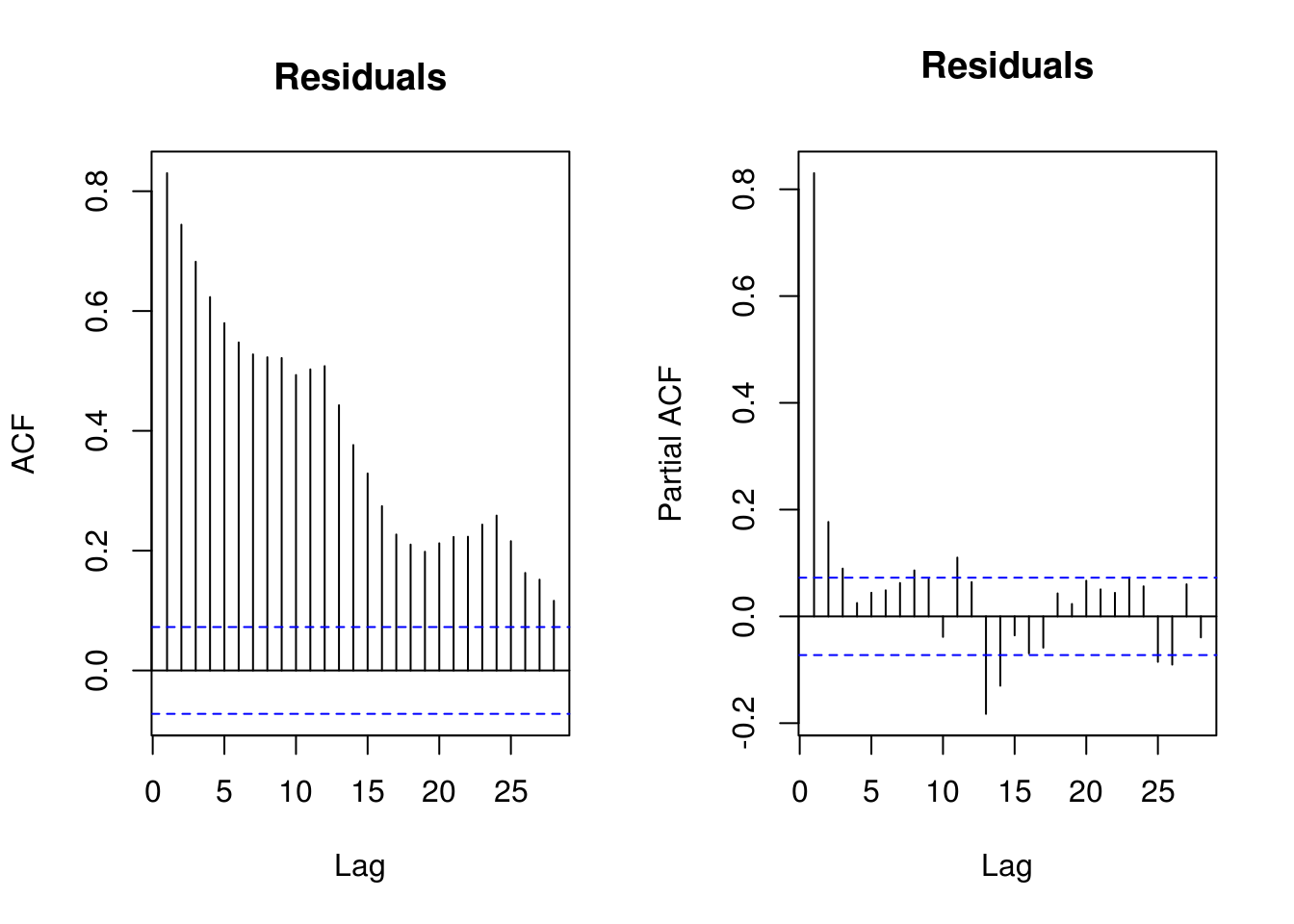

par(mfrow = c(1, 2))

TSA::acf(res, main = "Residuals")

pacf(res, main = "Residuals")

par(mfrow = c(1, 1))

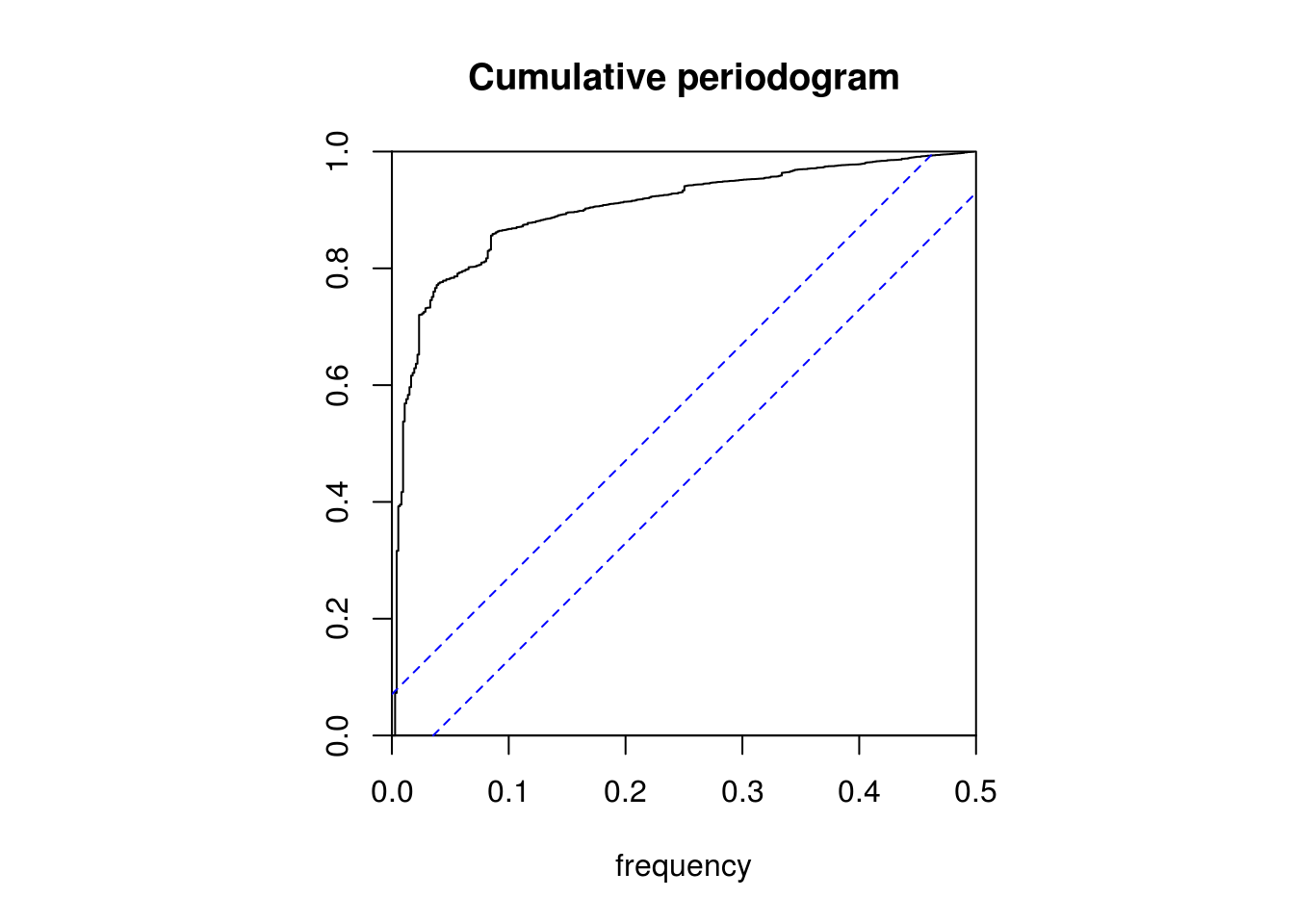

# KS test: are residuals white noise?

cpgram(res, main = "Cumulative periodogram")

# No, as one would expect

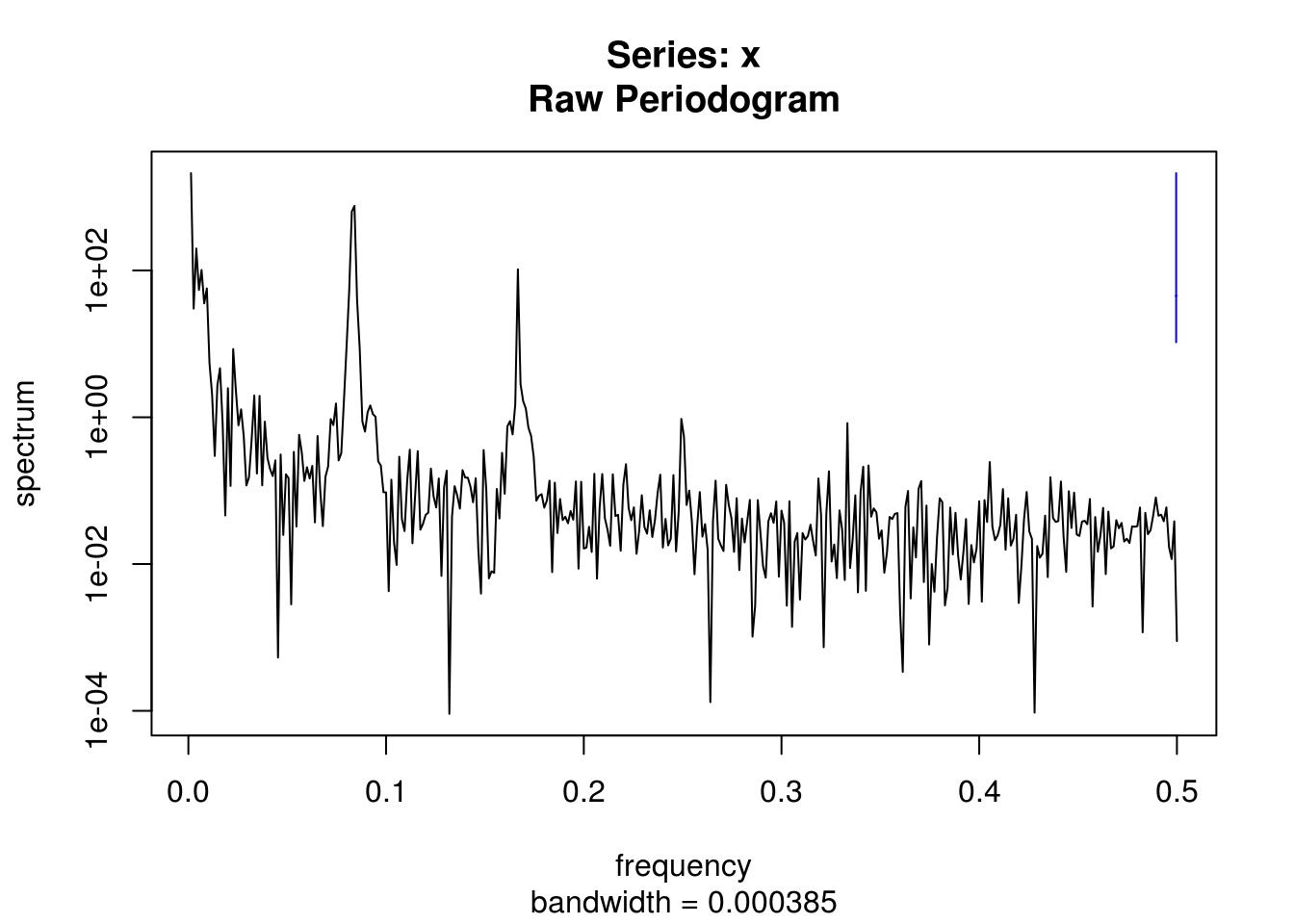

# Spectrum of raw series

spectrum(co2$interpolated)

# default with vector is to have frequency on [0,0.5]

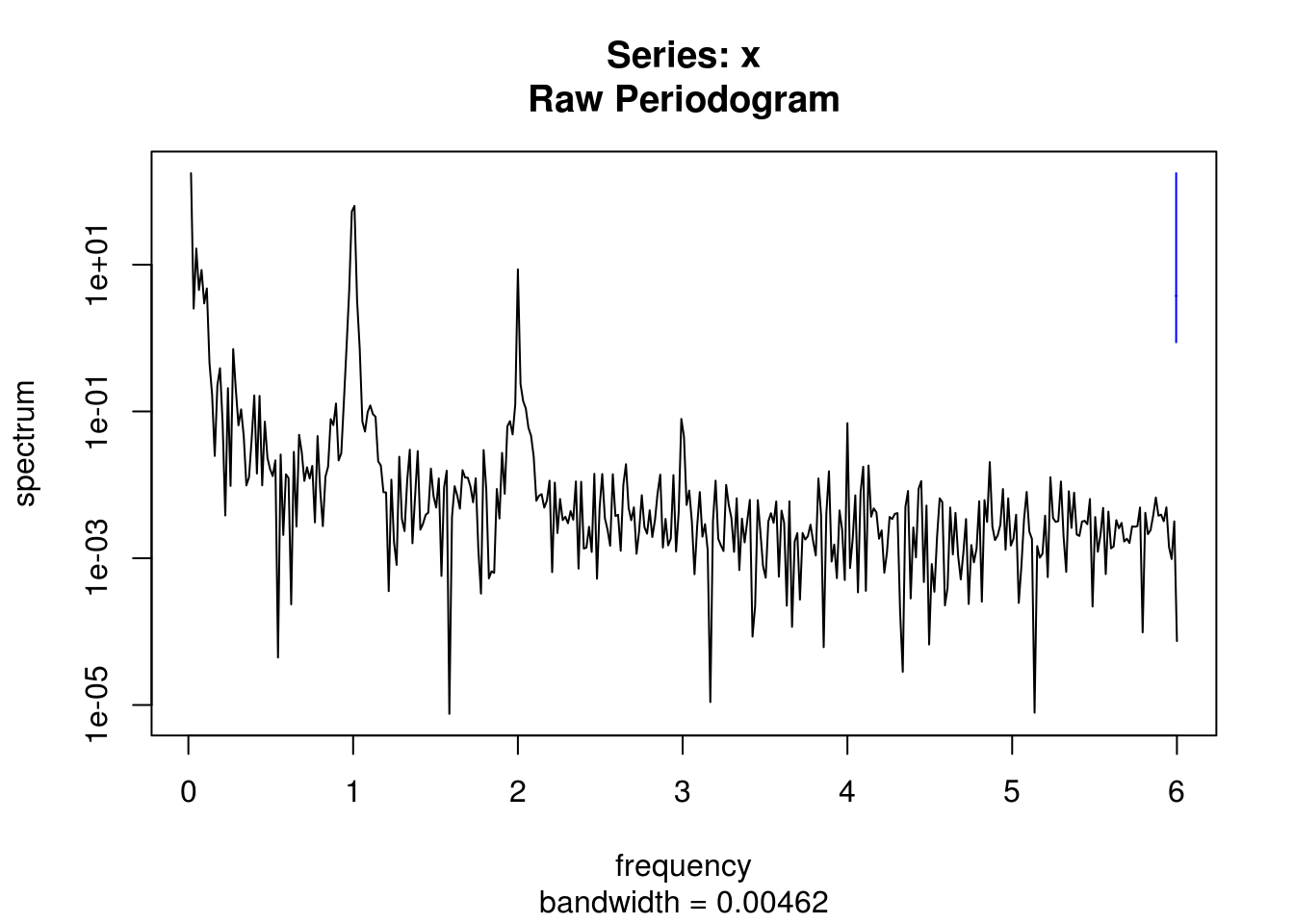

spectrum(co2_ts) #otherwise corresponds to frequency of `ts`, here yearly

filtered <- filter(co2$interpolated, method = "convolution", filter = rep(1/12,

12))

spectrum(na.contiguous(filtered))

# Detrended smoothed series

spectrum(resid(lm(filtered ~ poly(co2$time, 2))))

# Test for H0

`?`(tseries::kpss.test)

tseries::kpss.test(res, null = "Level")

KPSS Test for Level Stationarity

data: res

KPSS Level = 0.16743, Truncation lag parameter = 6, p-value = 0.1# Fail to reject null that it is level stationary

tseries::kpss.test(res, null = "Trend")

KPSS Test for Trend Stationarity

data: res

KPSS Trend = 0.16743, Truncation lag parameter = 6, p-value =

0.03214# Reject null at 5% that it is trend stationary

res_dec <- decompose(co2_ts)$random

res_stl <- stl(co2_ts, s.window = "periodic")$time.series[, "remainder"]

par(mfrow = c(1, 2))

# Some structure left due to incorrect model specification Residual

# frequency at lag 12-24 and two lag residuals

TSA::acf(res, na.action = na.pass, main = "Residuals from\n `lm`")

pacf(res, na.action = na.pass, main = "Residuals from\n `lm`")

# Residuals show some remaining periodicity at year 1. Would need AR(1)

# model

TSA::acf(res_dec, na.action = na.pass, main = "Residuals from\n `decompose`")

pacf(res_dec, na.action = na.pass, main = "Residuals from\n `decompose`")

# Similar output

TSA::acf(res_stl, main = "Residuals from\n `stl`")

pacf(res_stl, main = "Residuals from\n `stl`")